- United States

- /

- Semiconductors

- /

- NasdaqGS:AMD

Advanced Micro Devices (NasdaqGS:AMD) Unveils New AI PCs, Graphics Cards, and Processors

Reviewed by Simply Wall St

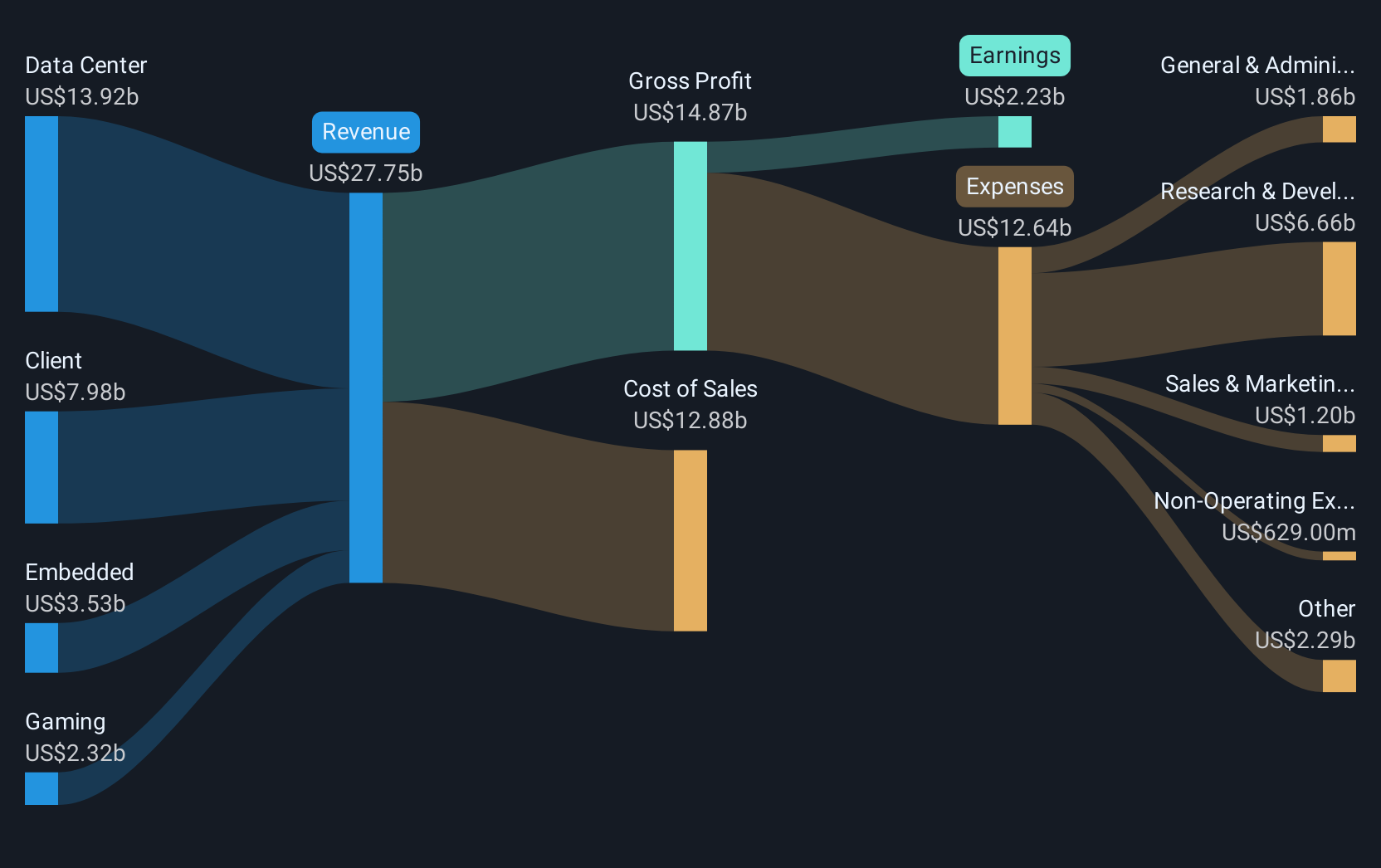

Advanced Micro Devices (NasdaqGS:AMD) recently unveiled several product innovations, such as the Radeon RX 9060 XT graphics card and Ryzen Threadripper 9000 Series processors, alongside strategic partnerships, including a collaboration with Red Hat to enhance AI capabilities. These events coincide with a 30% rise in AMD's share price over the past month, despite the broader market's flat weeks. The company's increased share buyback plan and improved earnings provide additional context to this positive movement, against a market backdrop where the tech-heavy Nasdaq saw modest gains while indices like the S&P 500 and Dow Jones experienced minor fluctuations.

The recent advancements in Advanced Micro Devices (AMD) product line, such as the Radeon RX 9060 XT and Ryzen Threadripper 9000 Series, along with their collaboration with Red Hat, can potentially bolster AMD's position in AI and graphics processing. These developments might positively influence future revenue streams, though the company still faces regulatory and competitive challenges that could impede market expansion and margin growth.

Over the past five years, AMD achieved a significant total shareholder return of 113.40%, emphasizing the company's historically robust performance compared to the previous 12 months, during which AMD underperformed the US Semiconductor industry by returning significantly less than the industry's 19.7% return. This discrepancy accentuates the stock's recent uptick by 30% in light of new product launches and strategic collaborations, suggesting a potential rebound amidst a generally stable broader market.

Despite these developments, analysts' consensus price target for AMD is US$126.92, meaning the recent price of US$98.62 reflects an 11.81% discount to this target. It's important to consider that while the product innovations and partnerships could influence revenue and earnings positively, the forecasted growth remains tempered by industry challenges, such as export restrictions and intensified competition, which align with the more conservative future profit estimates from bearish analysts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Advanced Micro Devices, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMD

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives