- United States

- /

- Semiconductors

- /

- NasdaqGS:AMD

Advanced Micro Devices (NasdaqGS:AMD) Stockholders Approve Increase in Authorized Shares

Reviewed by Simply Wall St

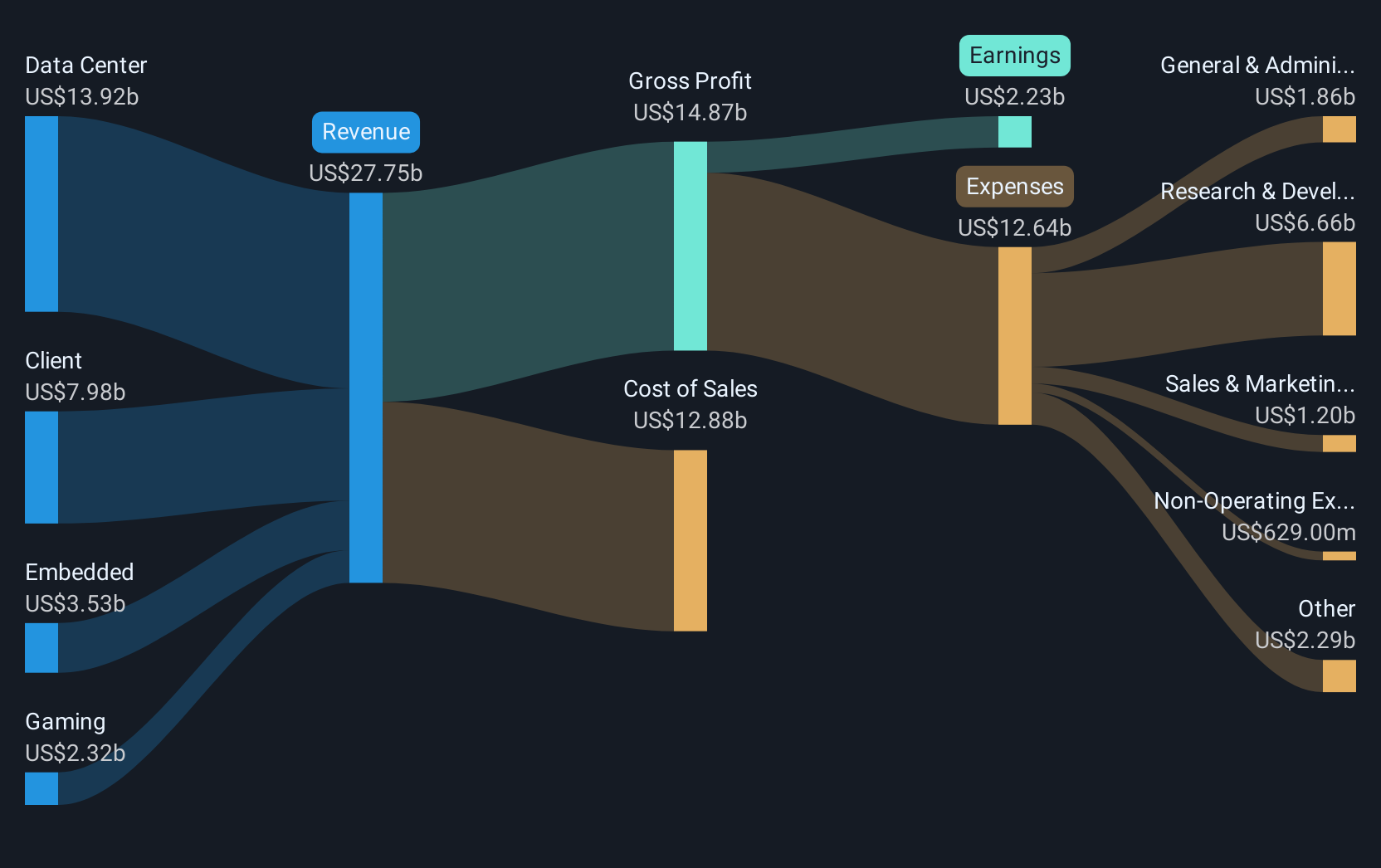

Advanced Micro Devices (NasdaqGS:AMD) has successfully amended its corporate bylaws to significantly increase its authorized shares, a move that could provide greater flexibility for future equity financing and initiatives. Over the past month, the company's stock has risen by 34%, a performance substantially outpacing the broader market's 5% gain. This price move is likely bolstered by the combination of strong earnings growth, an expanded buyback program, and pivotal partnerships in AI infrastructure, which together have positioned AMD favorably compared to market trends. The broader corporate developments certainly added weight to the momentum behind this price movement.

The recent amendment to Advanced Micro Devices' bylaws, aimed at increasing authorized shares, introduces greater flexibility for future equity initiatives. This regulatory maneuver could play a crucial role amidst challenges from deglobalization and export controls which threaten AMD's access to pivotal markets. Over a five-year span, AMD has delivered a substantial total return of 112.38%, reflecting its capability to adapt and pivot within the volatile semiconductor landscape, although the past year's performance lagged behind the broader semiconductor industry's 22.9% return.

Potential changes from this share authorization could impact revenue and earnings forecasts as they align with ongoing AI and innovation-driven demand. There are risks from competitive pressures and evolving supply chain dynamics that could compress margins and add volatility to earnings. Despite these hurdles, the company has set a target of US$127.19, with its current share price of US$98.62 reflecting an 8.55% discount to this target, suggesting potential upside if challenges are effectively managed and market conditions remain favorable. Balancing authorized share issuance with operational advancements might calibrate AMD's approach to navigate both growth and risk scenarios effectively.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMD

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives