- United States

- /

- Semiconductors

- /

- NasdaqGS:AMD

Stocks That May Be Priced Below Intrinsic Value In November 2025

Reviewed by Simply Wall St

As the U.S. market experiences mixed outcomes with the Dow Jones Industrial Average reaching unprecedented heights and the Nasdaq showing signs of volatility, investors are keenly observing how these fluctuations might impact stock valuations. In such an environment, identifying stocks that may be priced below their intrinsic value becomes crucial, as these opportunities could potentially offer resilience amid broader market uncertainties.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Ready Capital (RC) | $2.66 | $5.31 | 49.9% |

| Old National Bancorp (ONB) | $20.99 | $41.07 | 48.9% |

| Nicolet Bankshares (NIC) | $124.70 | $242.17 | 48.5% |

| Huntington Bancshares (HBAN) | $15.95 | $31.08 | 48.7% |

| First Busey (BUSE) | $23.15 | $45.34 | 48.9% |

| Fifth Third Bancorp (FITB) | $43.21 | $83.29 | 48.1% |

| Coeur Mining (CDE) | $15.63 | $30.65 | 49% |

| CNB Financial (CCNE) | $25.04 | $48.51 | 48.4% |

| Caris Life Sciences (CAI) | $24.77 | $47.82 | 48.2% |

| Byrna Technologies (BYRN) | $17.99 | $35.52 | 49.3% |

We're going to check out a few of the best picks from our screener tool.

Advanced Micro Devices (AMD)

Overview: Advanced Micro Devices, Inc. operates as a semiconductor company worldwide with a market cap of $386.69 billion.

Operations: The company's revenue segments include Client at $9.86 billion, Gaming at $3.63 billion, Embedded at $3.43 billion, and Data Center at $15.11 billion.

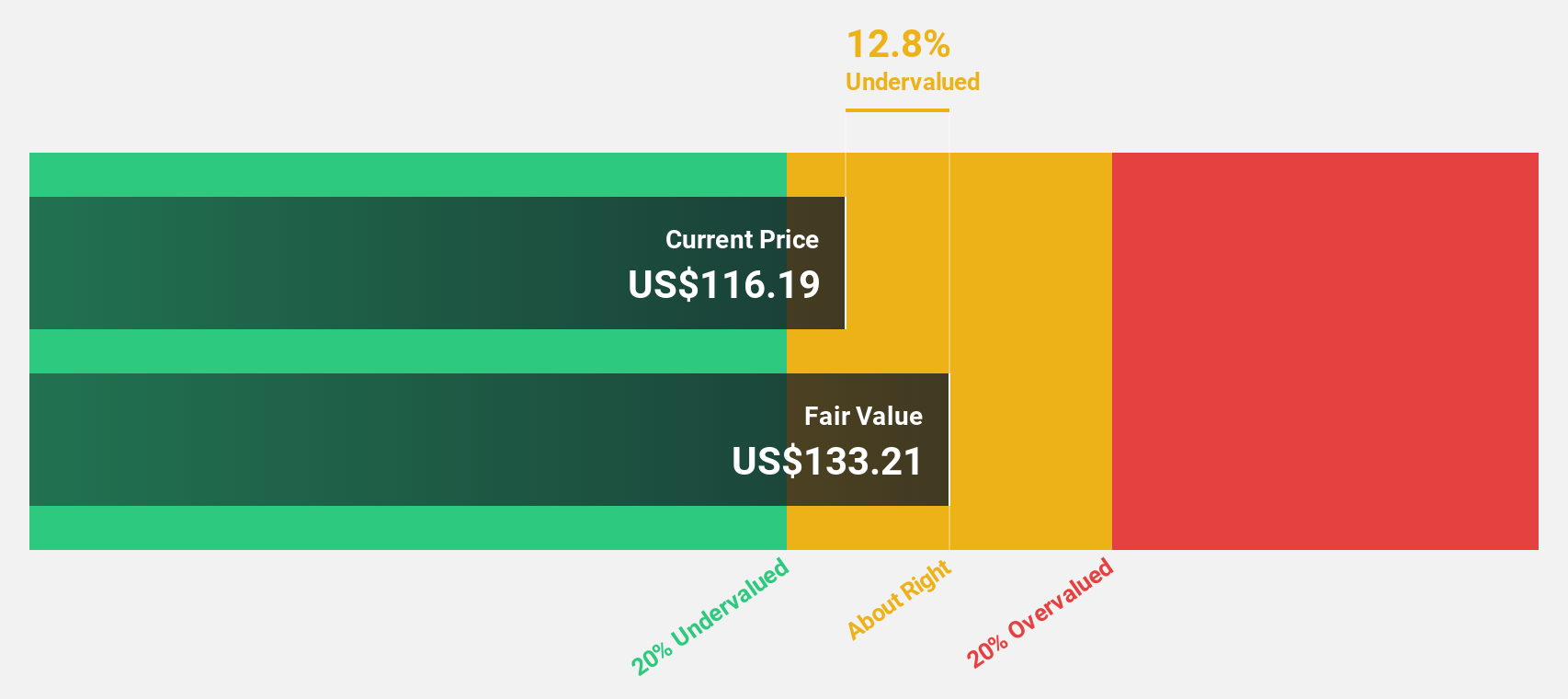

Estimated Discount To Fair Value: 33.8%

Advanced Micro Devices (AMD) appears undervalued with a trading price of US$258.89, significantly below its estimated fair value of US$391.22. Recent earnings growth and strategic collaborations, such as with STRADVISION for autonomous driving technology, support AMD’s robust cash flow potential. The company’s revenue and earnings are forecast to grow faster than the broader market, driven by strong demand in AI and high-performance computing sectors despite ongoing legal challenges from Adeia's patent infringement claims.

- The analysis detailed in our Advanced Micro Devices growth report hints at robust future financial performance.

- Delve into the full analysis health report here for a deeper understanding of Advanced Micro Devices.

Natera (NTRA)

Overview: Natera, Inc. is a diagnostics company that offers molecular testing services globally, with a market cap of approximately $28.53 billion.

Operations: The company's revenue primarily comes from its molecular testing services, generating approximately $2.12 billion.

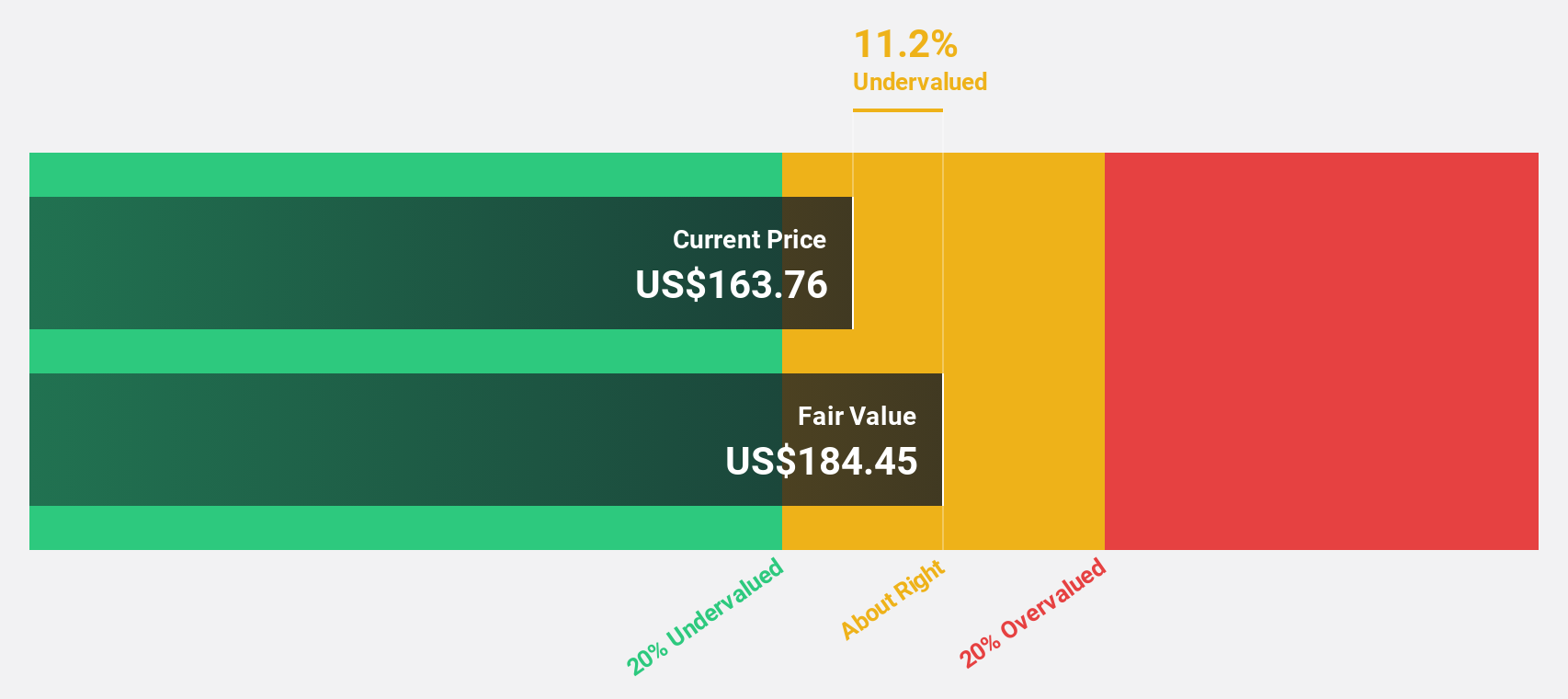

Estimated Discount To Fair Value: 17.6%

Natera's stock, trading at US$209.5, is below its estimated fair value of US$254.3, suggesting potential undervaluation. The company raised its 2025 revenue guidance to between US$2.18 billion and US$2.26 billion, supported by strong gross margin performance and recent strategic integration with Flatiron Health's OncoEMR platform. Despite reporting a net loss for the third quarter of 2025, Natera's earnings are projected to grow significantly over the next three years as profitability approaches amidst expanding oncology offerings and prenatal testing advancements.

- In light of our recent growth report, it seems possible that Natera's financial performance will exceed current levels.

- Navigate through the intricacies of Natera with our comprehensive financial health report here.

Coeur Mining (CDE)

Overview: Coeur Mining, Inc. is a gold and silver producer with operations in the United States, Canada, and Mexico, and has a market capitalization of approximately $9.77 billion.

Operations: The company's revenue segments include Wharf with $294.12 million, Palmarejo at $420.20 million, Rochester generating $377.30 million, and Kensington contributing $322.30 million.

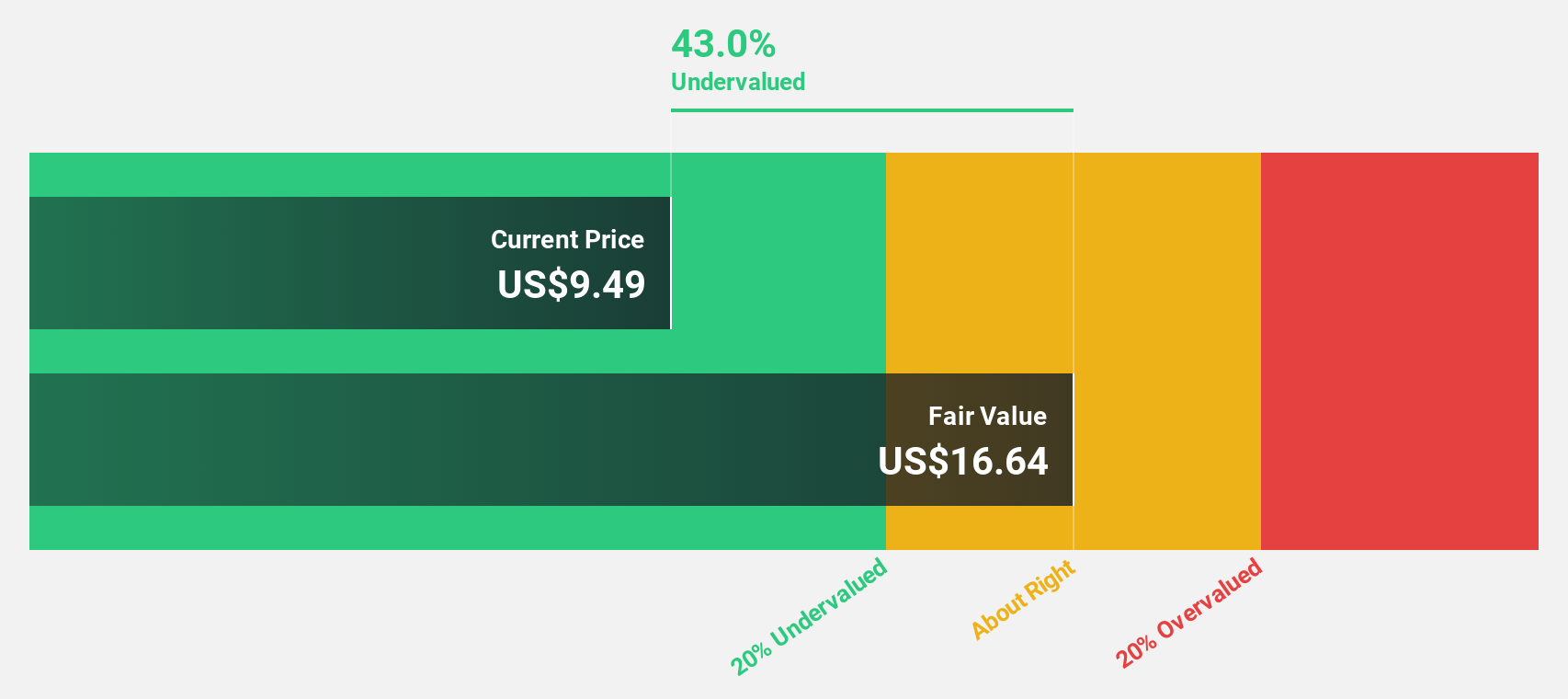

Estimated Discount To Fair Value: 49%

Coeur Mining's stock, at US$15.63, trades significantly below its estimated fair value of US$30.65, highlighting potential undervaluation. The company reported strong Q3 2025 results with sales of US$554.57 million and net income of US$266.82 million, a substantial increase from the previous year. Despite shareholder dilution over the past year, Coeur Mining's earnings are forecast to grow significantly by 26% annually over the next three years, outpacing market expectations.

- The growth report we've compiled suggests that Coeur Mining's future prospects could be on the up.

- Click here and access our complete balance sheet health report to understand the dynamics of Coeur Mining.

Where To Now?

- Unlock our comprehensive list of 190 Undervalued US Stocks Based On Cash Flows by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMD

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives