- United States

- /

- Semiconductors

- /

- NasdaqGS:ALAB

Is Astera Labs at Risk After 19% Drop Despite AI Market Momentum?

Reviewed by Bailey Pemberton

Trying to figure out what to do with Astera Labs stock? You are not alone. With prices leaping nearly 47% year-to-date and soaring a staggering 269.5% over the past year, this stock is on the radar of everyone from retail investors to seasoned pros. However, it has not been a straight shot up. Over the last week, Astera Labs fell 19.3%, signaling that market confidence can waver quickly and risk perceptions may be shifting. In the past month, though, there was a rebound of 10.4%, showing an appetite from buyers when the price dips.

Some of this volatility is tied to wider market excitement around AI-driven tech infrastructure and the ongoing wave of capital flowing into semiconductor-adjacent businesses like Astera Labs. While analysts debate whether this is the start of a new cycle or just a hype-fueled blip, smart investors are left to ask whether, at the current price, Astera Labs stock is undervalued, overvalued, or right on the money.

The straightforward answer, at least based on a simple valuation check, tilts cautious. Astera Labs is scoring a 0 out of 6 with our value score, meaning it does not appear undervalued by any of the standard measures we track. But numbers rarely tell the whole story. Next, we will dig into exactly which valuation methods we use and what they are showing about Astera Labs. Stay tuned, because at the end, I’ll share the most useful way you can think about valuation, especially in a dynamic market like this one.

Astera Labs scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.Approach 1: Astera Labs Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates the intrinsic value of a company by projecting its future cash flows and discounting them back to today’s value. For Astera Labs, this involves looking at how much money the company generates now, how quickly those cash flows could grow, and calculating what that is worth in present terms.

Currently, Astera Labs reported Free Cash Flow (FCF) of $219.3 million. Analyst estimates cover the next five years, with projections continuing beyond that using straightforward growth assumptions. By 2029, forecasts suggest FCF could reach $586 million, and longer-range extrapolations extend these figures further, although with less certainty. All cash flow projections are in US dollars and remain comfortably below $1 billion, keeping the focus on millions.

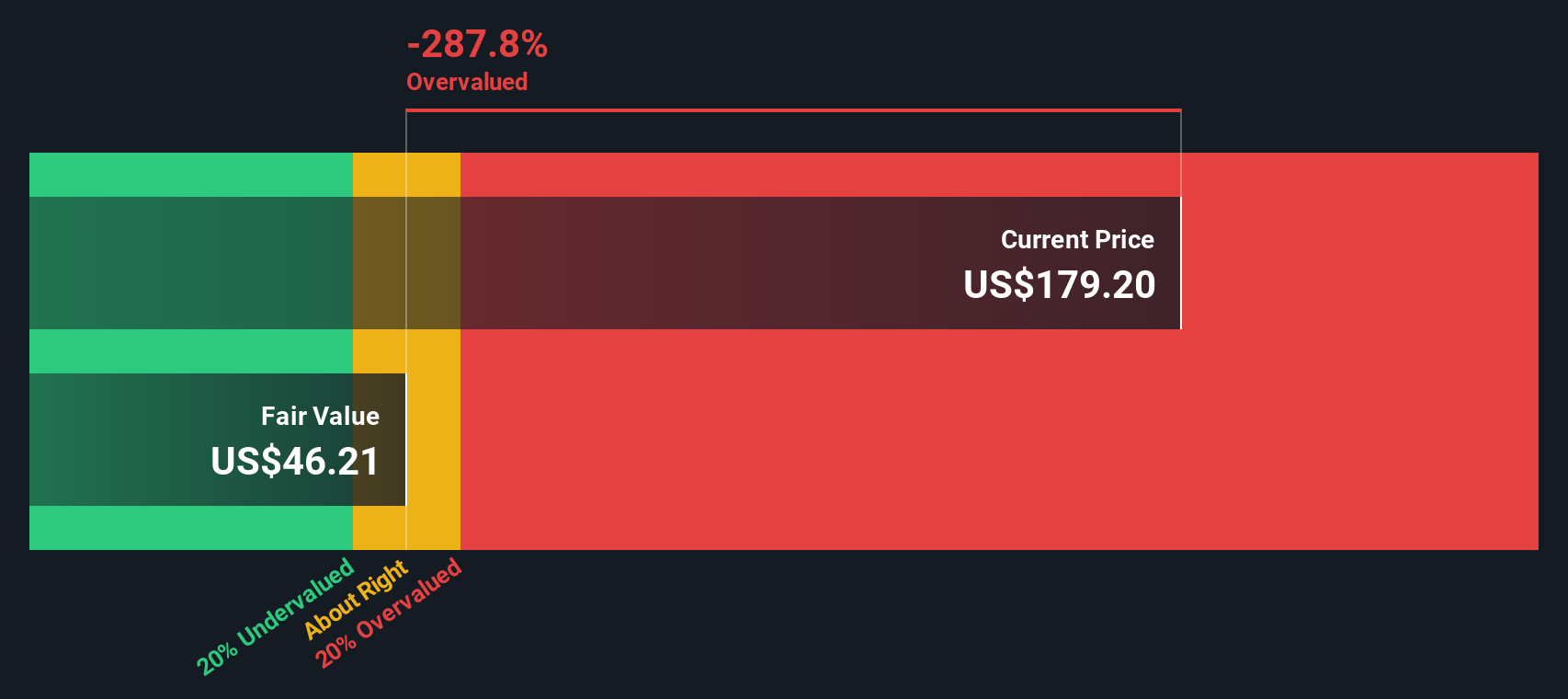

According to the DCF analysis, the resulting estimated intrinsic value for Astera Labs stock is $47.12 per share. At current market prices, this methodology suggests the stock is trading at a 319.7 percent premium. That means Astera Labs appears dramatically overvalued by this measure, and the price includes a substantial amount of future growth optimism or market hype.

Result: OVERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Astera Labs.

Approach 2: Astera Labs Price vs Book (P/B)

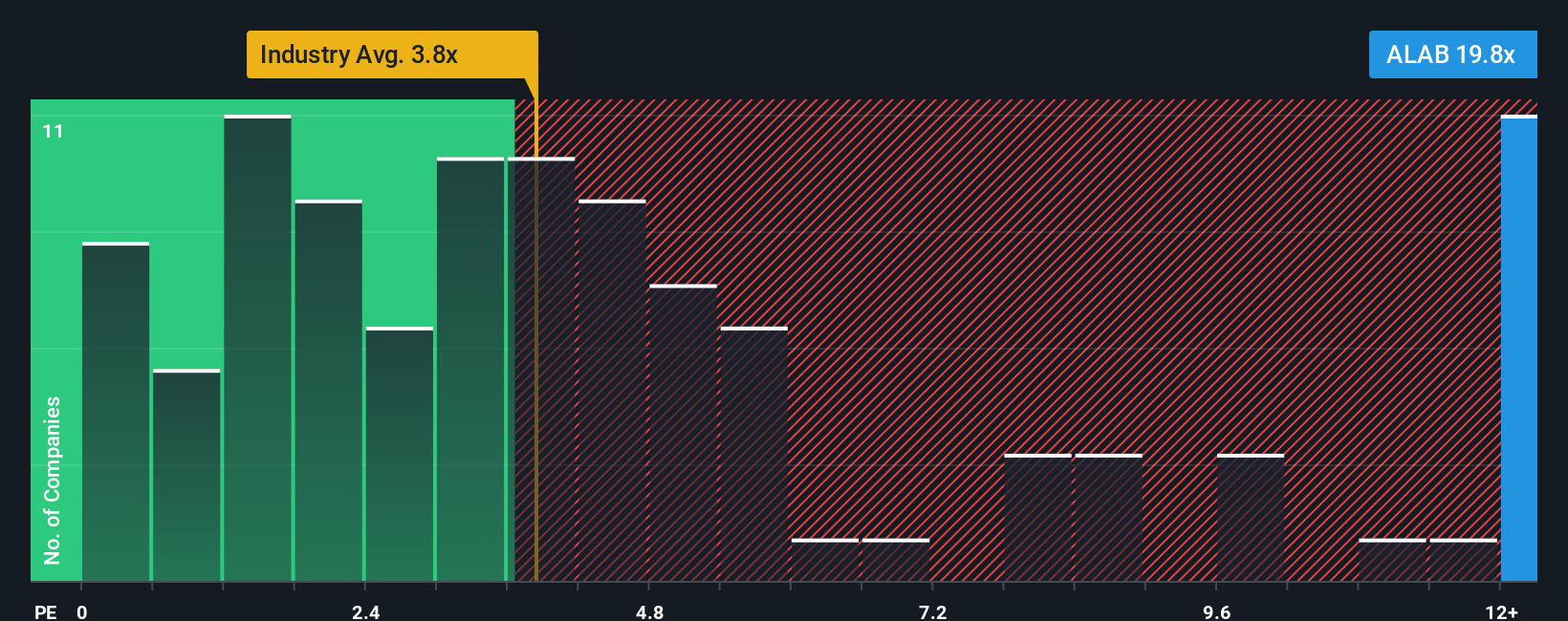

The Price-to-Book (P/B) ratio is especially useful for valuing profitable and asset-heavy technology companies like Astera Labs, as it reflects how the market values the company’s net assets. This multiple offers insights into whether investors are paying a reasonable price for the company’s tangible and intangible book value. Generally, if investors expect higher growth or lower risk, a higher P/B ratio can be justified. By contrast, slower growth or elevated risk tends to push a "normal" or "fair" P/B closer to industry averages.

Right now, Astera Labs is trading at a P/B ratio of 28.95x. This is significantly higher than the Semiconductor industry average of 3.19x and even above its peer group average of 13.79x. At first glance, this big premium suggests that the market is very optimistic about Astera Labs’ future.

To refine this view, we can turn to Simply Wall St’s proprietary "Fair Ratio." Unlike traditional comparisons, the Fair Ratio adjusts for Astera Labs’ specific growth forecasts, margins, market cap, risk profile, and its position in the industry. This gives a more personalized benchmark, helping investors see past headline multiples and focus on what is truly justified for Astera Labs specifically.

When comparing Astera Labs’ actual P/B multiple of 28.95x to its Fair Ratio, the large difference indicates the shares are trading well above what company fundamentals suggest is fair. By this measure, Astera Labs appears overvalued on a Price-to-Book basis.

Result: OVERVALUED

Upgrade Your Decision Making: Choose your Astera Labs Narrative

Earlier, we mentioned there is a more insightful way to make investment decisions. Let’s introduce Narratives. A Narrative is a personalized story that connects your perspective on a company, like Astera Labs, with your own estimates of its future revenues, margins, and fair value, all backed by your reasoning behind the numbers. Narratives turn valuation from a static formula into a living, breathing forecast. This approach links Astera Labs’ business story to your financial outlook and a calculated fair value you can regularly compare with the current share price.

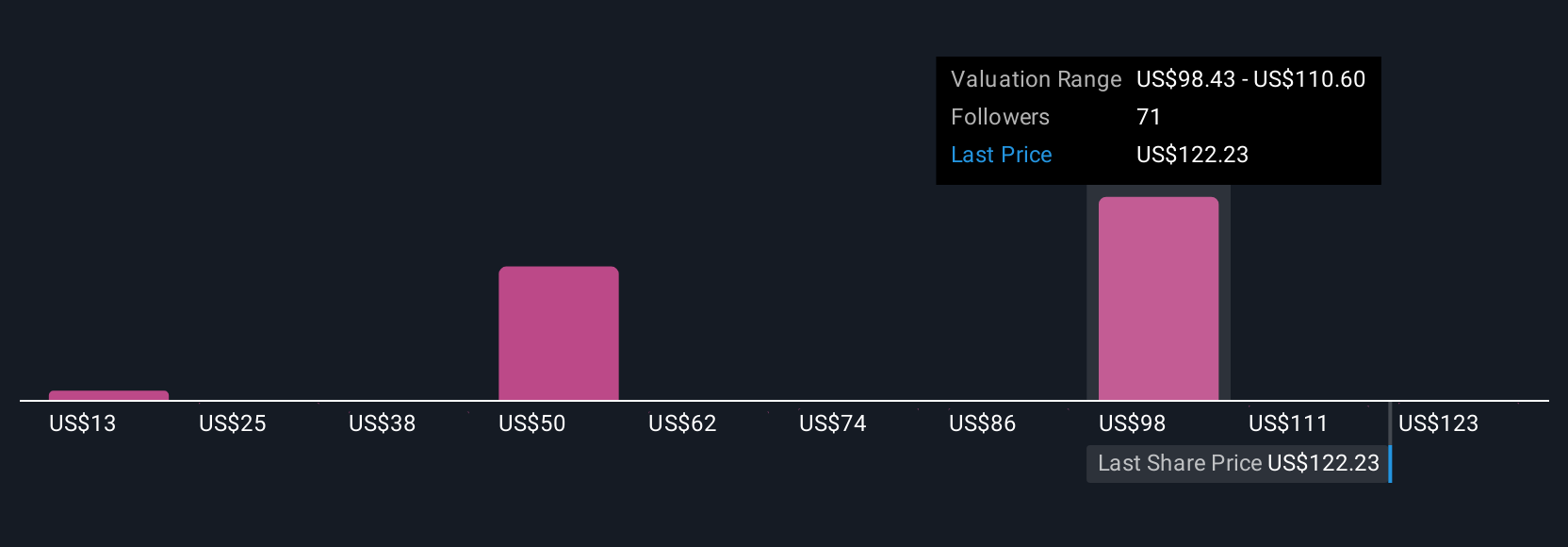

On Simply Wall St’s Community page, millions of investors are already using Narratives to easily track their logic for buying or selling stocks as new news or results emerge, automatically updating their fair value when assumptions change. For example, one investor might see Astera Labs at the forefront of AI infrastructure, building on industry partnerships to project a fair value as high as $215.00 per share. Another could focus on competitive and technology risks, estimating its worth closer to $125.00. Narratives empower you to turn today’s fast-evolving facts into your own actionable investment roadmap.

Do you think there's more to the story for Astera Labs? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ALAB

Astera Labs

Designs, manufactures, and sells semiconductor-based connectivity solutions for cloud and AI infrastructure.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)