- United States

- /

- Semiconductors

- /

- NasdaqGS:AMD

A Fresh Look at AMD (AMD) Valuation Following Intel Foundry Talks and New AI Partnerships

Reviewed by Kshitija Bhandaru

Advanced Micro Devices (AMD) is in the spotlight after reports surfaced it is in early discussions to use Intel’s foundry services. This move could reshape the semiconductor manufacturing landscape and support AMD’s supply chain flexibility.

At the same time, AMD is deepening its ties with IBM and Cohere to expand AI infrastructure solutions, reinforcing its growing presence in global AI and enterprise projects. The combination of these developments comes as investor confidence in chipmakers rises, fueled by OpenAI’s significant infrastructure investments and accelerating demand for advanced semiconductors.

See our latest analysis for Advanced Micro Devices.

AMD’s share price has gained fresh momentum alongside soaring investor enthusiasm for semiconductors, fueled by OpenAI’s blockbuster investments and headline partnerships across the industry. News of early-stage talks with Intel, plus deeper AI collaborations with IBM and Cohere, have helped reinforce AMD’s supply chain resilience and growth outlook. Over the past year, total shareholder returns stand at over 4%, while three-year performance is robust at more than 150%. This highlights both the stock’s long-term upside and the sector’s current strengths.

If this burst of innovation in the chip space has you curious, it’s a great moment to discover other top movers. Check out the See the full list for free..

With all this momentum and visibility, the key question for investors remains: Is AMD undervalued given its growth and strategic moves, or has the market already factored in all the potential upside from its AI and manufacturing tailwinds?

Most Popular Narrative: 41.6% Undervalued

According to the most popular narrative from Zwfis, AMD’s intrinsic worth is seen to be far above the last close price of $169.73. This perspective sets up a bold case for AMD’s next phase, hinging on the company’s remarkable growth forecasts and ambitious targets for profitability and efficiency.

However, in the next year to two AMD's growth is going to start running off the charts. For the valuation I have it tied to a growth of about 31%, PE following their 10 year at 34.27 and a profit margin of 8.03%. Now, I feel like however that this stock will in the next couple of years grow to a larger profit margin with how the CEO, Lisa Sue, has been talking about how they are wanting to work towards being more efficient.

Curious what ropes AMD will pull to justify such a high valuation? The entire fair value hinges on aggressive expansion and margin improvement. Discover the bold numbers and financial leaps envisioned in the full narrative. You might be surprised by the ambition driving these projections.

Result: Fair Value of $290.64 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain if global chip demand falters or if execution missteps delay AMD’s AI and manufacturing gains. These factors could potentially challenge this optimistic valuation outlook.

Find out about the key risks to this Advanced Micro Devices narrative.

Another View: High Hopes or High Price?

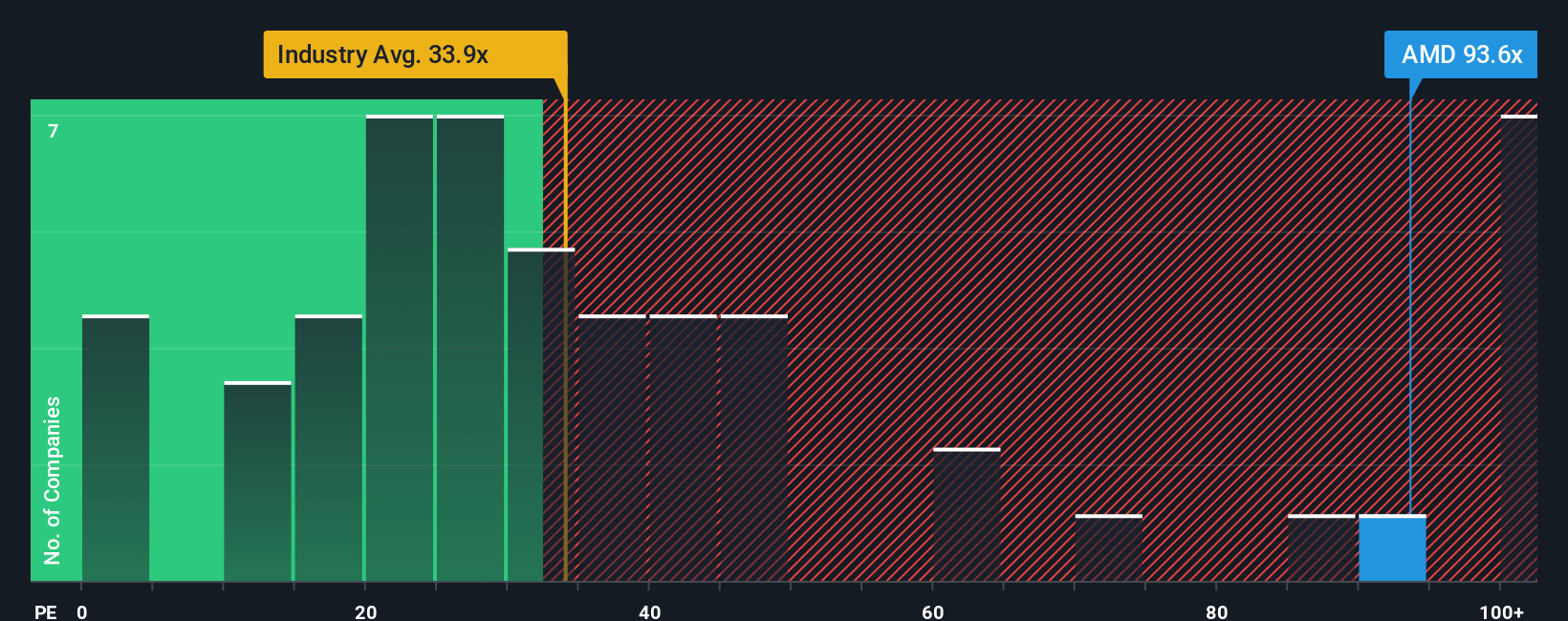

While the bullish narrative points to significant upside, traditional measures tell a more cautious story. AMD trades at a price-to-earnings ratio of 100.9x, which is much higher than both the semiconductor industry average of 37.7x and peer average of 33.4x. Even compared to its fair ratio of 51.6x, AMD appears expensive. This steep premium suggests investors are paying up for growth, but it leaves little room for disappointment, especially if future results do not meet expectations. Are investors too eager, or is there more upside ahead?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Advanced Micro Devices Narrative

If you see things differently or prefer your own dive into the data, you can craft a unique perspective in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Advanced Micro Devices.

Looking for More Investment Ideas?

Take control of your investing journey and spot tomorrow’s winners before the crowd. You’ll regret missing the opportunity to get ahead with these fresh stock ideas:

- Explore the momentum of powerful disruptors by scanning these 24 AI penny stocks that are pushing the boundaries of artificial intelligence across industries.

- Find overlooked bargains in the market by zeroing in on these 904 undervalued stocks based on cash flows with strong cash flow potential and proven staying power.

- Start building a portfolio with consistent returns by targeting these 19 dividend stocks with yields > 3% that offer impressive yields and reliable income streams.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMD

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion