- United States

- /

- Semiconductors

- /

- NasdaqGS:AMD

October 2024's US Stocks That May Be Trading Below Estimated Fair Value

Reviewed by Simply Wall St

As the U.S. stock market continues its impressive rally, with the S&P 500 and Dow Jones Industrial Average reaching record highs, investors are increasingly focused on identifying opportunities that may be trading below their estimated fair value. In this buoyant market environment, a good stock is often characterized by strong fundamentals and potential for growth that hasn't yet been fully recognized by the broader market.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| MidWestOne Financial Group (NasdaqGS:MOFG) | $27.17 | $53.65 | 49.4% |

| Molina Healthcare (NYSE:MOH) | $330.30 | $641.75 | 48.5% |

| Cadence Bank (NYSE:CADE) | $31.37 | $61.35 | 48.9% |

| Western Alliance Bancorporation (NYSE:WAL) | $86.11 | $167.67 | 48.6% |

| EVERTEC (NYSE:EVTC) | $33.05 | $66.00 | 49.9% |

| Bowhead Specialty Holdings (NYSE:BOW) | $28.50 | $56.60 | 49.7% |

| Vasta Platform (NasdaqGS:VSTA) | $2.53 | $5.01 | 49.5% |

| Shoals Technologies Group (NasdaqGM:SHLS) | $5.25 | $10.21 | 48.6% |

| Vertex Pharmaceuticals (NasdaqGS:VRTX) | $467.97 | $934.59 | 49.9% |

| Viking Holdings (NYSE:VIK) | $37.87 | $74.70 | 49.3% |

Let's dive into some prime choices out of the screener.

Advanced Micro Devices (NasdaqGS:AMD)

Overview: Advanced Micro Devices, Inc. is a global semiconductor company with a market capitalization of approximately $279.67 billion.

Operations: The company's revenue segments consist of Client at $5.77 billion, Gaming at $4.44 billion, Embedded at $4.01 billion, and Data Center at $9.05 billion.

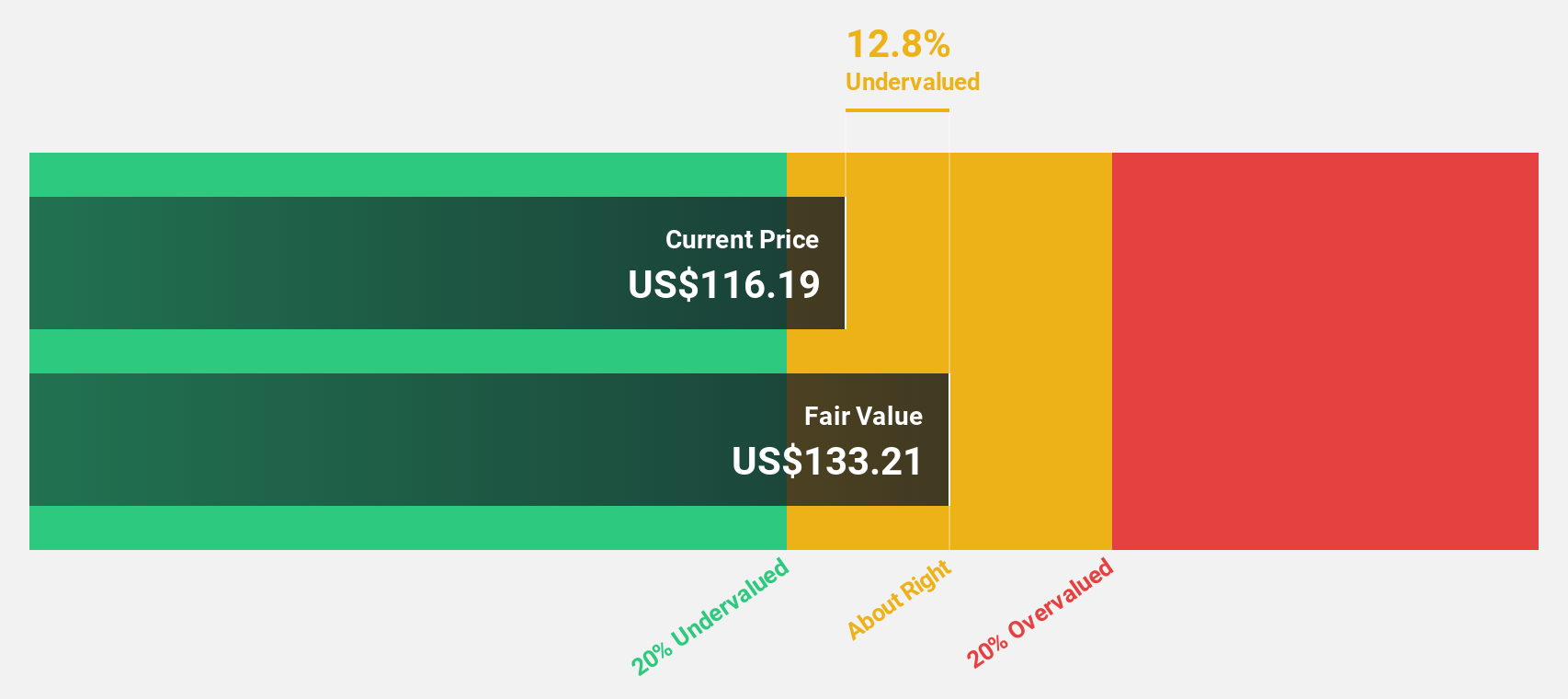

Estimated Discount To Fair Value: 21.8%

Advanced Micro Devices is trading at US$171.02, below its estimated fair value of US$218.83, suggesting undervaluation based on cash flows. Recent earnings show significant improvement with net income rising to US$265 million from US$27 million a year ago. The company's revenue is forecasted to grow 18% annually, outpacing the broader market's 8.8% growth rate, while earnings are expected to increase by over 40% per year, reflecting robust financial health and potential for future growth.

- According our earnings growth report, there's an indication that Advanced Micro Devices might be ready to expand.

- Click here and access our complete balance sheet health report to understand the dynamics of Advanced Micro Devices.

Vertex Pharmaceuticals (NasdaqGS:VRTX)

Overview: Vertex Pharmaceuticals Incorporated is a biotechnology company focused on developing and commercializing therapies for treating cystic fibrosis, with a market cap of approximately $118.45 billion.

Operations: The company's revenue is primarily derived from its pharmaceuticals segment, which generated $10.34 billion.

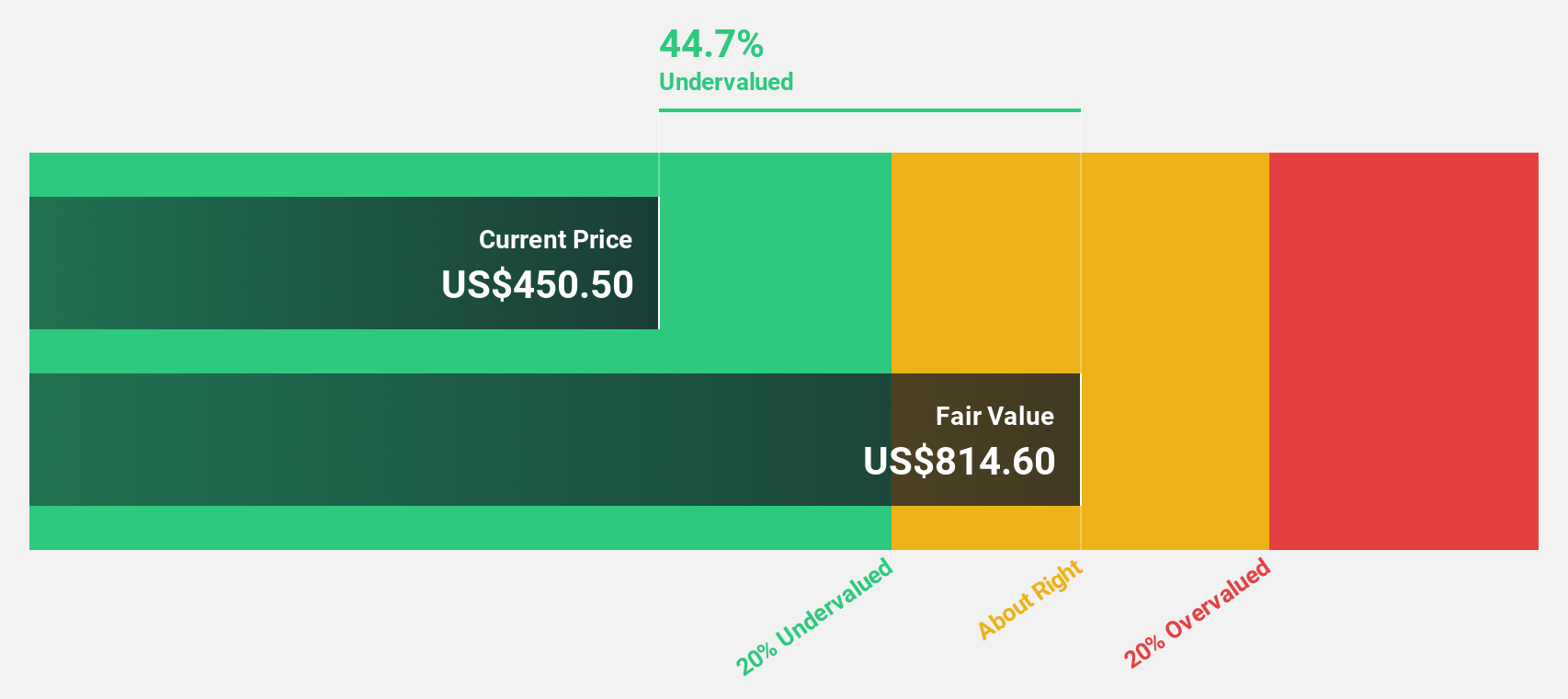

Estimated Discount To Fair Value: 49.9%

Vertex Pharmaceuticals is trading at US$467.97, significantly below its estimated fair value of US$934.59, indicating it may be undervalued based on cash flows. Despite a net loss reported recently, Vertex's earnings are expected to grow by 46.4% annually and become profitable within three years, outpacing average market growth rates. The company has raised its revenue guidance for 2024 and continues to innovate with promising drug candidates like suzetrigine under FDA review.

- Upon reviewing our latest growth report, Vertex Pharmaceuticals' projected financial performance appears quite optimistic.

- Delve into the full analysis health report here for a deeper understanding of Vertex Pharmaceuticals.

Palantir Technologies (NYSE:PLTR)

Overview: Palantir Technologies Inc. develops and implements software platforms for intelligence agencies to support counterterrorism efforts globally, with a market cap of $92.83 billion.

Operations: The company's revenue is derived from two main segments: Commercial, generating $1.14 billion, and Government, contributing $1.34 billion.

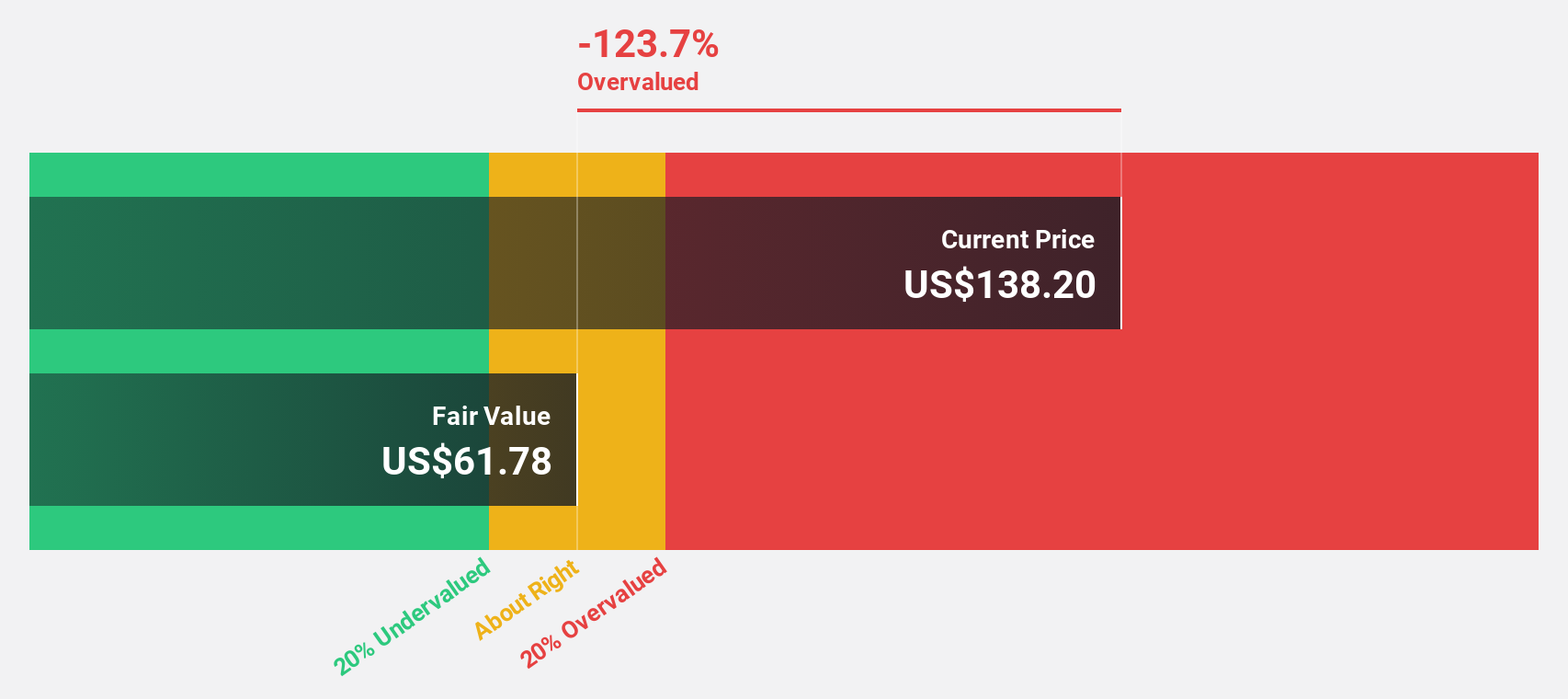

Estimated Discount To Fair Value: 16.3%

Palantir Technologies, trading at US$43.13, is undervalued relative to its fair value estimate of US$51.53 based on cash flows. The company has become profitable this year and forecasts a 23.9% annual earnings growth rate, surpassing the U.S. market average of 15.9%. Recent strategic partnerships with firms like Edgescale AI and Nebraska Medicine highlight Palantir's expanding influence in AI-driven solutions across various sectors, potentially enhancing future cash flows and operational efficiencies.

- The analysis detailed in our Palantir Technologies growth report hints at robust future financial performance.

- Click here to discover the nuances of Palantir Technologies with our detailed financial health report.

Where To Now?

- Gain an insight into the universe of 188 Undervalued US Stocks Based On Cash Flows by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMD

Flawless balance sheet with reasonable growth potential.