- United States

- /

- Semiconductors

- /

- NasdaqGS:AMD

Advanced Micro Devices (NasdaqGS:AMD) Unveils High-Performance AI GPUs And CPUs At COMPUTEX 2025

Reviewed by Simply Wall St

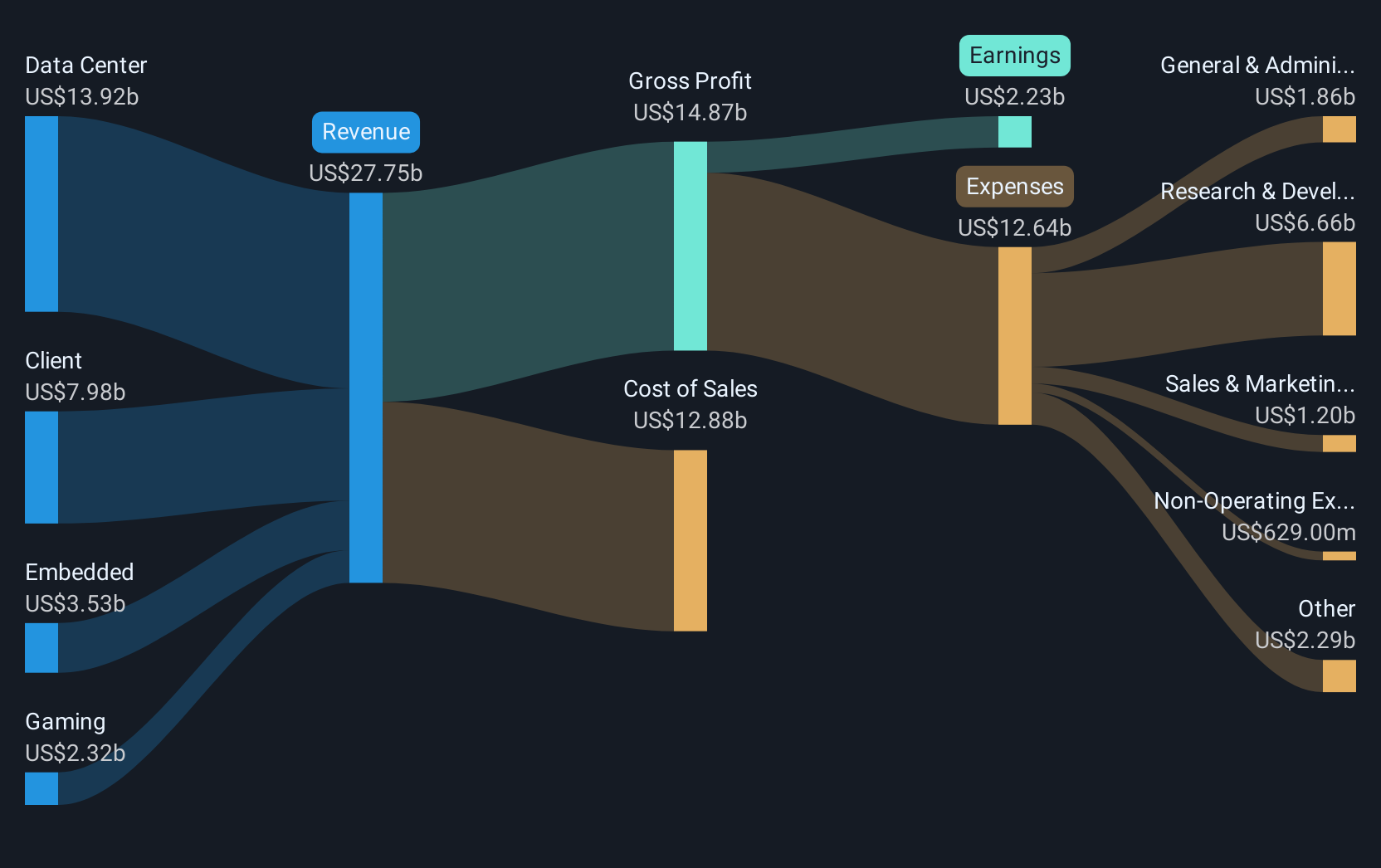

Advanced Micro Devices (NasdaqGS:AMD) showcased new high-performance graphics cards and processors at COMPUTEX 2025, alongside a collaboration with ASUS on advanced AI PCs, highlighting their focus on gaming and professional computing solutions. During the past month, the company also announced solid first-quarter earnings and a significant increase in its share buyback plan. These developments may have added weight to AMD's notable 31% stock surge last month, countering broader market movements amid a slight 1% decline. The tech sector, particularly the Nasdaq Composite, was on a positive trajectory, which likely supported AMD's strong performance.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

The recent developments surrounding Advanced Micro Devices (AMD) highlighted in the introduction could significantly influence the company's future trajectory. The unveiling of cutting-edge graphics cards and processors, along with a key partnership with ASUS, might drive higher consumer demand, especially in gaming and professional computing sectors. This could positively impact AMD's revenue and earnings forecasts, as such innovations often attract increased sales and market share, potentially counterbalancing the regulatory and competitive challenges the company faces.

Over the longer term, AMD's stock has shown impressive performance. Over the past five years, the company's total shareholder return, including dividends, reached 112.48%. While this showcases substantial growth, the company's one-year performance was less robust, with AMD underperforming both the US market, which returned 9.1%, and the US Semiconductor industry, which returned 12.3%. These comparisons indicate varying performance dynamics over different time frames, with more significant gains evident over the extended period.

The recent market activities also place AMD's current stock price of US$98.62 in perspective against the consensus price target of US$126.92, reflecting a discount of about 13.26%. This price movement suggests that despite AMD's innovations and strategic collaborations, analysts remain cautious about future growth, which is highlighted by the regulatory and competitive threats in global markets. Investors might find the current price appealing given the long-term potential if AMD effectively leverages its AI and cloud capabilities to bolster its market position. However, aligning expectations with analysts’ forecasts remains crucial in evaluating the company's prospects.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMD

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives