- United States

- /

- Semiconductors

- /

- NasdaqGS:ASML

Is ASML (NasdaqGS:ASML) Still Fairly Valued After Its Strong 3-Month Share Price Rally?

Reviewed by Simply Wall St

ASML Holding (NasdaqGS:ASML) has quietly kept rewarding patient investors, with the stock up around 32% over the past 3 months and more than 50% over the past year despite recent pullbacks.

See our latest analysis for ASML Holding.

That mix of a strong 90 day share price return of 32.8% and a 1 year total shareholder return above 50% suggests momentum is very much still building as investors reassess ASML Holding's growth runway and risk profile.

If ASML Holding has you thinking about the broader chip boom, it might be worth exploring other high growth tech names via high growth tech and AI stocks to see what else fits your strategy.

With shares near 1,080 dollars, just shy of analyst targets and trading at a steep premium to typical chipmakers, the key question now is whether ASML is still undervalued or if markets already price in its future growth.

Most Popular Narrative: 7.8% Overvalued

With ASML Holding last closing at 1,080.85 dollars versus a narrative fair value near 1,002 dollars, the stage is set for a nuanced long term debate.

ASML’s Q2 results were objectively strong, but a cautious tone on the near-term outlook spooked investors. However, this creates an opportunity for long-term investors.

Curious how strong margins, steady revenue expansion, and a confident future profit multiple can still point to downside from here? The narrative’s math might surprise you.

Result: Fair Value of $1002.53 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing export controls and a potential 2026 demand plateau could squeeze orders, challenge lofty growth assumptions, and trigger a reassessment of ASML’s premium valuation.

Find out about the key risks to this ASML Holding narrative.

Another Angle on Valuation

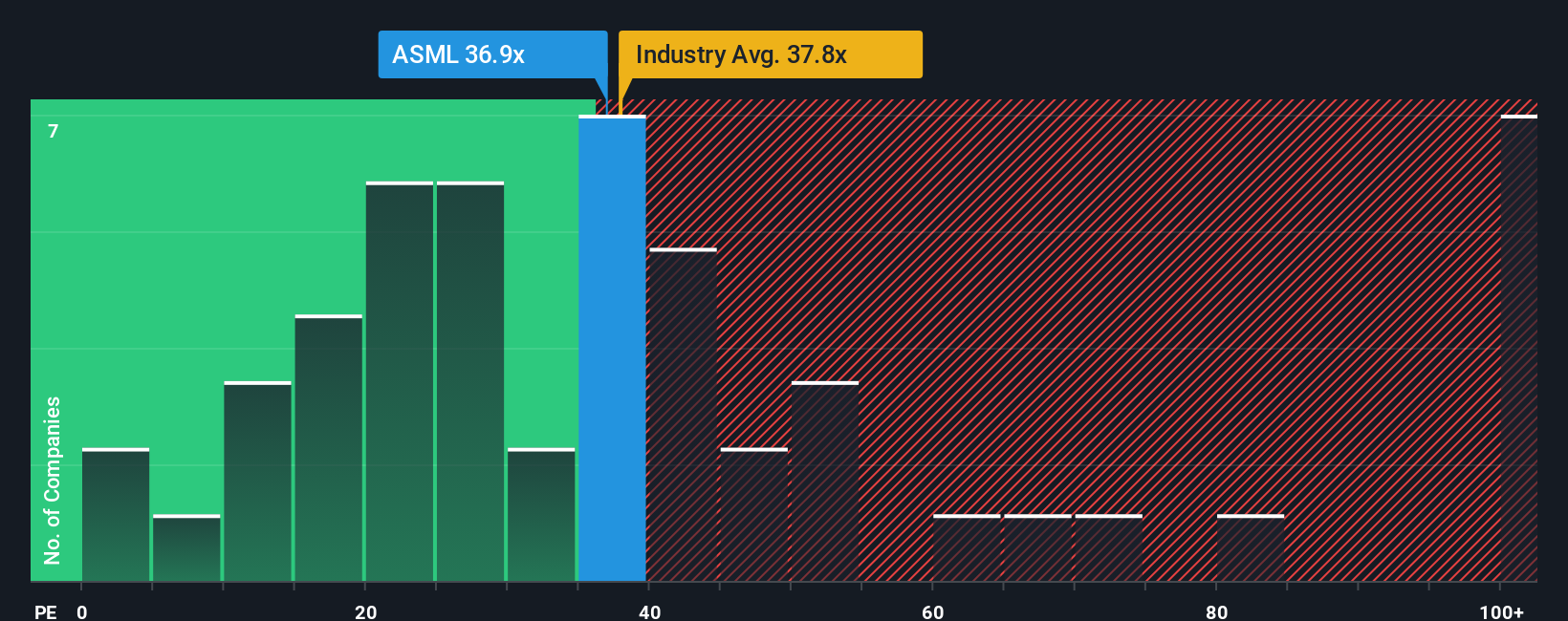

On earnings, ASML trades at 37.9 times profits, richer than its fair ratio of 31.1 times and slightly above the US semiconductor average of 37 times. This implies investors are paying up for quality and growth, but also leaving less room for disappointment if the cycle softens.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own ASML Holding Narrative

If you see the story differently or would rather dig into the numbers yourself, you can build a personalized view in just a few minutes: Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding ASML Holding.

Ready for your next investing move?

Do not stop with a single great company. Use the Simply Wall St Screener to surface hand picked ideas that could sharpen and strengthen your portfolio.

- Capture potential mispricings by targeting companies trading below their estimated cash flow value with these 907 undervalued stocks based on cash flows while the market is still catching up.

- Position yourself for the next wave of intelligent automation by focusing on future facing innovators through these 26 AI penny stocks before sentiment and valuations accelerate further.

- Turn volatility into opportunity by narrowing in on resilient small caps with these 3606 penny stocks with strong financials that pair manageable risk with meaningful upside potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ASML

ASML Holding

Provides lithography solutions for the development, production, marketing, sales, upgrading, and servicing of advanced semiconductor equipment systems.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)