- United States

- /

- Semiconductors

- /

- NasdaqGS:AVGO

Broadcom (AVGO) Margin Surge to 36.2% Reinforces Bullish AI Profitability Narrative

Reviewed by Simply Wall St

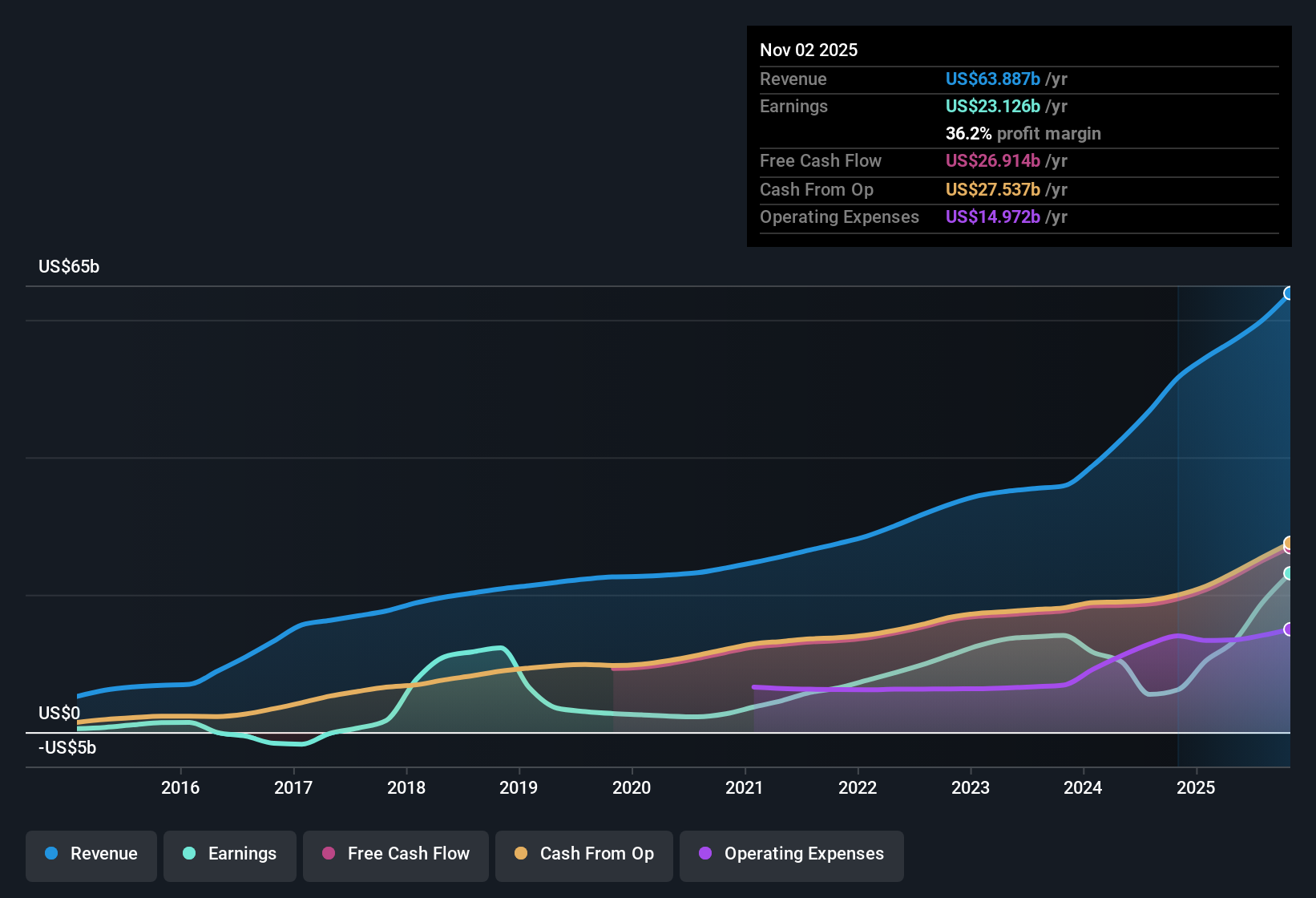

Broadcom (AVGO) kicked off FY 2025 with fiscal Q4 revenue of about $18.0 billion and basic EPS of $1.80, capping off a year in which trailing 12 month revenue reached roughly $63.9 billion and EPS climbed to $4.91 as reported earnings jumped 275.4% with net margins advancing to 36.2% from 12% the prior year. The company has seen revenue move from around $51.6 billion on a trailing 12 month basis in late 2024 to $63.9 billion by Q4 2025, while net income over the same window expanded from $6.2 billion to $23.1 billion, which puts a spotlight on how much of that profitability can stick for investors.

See our full analysis for Broadcom.With the headline numbers on the table, the next step is to see how this jump in revenue and earnings lines up with the dominant market narratives around Broadcom and whether those stories still fit the latest margin profile.

See what the community is saying about Broadcom

AI demand lifts trailing profit to 36.2 percent margin

- On a trailing basis, Broadcom generated about $63.9 billion in revenue and $23.1 billion in net income, which works out to a 36.2 percent net margin compared with 12 percent a year earlier.

- Consensus narrative credits accelerating demand for AI accelerators and advanced networking as key drivers of these higher margins. It also notes that non AI chip areas like enterprise networking and storage are still in a slower recovery phase, which could matter if AI spending from a few large customers ever cools.

Fast growing top line meets premium valuation

- Revenue is growing at about 21.6 percent per year while earnings surged 275.4 percent over the past year. The stock trades around $359.93, which is roughly 22 percent above a DCF fair value of about $294.58 and on a 73.5 times trailing P E versus 37 times for the broader semiconductor industry.

- Bulls argue that forecasts for roughly 24.6 percent annual earnings growth and analyst targets around $445.37 justify paying above both DCF fair value and peer multiples. They also note that the current price is already well above modelled fair value and industry P E, which leaves less room for disappointment if those high growth expectations are not met.

Debt load and insider selling sit behind the growth story

- Alongside the strong $23.1 billion of trailing net income, Broadcom is described as carrying high debt and seeing notable insider selling over the last three months. This makes the balance sheet and capital allocation choices more important to watch.

- Bears highlight that over $66 billion of acquisition driven debt and a heavy reliance on a small set of AI customers could pressure future earnings if VMware synergies or software growth fall short. At the same time, the current 36.2 percent net margin and large $110 billion backlog cited in the consensus view show that, so far, profitability is holding up even as these balance sheet and concentration risks remain in the background.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Broadcom on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers in a different light? Use that angle to build your own narrative in just a few minutes, then Do it your way.

A great starting point for your Broadcom research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Explore Alternatives

Broadcom’s rich valuation, heavy acquisition driven debt, and insider selling raise questions about how durable its AI powered margins will be if growth slows.

If you want stronger balance sheets and fewer leverage worries, use our solid balance sheet and fundamentals stocks screener (1944 results) now to concentrate on companies built to withstand shocks without compromising growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Broadcom might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AVGO

Broadcom

Designs, develops, and supplies various semiconductor devices and infrastructure software solutions worldwide.

Exceptional growth potential with outstanding track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)