- United States

- /

- Semiconductors

- /

- NasdaqGS:AMAT

Applied Materials (AMAT): Assessing Valuation After Record Revenues and Cautious Guidance on Near-Term Outlook

Reviewed by Simply Wall St

Applied Materials (AMAT) is making waves after reporting record revenues in its Semiconductor Systems segment, driven by strong demand for foundry-logic, DRAM, and NAND products. The real eye-opener, however, is the company’s guidance: while management is optimistic about roughly 50% growth in revenues from leading-edge DRAM customers this year, thanks in part to long-term trends like AI and advanced packaging, they are urging some caution for the next quarter. Weaker guidance was pinned on short-term hurdles, including a digestion of capacity in China, delayed export licenses, and unpredictable timing from a handful of large customers.

This mix of long-term optimism and near-term caution has made AMAT’s stock movements this year especially interesting. It has been a choppy ride, with modest losses over the past month and a mild decline over twelve months, despite the company’s big wins in recent quarters. Momentum remains clearly positive over several years, as AMAT has more than doubled over five years and returned over 84% in the past three years. Recent events suggest investors are still grappling with how to price both the company’s strong business positions and the uncertainties ahead.

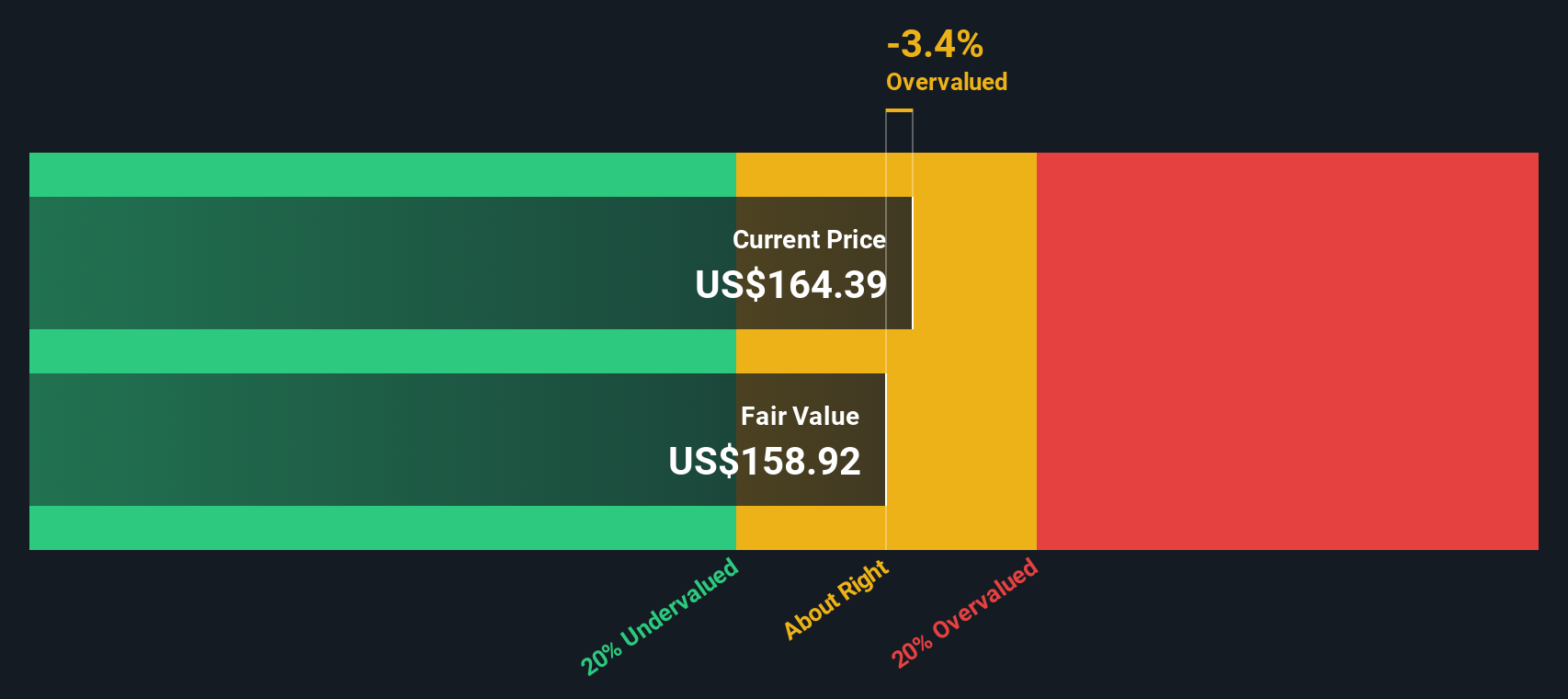

With record results, but softer guidance dampening enthusiasm, the question for investors is whether Applied Materials now offers a rare opportunity to buy on weakness, or if the market is simply pricing in future growth already.

Most Popular Narrative: 16.5% Undervalued

According to the most popular narrative, Applied Materials shares are seen as trading at a meaningful discount to fair value, suggesting significant upside compared to current prices.

New Chip Technologies (Gate-All-Around, 3D Transistors, EUV Lithography): AMAT supplies deposition, etching, and metrology tools critical for next-gen semiconductor manufacturing. Automotive & Power Semiconductors: Growth in electric vehicles (EVs), industrial automation, and IoT will drive more chip demand, requiring AMAT’s specialized tools.

Curious about what sets this valuation apart? The narrative rests on bullish assumptions about revenue acceleration, strong margins, and cutting-edge tech demand. Discover which numbers and forecasts turn these next-generation catalysts into a case for big upside.

Result: Fair Value of $194.11 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, investors must watch for U.S. export restrictions on China and the semiconductor industry’s cyclical downturns, as both could quickly change the outlook.

Find out about the key risks to this Applied Materials narrative.Another View: The DCF Perspective

While multiples suggest Applied Materials is undervalued, our SWS DCF model looks at future cash flows and arrives at a similar conclusion. However, could both methods be too optimistic, or are they onto something?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Applied Materials for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Applied Materials Narrative

If you think there’s more to the story or want to dig into the numbers yourself, you can easily put together your own view in under three minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Applied Materials.

Looking for More Investment Ideas?

Don’t miss your chance to put your money to work in promising opportunities beyond Applied Materials. Use these hand-picked ideas to get ahead of the curve and spot tomorrow’s standout investments before everyone else.

- Tap into growth potential and stability when you browse dividend stocks with yields > 3%. These deliver income streams through reliable payouts and solid fundamentals.

- Ride the AI momentum by searching AI penny stocks offering advancements in intelligent automation, big data, and transformative business models.

- Zero in on value plays by tracking undervalued stocks based on cash flows. These are opportunities that the market may have overlooked, allowing you to seek long-term gains before the crowd catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NasdaqGS:AMAT

Applied Materials

Engages in the provision of manufacturing equipment, services, and software to the semiconductor, display, and related industries.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion