- United States

- /

- Semiconductors

- /

- NasdaqGS:AVGO

Broadcom (AVGO): Evaluating Valuation as Big Tech’s AI Demands Drive Record Growth

Reviewed by Simply Wall St

If you’re wondering whether Broadcom (AVGO) is due for another leg up, or if this week’s price moves have you questioning whether it’s the right time to buy, you’re not alone. The latest surge in Big Tech spending on data infrastructure has given Broadcom a clear spotlight, with demand for its custom AI-focused chips and networking gear rising rapidly. Adding fuel to the fire, new product launches like the Jericho4 ethernet fabric router signal that Broadcom is not just riding the AI trend; it is helping build it.

The stock has powered higher this year, gaining over 86% in the past 12 months and 25% in the past three months, even as the broader tech market has taken a few breathers. Along the way, Broadcom rolled out AI product lines with sales up 40% and software revenue climbing 25% in its April quarter, while also contending with EU regulatory scrutiny over its VMware acquisition. While short-term volatility remains, with a recent pullback that saw shares slip about 3%, the long-term momentum around AI spending and cloud infrastructure is hard to miss.

So after a year of torrid gains and hype around AI, is Broadcom now a bargain, or is the market already factoring in all of its future growth?

Most Popular Narrative: Fairly Valued

Broadcom’s current valuation reflects aggressive assumptions about the company’s future earnings, margins, and continued dominance in the AI and infrastructure software markets, according to community narrative. Analysts see little difference between today’s price and their fair value target, indicating that expectations are already high.

The company's strategy to enable AI data centers with large-scale clusters for hyperscale customers positions it to capture a substantial serviceable addressable market (SAM) of $60 billion to $90 billion by fiscal 2027. This could boost revenue and net margins as these opportunities mature.

Why is the gap between the current price and the estimated fair value so narrow? The narrative centers on transformative next-generation technology, anticipated margin expansion, and a significant focus on AI as the company's revenue engine. Which upcoming milestones shape this precise analyst target? Explore the narrative’s projections to understand how ambitious estimates and confidence in Broadcom’s potential growth contribute to its current “fairly valued” status.

Result: Fair Value of $297.41 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.However, slowing non-AI chip sales or the loss of key hyperscale customers could quickly test the validity of even the most robust growth assumptions.

Find out about the key risks to this Broadcom narrative.Another View: Discounted Cash Flow Says Overvalued

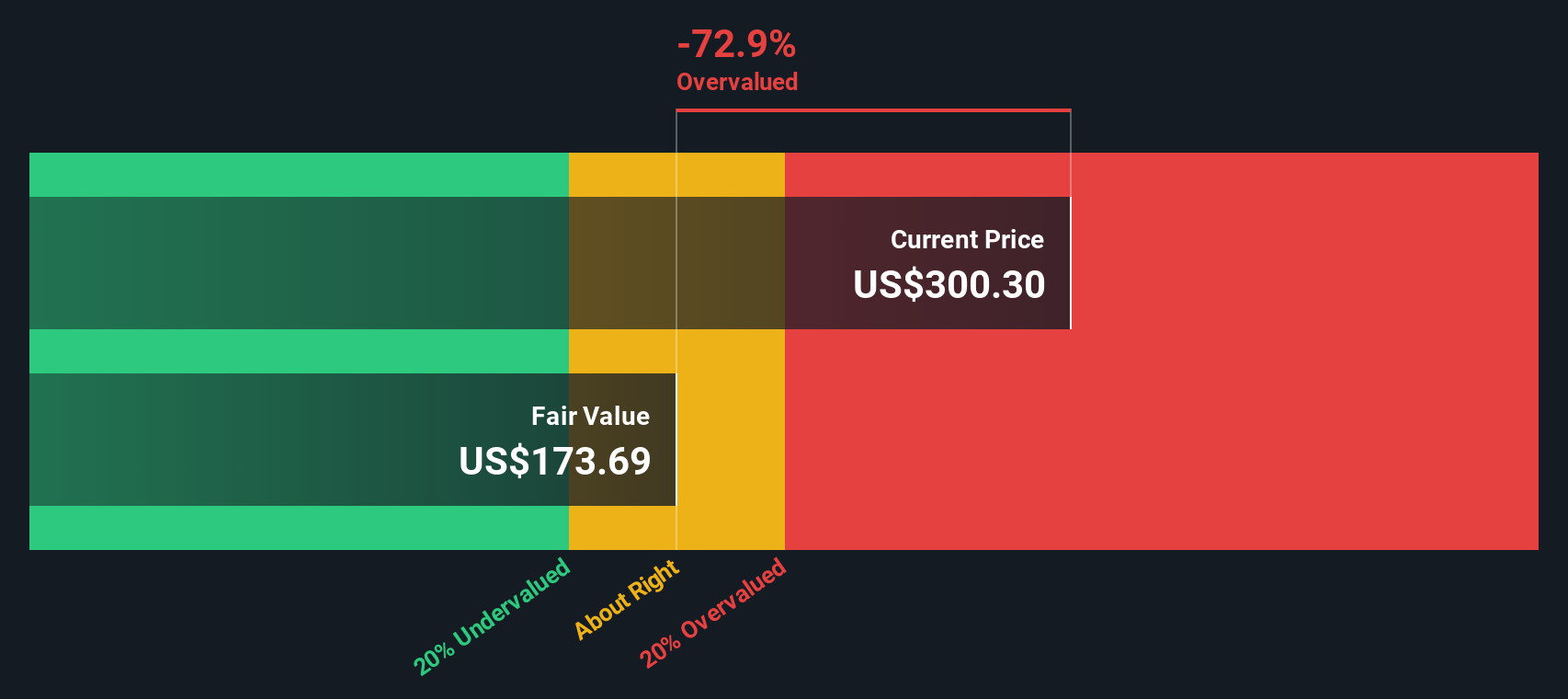

While analysts see Broadcom as fairly priced based on earnings expectations, our DCF model suggests the current share price is well above its estimated fair value. This could indicate that the growth story is already more than priced in.

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Broadcom Narrative

If you would rather dig into the numbers yourself or have a different take on Broadcom’s outlook, you can shape your own perspective in just a few minutes. do it your way.

A great starting point for your Broadcom research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Standout Investment Ideas?

Smart investors know the best opportunities rarely wait. Why not expand your research beyond Broadcom? Turn today’s insights into tomorrow’s gains by checking out stocks with unique strengths and potential. Let Simply Wall Street’s powerful screeners give you a jump on fresh ideas worth your attention.

- Boost your passive income and secure your portfolio’s cash flow by scanning for dividend stocks with yields > 3%.

- Tap into the growth stories transforming healthcare with leading-edge solutions using healthcare AI stocks.

- Zero in on value plays riding the artificial intelligence wave with our list of AI penny stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Broadcom might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AVGO

Broadcom

Designs, develops, and supplies various semiconductor devices and infrastructure software solutions worldwide.

High growth potential with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives