- United States

- /

- Semiconductors

- /

- NasdaqGS:AMD

Is AMD’s Oracle AI Chip Deal Justifying the Recent Surge in Its Stock Price?

Reviewed by Bailey Pemberton

If you are weighing what to do with your Advanced Micro Devices shares, you are in good company. AMD's stock has been on a tear, up 6.2% in the past week, 36.5% over the last month, and an eye-catching 79.4% year-to-date. That is after climbing more than 273% in three years. Investors and tech enthusiasts alike are flocking to AMD, and recent headlines explain part of this excitement.

For example, AMD's graphics chips were just picked by Oracle for massive cloud deployments, a clear sign AMD is gaining traction as cloud companies look for alternatives to rival Nvidia. On top of that, AMD is teasing new GPU technology with Sony for its next gaming console, pointing toward potential long-term growth in the gaming space. Meanwhile, market analysts are catching on. Piper Sandler recently bumped AMD's price target from $190 to $240, confident the company's AI partnerships and hardware deals will pay off down the road.

But before you let the momentum sweep you away, it's important to ask: is AMD’s stock actually undervalued? Using a standard valuation scoring system, AMD currently checks zero out of six boxes for being undervalued, earning a value score of 0. That may seem surprising given the news and price action, but understanding what this means requires digging a bit deeper into how we judge value, using both traditional metrics and, as we will see later, a smarter way to size up AMD's true worth.

Advanced Micro Devices scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Advanced Micro Devices Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's value by projecting its future cash flows and discounting them back to present value. Essentially, it asks how much AMD's forecasted Free Cash Flow (FCF) over the next decade is worth in today's dollars.

AMD currently generates Free Cash Flow of $4.1 Billion. According to analyst estimates, FCF is expected to grow rapidly, with projections reaching $8.1 Billion in 2026 and $12.6 Billion by 2027. Although analysts provide estimates up to five years out, further projections such as AMD's expected FCF of $18.7 Billion in 2029 are extrapolated based on trends by Simply Wall St.

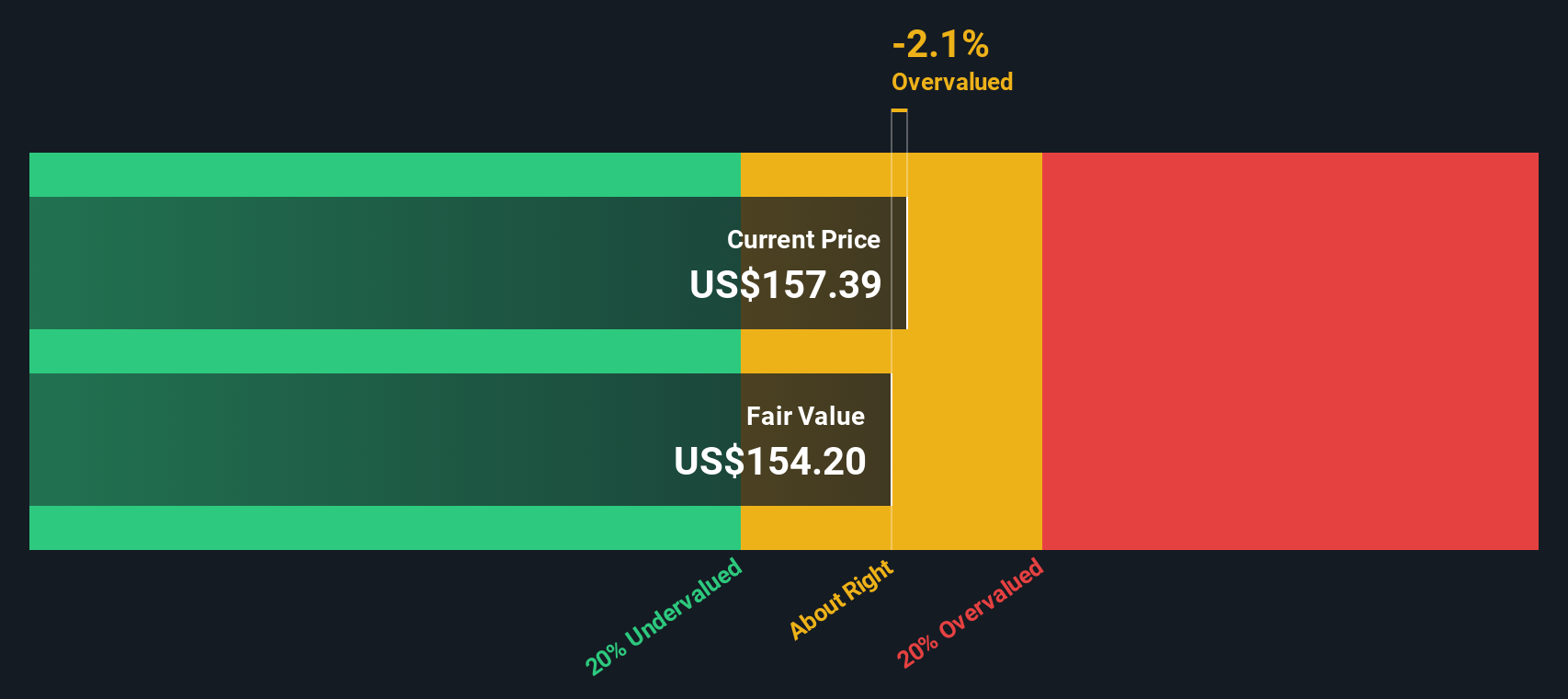

These growing cash flows are run through the DCF model, which calculates that AMD's intrinsic value stands at $164.71 per share. However, the DCF also reveals that the current share price is about 31.4% higher than this estimate, suggesting the market is already pricing in future growth and more.

In summary, AMD’s DCF valuation indicates the stock is overvalued at its current price level. This is not necessarily a red flag, but a cue for investors to keep expectations grounded.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Advanced Micro Devices may be overvalued by 31.4%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Advanced Micro Devices Price vs Earnings

The Price-to-Earnings (PE) ratio is a preferred valuation tool for companies like Advanced Micro Devices that are solidly profitable. It gives investors a straightforward sense of how much they are paying for each dollar of a company’s earnings. This is a foundational approach when a company has consistent profits to analyze.

What counts as a “normal” PE ratio is not set in stone. Higher PE ratios often reflect expectations of faster future growth, a more dominant industry position, or lower risk. Conversely, lower ratios can signal slower growth or added risk. Understanding a fair PE requires weighing AMD’s prospects not just in a vacuum, but in the context of its sector and future potential.

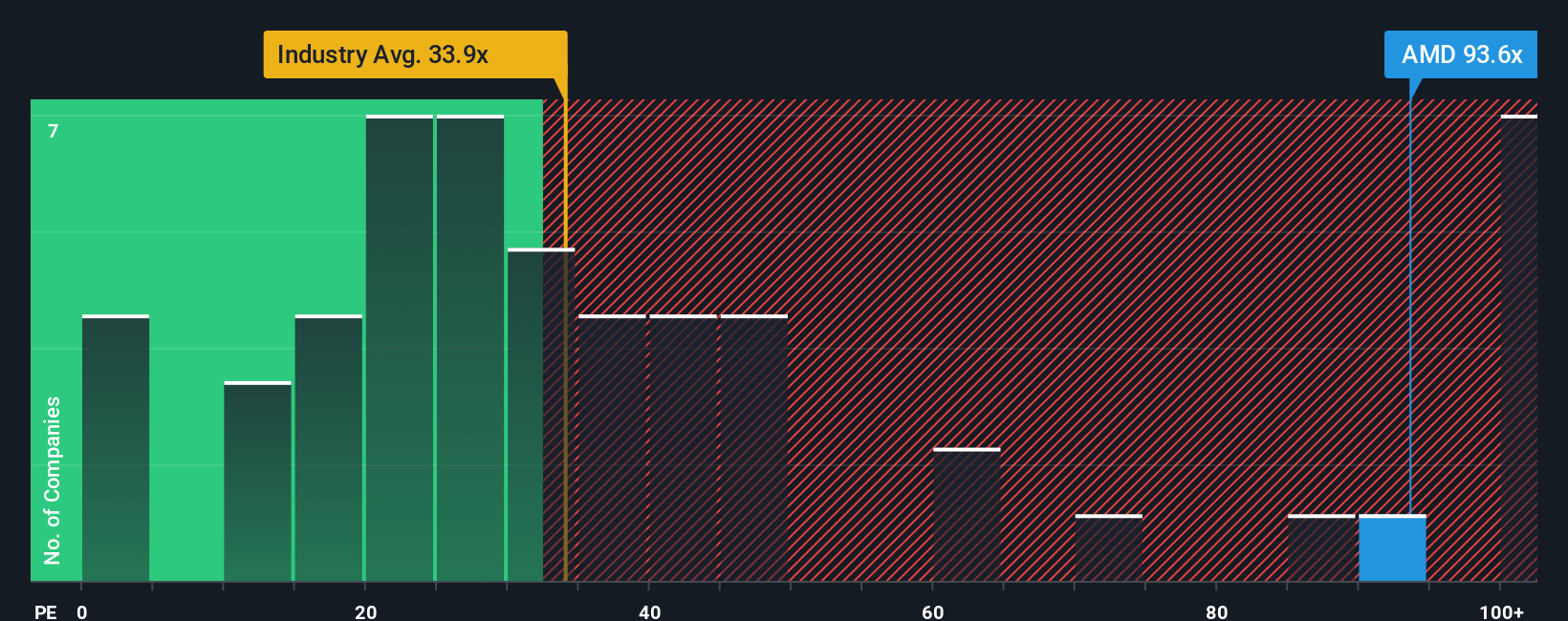

Currently, AMD trades at a lofty PE ratio of 128.7x. That is well above both the industry average of 35.5x and the average among peers at 32.8x. However, industry benchmarks have their limits because they might not capture AMD’s unique growth trajectory or challenges.

This is where Simply Wall St’s “Fair Ratio” comes in. This proprietary metric sets expectations for an appropriate multiple by considering AMD’s earnings growth, market cap, profit margins, industry trends, and company-specific risks. In this case, the Fair Ratio for AMD is 57.0x. Unlike simple industry averages, this approach delivers a more meaningful yardstick, tailored to AMD’s specific business strengths and risks rather than just its sector.

Comparing this Fair Ratio of 57.0x with AMD’s actual PE of 128.7x, the stock still appears significantly overvalued relative to its fundamentals, even accounting for its growth outlook.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Advanced Micro Devices Narrative

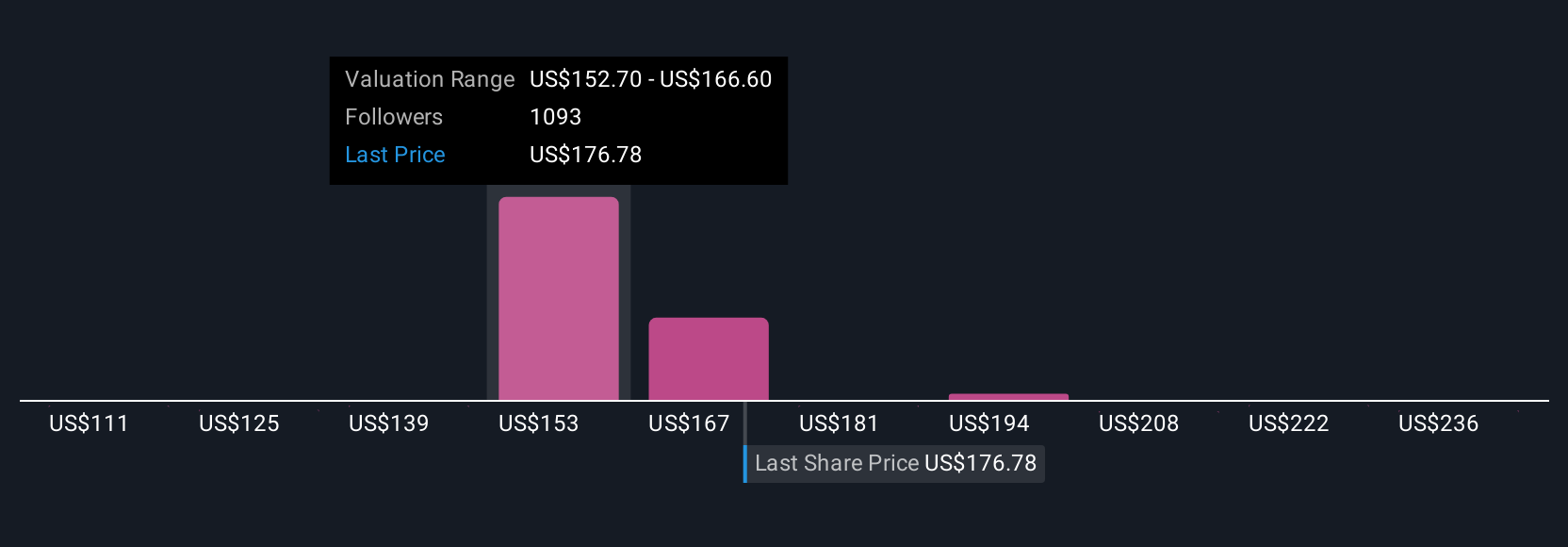

Earlier we mentioned that there's an even better way to understand valuation. Let's introduce you to Narratives. Unlike traditional ratios or models, a Narrative empowers you to connect your unique story about a company, including factors like expected growth, risks, and industry shifts, to an actual financial forecast and then to your own estimate of fair value.

With Narratives, you move beyond static metrics by combining your perspective on Advanced Micro Devices (such as future revenue, profit margins, and key industry events) with a value calculation that dynamically updates as new information emerges. This tool is available on Simply Wall St's Community page and is used by millions of investors globally, making professional-level valuation accessible to everyone, without the need for specialized tools or spreadsheets.

Narratives help you decide if, and when, to buy or sell AMD by comparing your chosen Fair Value (driven by your story) to the latest share price. This ensures your decisions are always grounded in real, up-to-date expectations. When breaking news or fresh earnings come in, your Narrative adapts automatically, keeping your investment thesis current.

For example, one investor’s Narrative might reflect tremendous optimism (Fair Value: $230, driven by aggressive AI revenue growth), while another might take a more cautious view amid export risks (Fair Value: $137). The difference comes down to their outlook, assumptions, and confidence in AMD’s future path.

For Advanced Micro Devices, here are previews of two leading Advanced Micro Devices Narratives:

🐂 Advanced Micro Devices Bull Case

Fair Value: $290.64

Current price vs fair value: 25.5% undervalued

Projected Revenue Growth Rate: 31%

- Bullish on AMD's near-term and long-term growth, expecting profit margins to expand as efficiency increases under CEO Lisa Su and robust new product cycles roll out.

- Sees strong recent gross profit and revenue growth trends continuing, with new products set to drive acceleration from 2026 and beyond.

- Foresees the stock reaching the $200 to $300 range in the next few years, with a fair value above $290, based on high growth and improving profitability forecasts.

🐻 Advanced Micro Devices Bear Case

Fair Value: $180.10

Current price vs fair value: 20.2% overvalued

Projected Revenue Growth Rate: 16.5%

- Focuses on AMD’s efficiency gains, aggressive GPU pricing, and major acquisitions, but notes strong competition from Nvidia and ongoing risk from supply chain disruptions.

- Sees strong growth opportunities in Data Center and Client segments, but is more cautious about Gaming and Embedded segment momentum given recent revenue declines and market challenges.

- Updates projections based on recent financial performance, but holds a more conservative fair value due to risks of competition, cyclical markets, and execution requirements.

Do you think there's more to the story for Advanced Micro Devices? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMD

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion