- United States

- /

- Semiconductors

- /

- NasdaqGS:ASYS

Amtech Systems (ASYS) Q4 Profit of $0.07 EPS Tests Bearish Margin Narratives

Reviewed by Simply Wall St

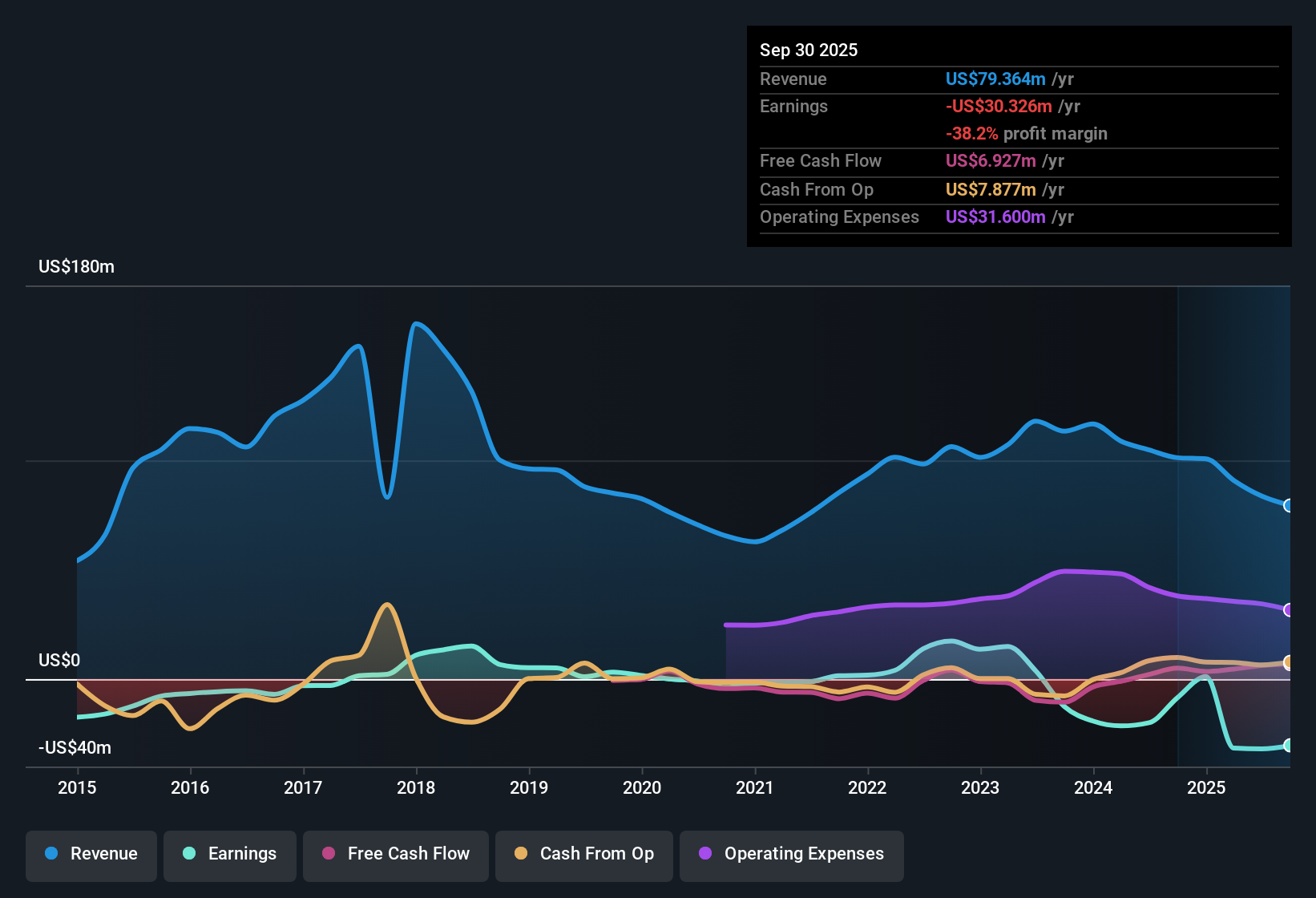

Amtech Systems (ASYS) has just posted its FY 2025 fourth quarter numbers, with revenue of about $19.8 million and EPS of roughly $0.07 setting the tone for the latest print. Over the past six quarters, the company has seen quarterly revenue move from about $24.1 million in Q4 2024 to a peak of $26.7 million in Q3 2024 before landing at $19.8 million in Q4 2025. Over the same period, EPS has swung from a loss of roughly $0.04 in Q4 2024 to a deep trough of about negative $2.23 in Q2 2025 and then back to a modest profit this quarter, leaving investors to weigh how durable any margin recovery might be.

See our full analysis for Amtech Systems.With the headline numbers on the table, the next step is to compare this latest earnings profile with the dominant narratives around Amtech to see which stories about its margins and trajectory still hold up and which ones may need a rethink.

See what the community is saying about Amtech Systems

Deep FY 2025 Loss Still Dominates

- Across the last 12 months, Amtech posted a net loss of about $30.3 million on $79.4 million of revenue, with trailing EPS at roughly negative $2.12.

- Consensus narrative highlights demand tailwinds from AI infrastructure and next generation packaging, yet this trailing loss contrasts with the idea of margin expansion, as:

- Losses have been worsening at around 51% per year over the past five years, which sits awkwardly beside claims of stronger operational leverage.

- Analysts still do not forecast the company becoming profitable over the next three years, even as they assume revenue growth of about 4.4% annually.

Short Term Profit, Long Term Drag

- In Q4 FY 2025, net income was about $1.1 million with EPS of roughly $0.07, but the full year still shows a trailing net loss of around $30.3 million.

- Bears argue that reliance on cost cuts and nonrecurring items masks structural margin pressure, and the numbers give them support because:

- Q2 FY 2025 alone saw a net loss of about $31.8 million and EPS of roughly negative $2.23, dominating the year’s profitability picture despite the profitable Q4.

