- United States

- /

- Semiconductors

- /

- NasdaqGS:AMBA

Ambarella (AMBA): Valuation Insights After Upbeat 2026 Outlook and Improved Quarterly Results

Reviewed by Simply Wall St

Ambarella (AMBA) just made waves in the market by raising its revenue growth forecast for fiscal 2026 to 31% to 35%. On top of this, the company delivered a clear improvement in its latest earnings report with second quarter sales up from a year ago and net losses narrowing significantly. After periods of sluggishness, this twin update has turned the spotlight back on whether Ambarella’s future might be brighter than investors expected just a few months ago.

The combination of sharply higher revenue guidance and improved margins caught investors’ attention. Momentum has been picking up over the past month, pushing the stock up 30% and over 62% for the year. A few weak quarters earlier in the year had weighed on the share price, so the shift suggests the market now sees reduced risk and stronger execution. Over the past three years, Ambarella’s returns look more modest, but recent results are forcing investors to take a fresh look at the underlying business.

Now that optimism has returned to the stock, the big question is whether Ambarella is undervalued after this rally, or if investors are already pricing in all of that future growth.

Most Popular Narrative: 6.7% Undervalued

The prevailing narrative suggests Ambarella is currently undervalued compared to its estimated fair value, with the market possibly underestimating its potential for future revenue and margin expansion.

Accelerated adoption and ramp of higher-margin, 5-nanometer AI SoCs in both new and existing markets are driving increases in average selling prices (ASP). This, combined with scale from broader AI-enabled product lines, is supporting higher gross margins and improved net income.

Curious why Ambarella’s future earnings may justify a price tag higher than today’s? This narrative hinges on assumptions about outsized growth and a significant turnaround in profitability. Want to peek under the hood at the financial leaps they see playing out soon? Discover which underlying business shifts—and what kind of leap in bottom-line results—analysts are betting on to set Ambarella's value above its current level.

Result: Fair Value of $90.05 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent reliance on the volatile IoT segment and concentrated customers may still threaten Ambarella's revenue stability and margin recovery in the future.

Find out about the key risks to this Ambarella narrative.Another View: What Multiples Say

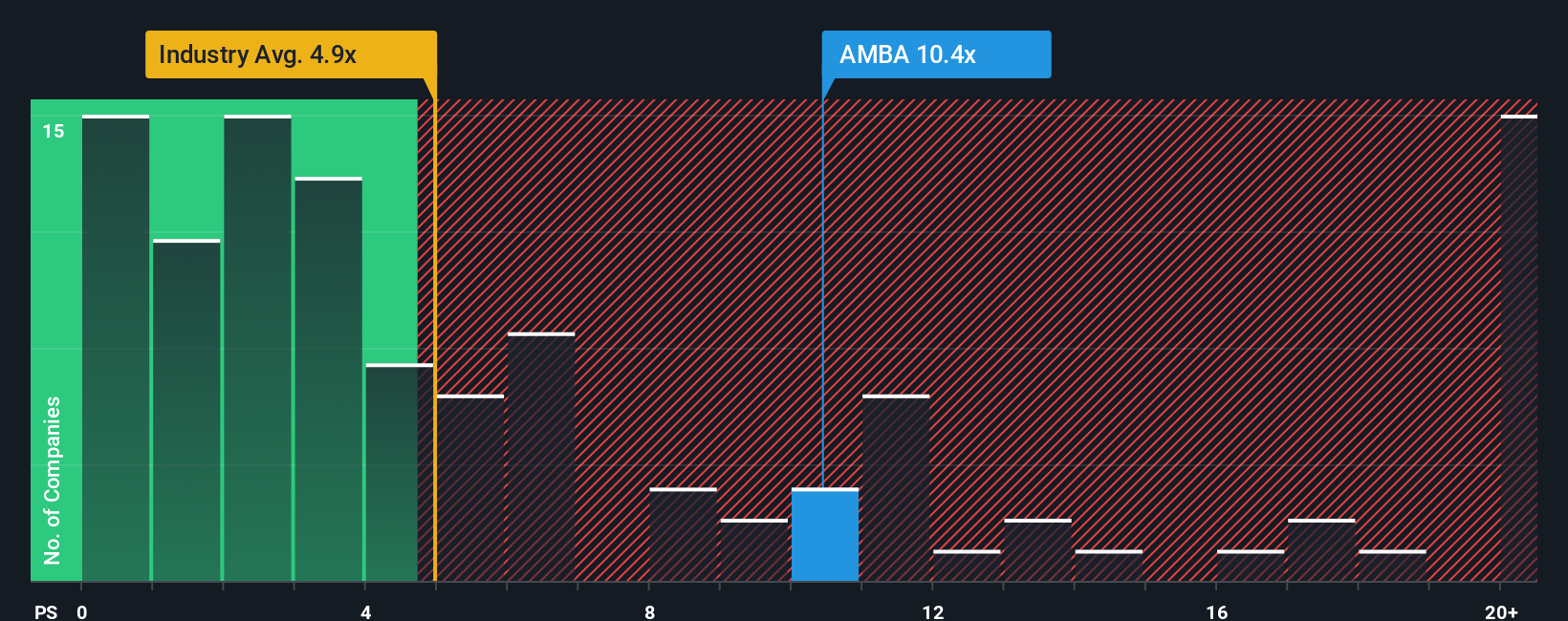

While the analyst narrative points to Ambarella being undervalued, a look at its sales-based valuation compared to the semiconductor industry average paints a different picture. Ambarella actually appears expensive using this lens. What does this say about the growth the market is pricing in?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ambarella Narrative

Keep in mind, if you want a different perspective or prefer to dig through the details yourself, you can shape your own take on Ambarella in just a few minutes: Do it your way.

A great starting point for your Ambarella research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Why stop here? Accelerate your investment journey with handpicked opportunities that cater to your interests and goals. Take the next step; these standout ideas could put you ahead of the crowd.

- Capitalize on fast-growing, AI-powered disruptors shaking up industries when you get started with the AI penny stocks.

- Uncover tomorrow’s potential leaders trading at bargain prices by tapping into our selection of undervalued stocks based on cash flows.

- Boost your passive income strategy with stocks offering consistently high yields. See what’s possible through dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NasdaqGS:AMBA

Ambarella

Develops semiconductor solutions that enable artificial intelligence (AI) processing, advanced image signal processing, and high-definition (HD) and ultra-HD compression.

Flawless balance sheet with very low risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)