- United States

- /

- IT

- /

- NasdaqGS:CRWV

Discover 3 Growth Stocks With Insider Ownership Up To 28%

Reviewed by Simply Wall St

Over the last 7 days, the United States market has experienced a 1.4% drop, but it remains up by 11% over the past year with earnings expected to grow by 14% annually in the coming years. In this context of fluctuating yet promising market conditions, growth stocks with significant insider ownership can be appealing as they often indicate confidence from those closest to the company's operations and potential for future success.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Super Micro Computer (NasdaqGS:SMCI) | 25.3% | 39.1% |

| Duolingo (NasdaqGS:DUOL) | 14.3% | 39.9% |

| AST SpaceMobile (NasdaqGS:ASTS) | 13.4% | 67.1% |

| FTC Solar (NasdaqCM:FTCI) | 27.9% | 61.8% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 12.1% | 65.1% |

| Astera Labs (NasdaqGS:ALAB) | 15.2% | 44.3% |

| BBB Foods (NYSE:TBBB) | 16.2% | 30.2% |

| Enovix (NasdaqGS:ENVX) | 12.1% | 58.4% |

| Upstart Holdings (NasdaqGS:UPST) | 12.5% | 102.6% |

| Eagle Financial Services (NasdaqCM:EFSI) | 15.8% | 82.8% |

We're going to check out a few of the best picks from our screener tool.

Corcept Therapeutics (NasdaqCM:CORT)

Simply Wall St Growth Rating: ★★★★★☆

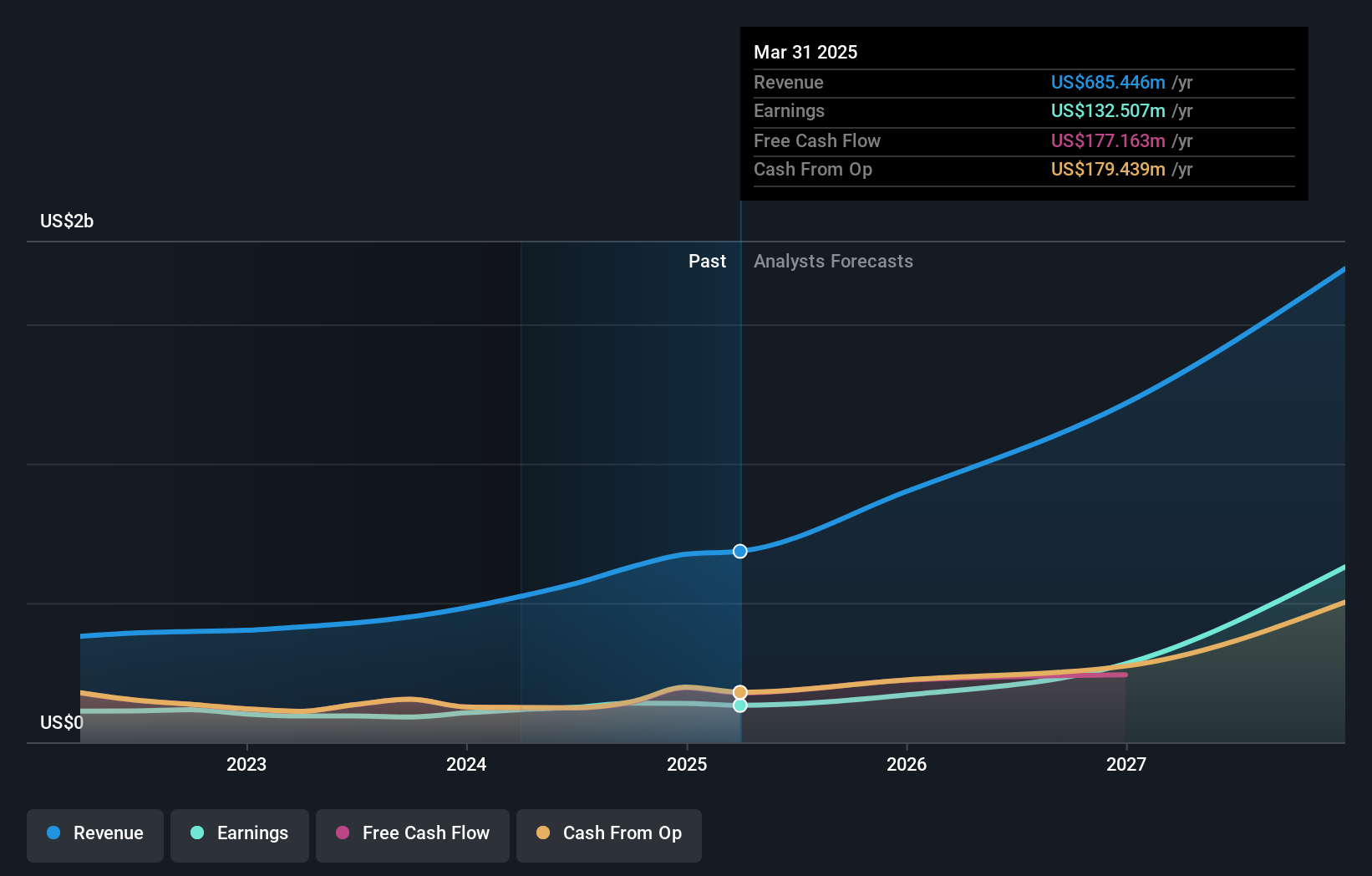

Overview: Corcept Therapeutics Incorporated focuses on discovering and developing medications for severe endocrinologic, oncologic, metabolic, and neurologic disorders in the United States, with a market cap of $8.04 billion.

Operations: The company's revenue is primarily derived from the discovery, development, and commercialization of pharmaceutical products, amounting to $685.45 million.

Insider Ownership: 11.5%

Corcept Therapeutics is poised for significant growth, with revenue expected to increase by 27.5% annually, outpacing the broader US market. Despite recent earnings showing a decline in net income to US$20.55 million for Q1 2025, the company maintains robust revenue guidance of US$900-950 million for the year. Corcept's strategic focus on cortisol modulation and its proprietary drug relacorilant shows promise in treating serious conditions like ovarian cancer and Cushing's syndrome, supported by successful clinical trials.

- Click here to discover the nuances of Corcept Therapeutics with our detailed analytical future growth report.

- According our valuation report, there's an indication that Corcept Therapeutics' share price might be on the expensive side.

Astera Labs (NasdaqGS:ALAB)

Simply Wall St Growth Rating: ★★★★★★

Overview: Astera Labs, Inc. designs, manufactures, and sells semiconductor-based connectivity solutions for cloud and AI infrastructure with a market cap of $15.20 billion.

Operations: The company generates $490.47 million in revenue from its semiconductor-based connectivity solutions for cloud and AI infrastructure.

Insider Ownership: 15.2%

Astera Labs is experiencing rapid growth, with earnings projected to rise significantly at 44.3% annually and revenue expected to grow at 24% per year, both surpassing US market averages. Despite recent insider selling, the company's collaboration with NVIDIA on AI infrastructure solutions highlights its strategic positioning in advanced connectivity technologies. Recent announcements include a Q1 net income of US$31.82 million from sales of US$159.44 million, marking a turnaround from previous losses.

- Take a closer look at Astera Labs' potential here in our earnings growth report.

- Our valuation report unveils the possibility Astera Labs' shares may be trading at a premium.

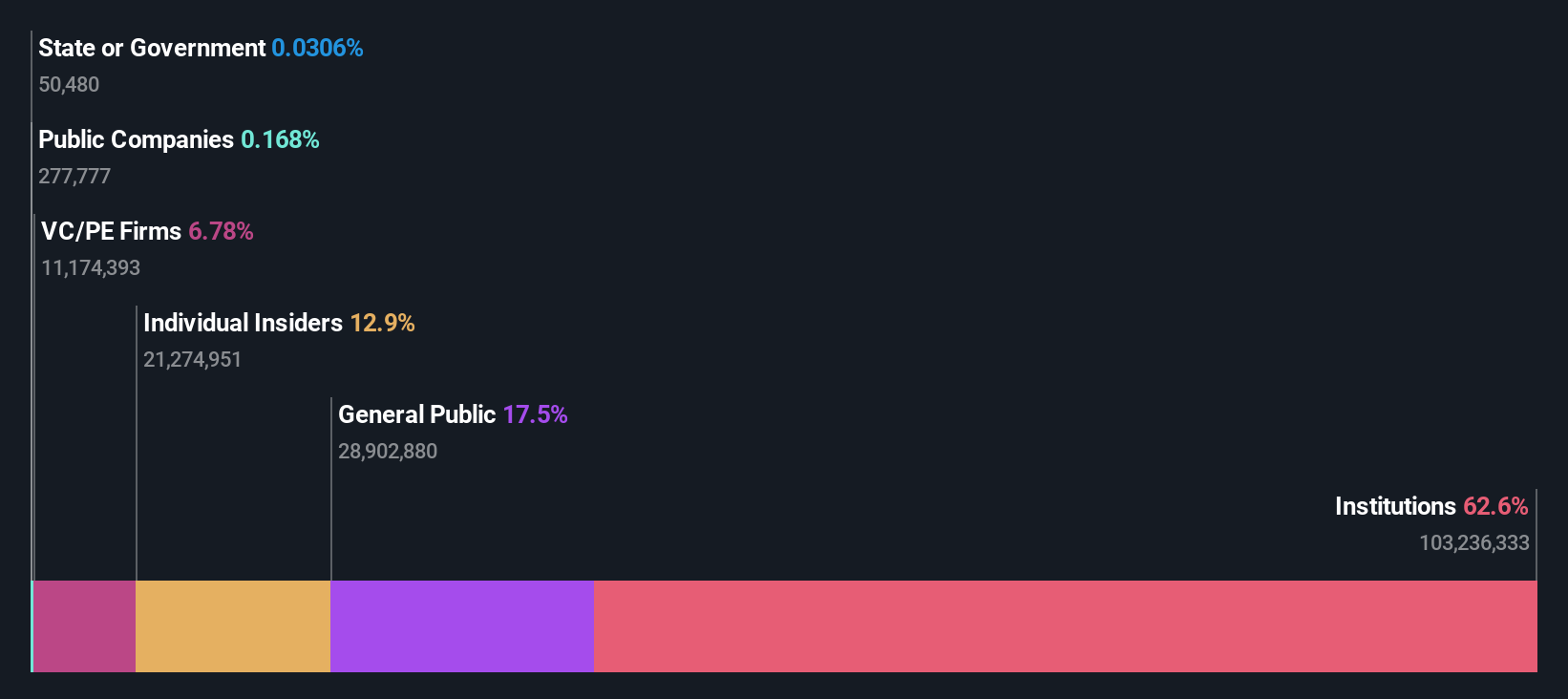

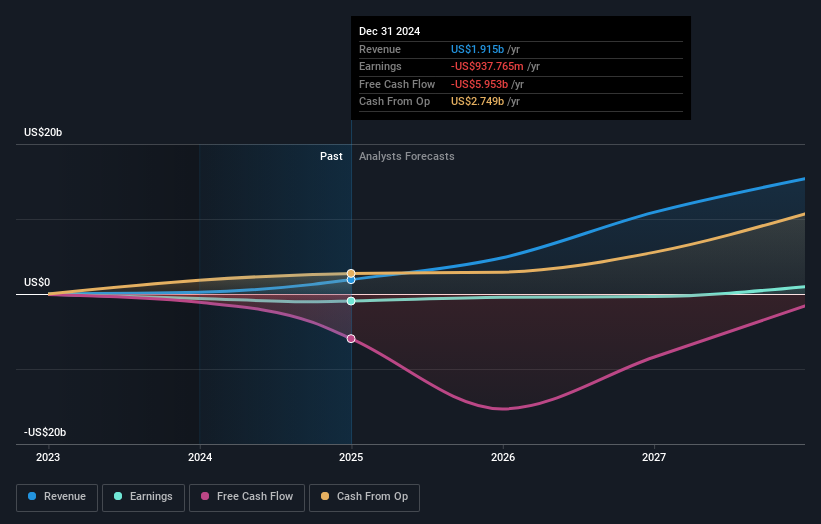

CoreWeave (NasdaqGS:CRWV)

Simply Wall St Growth Rating: ★★★★★☆

Overview: CoreWeave, Inc. operates a cloud platform focused on scaling, support, and acceleration for GenAI with a market cap of $51.54 billion.

Operations: The company's revenue is primarily derived from its data processing segment, which generated $2.71 billion.

Insider Ownership: 28.7%

CoreWeave's recent $2 billion debt offering, alongside a $4 billion cloud computing deal with OpenAI, underscores its strategic growth in AI infrastructure. Despite high share price volatility and significant insider selling over the past three months, CoreWeave's revenue is forecast to grow at 37.3% annually, outpacing the US market. The company's financial maneuvers aim to enhance flexibility for expanding its AI cloud platform globally while maintaining a focus on technological innovation and partnerships.

- Delve into the full analysis future growth report here for a deeper understanding of CoreWeave.

- Our expertly prepared valuation report CoreWeave implies its share price may be too high.

Next Steps

- Embark on your investment journey to our 189 Fast Growing US Companies With High Insider Ownership selection here.

- Searching for a Fresh Perspective? AI is about to change healthcare. These 22 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CRWV

CoreWeave

Operates a cloud platform that provides scaling, support, and acceleration for GenAI.

High growth potential low.

Similar Companies

Market Insights

Community Narratives