- Trailing 12 month revenue has stepped down from about $101.2 million in Q4 2024 to $79.4 million in Q4 2025, while losses have persisted, underscoring concerns about both scale and margin durability.

Cheap On Sales, Rich To DCF

- The stock trades at a Price to Sales of roughly 2 times on $79.4 million of trailing revenue and a share price of $10.99, while the DCF fair value is about $3.25 per share.

- What stands out for bullish investors is the tension between relative and absolute valuation, because:

- The 2 times Price to Sales is below the 2.8 times peer average and well under the 5.6 times US semiconductor industry level, which can look attractive if sales stabilize.

- At the same time, the $10.99 share price sits far above the $3.25 DCF fair value and above a $12.00 analyst style target reference, which aligns more with the bearish view that current pricing already bakes in optimistic recovery assumptions.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Amtech Systems on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers differently and think the story points another way? Capture that view in just a few minutes, starting with Do it your way.

A great starting point for your Amtech Systems research is our analysis highlighting 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Amtech’s deep, persistent losses, sliding revenue base, and valuation premium to DCF all challenge the bullish recovery story and keep risk firmly on the table.

If rich pricing on fragile fundamentals concerns you, use our these 907 undervalued stocks based on cash flows to quickly pinpoint companies where cash flow, growth, and valuation work harder in your favor.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ASYS

Amtech Systems

Manufactures and sells capital equipment and related consumables for use in fabricating and packaging semiconductor devices in the United States, Canada, Mexico, China, Malaysia, Taiwan, Singapore, the Czech Republic, Austria, Hungary, the United Kingdom, Germany, and internationally.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Mastersystem Infotama will achieve 18.9% revenue growth as fair value hits IDR1,650

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026