- United States

- /

- Semiconductors

- /

- NasdaqGS:AMD

Advanced Micro Devices (NasdaqGS:AMD) Introduces 5th Gen AMD EPYC Processors Amid 15% Dip Last Month

Reviewed by Simply Wall St

Advanced Micro Devices (NasdaqGS:AMD) recently unveiled its 5th Gen AMD EPYC™ processors, significantly boosting Oracle Cloud Infrastructure's performance, as well as expanding its x86 embedded processor portfolio. Despite these announcements, the company's share price decreased by 15% over the past month. This decline occurs amid a broader tech sector downturn, with the Nasdaq entering bear market territory following heightened volatility due to a trade war with China. The tech-heavy index witnessed a 10% drop, directly affecting AMD and highlighting the pressures on semiconductor stocks during this turbulent period.

Find companies with promising cash flow potential yet trading below their fair value.

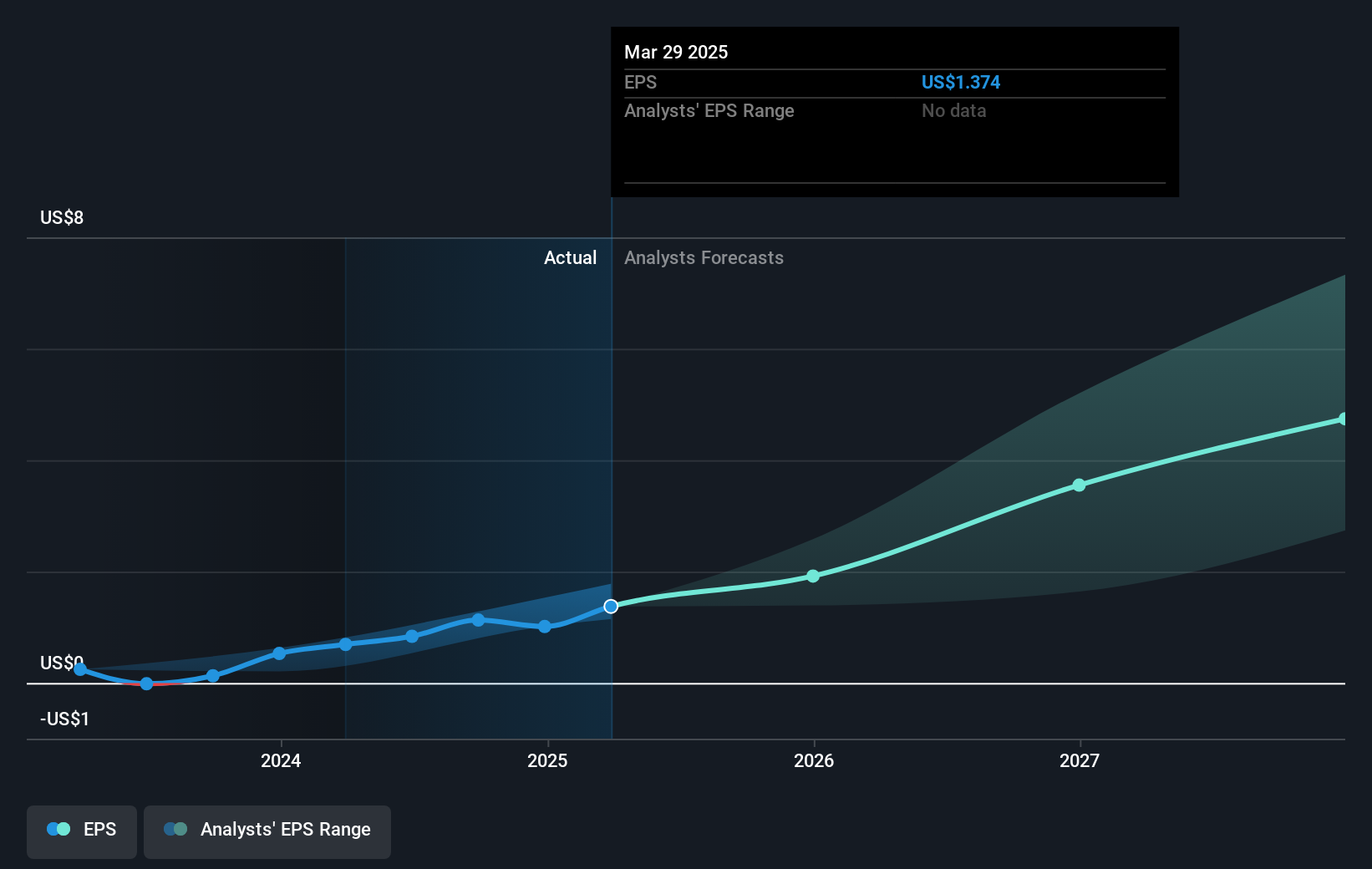

The recent unveiling of AMD's 5th Gen EPYC processors and enhancements in Oracle Cloud Infrastructure suggest a potential positive impact on AMD's revenue and earnings forecasts, despite a recent 15% decline in the share price amid broader tech sector challenges. This news may bolster AMD's Data Center AI offerings, expected to drive significant revenue growth and improve margins through the introduction of Instinct accelerators and ROCm updates.

Over the past five years, AMD's total return, including share price appreciation and dividends, was 77.26%, reflecting a substantial upward performance in comparison to its recent setbacks. Over the last year, however, AMD has underperformed the US market and semiconductor industry, which saw returns of 3.4% and 10.7% declines, respectively.

While catalysts like the EPYC processors and collaboration with hyperscale cloud providers offer promising growth avenues, potential competitive pressures and sector volatility remain risks. Analysts have set a consensus price target of US$146.53, indicating a significant premium over the current share price of roughly US$102.78, which could suggest market confidence in AMD's longer-term growth potential despite current challenges.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMD

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives