- United States

- /

- Banks

- /

- NasdaqCM:BFC

Undiscovered Gems In The US Featuring Three Promising Small Caps

Reviewed by Simply Wall St

Over the last 7 days, the United States market has experienced a slight decline of 1.0%, yet it remains robust with a 30% increase over the past year and an anticipated annual earnings growth of 15%. In this dynamic environment, identifying promising small-cap stocks can offer unique opportunities for investors seeking to uncover potential growth beyond the mainstream radar.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Franklin Financial Services | 222.36% | 5.55% | -1.86% | ★★★★★★ |

| Parker Drilling | 46.25% | -0.33% | 53.04% | ★★★★★★ |

| Morris State Bancshares | 17.84% | 4.83% | 6.58% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.65% | 11.17% | ★★★★★★ |

| Teekay | NA | -3.71% | 60.91% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.11% | -35.88% | ★★★★★☆ |

| AirJoule Technologies | NA | nan | 127.67% | ★★★★★☆ |

| FRMO | 0.13% | 19.43% | 29.70% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

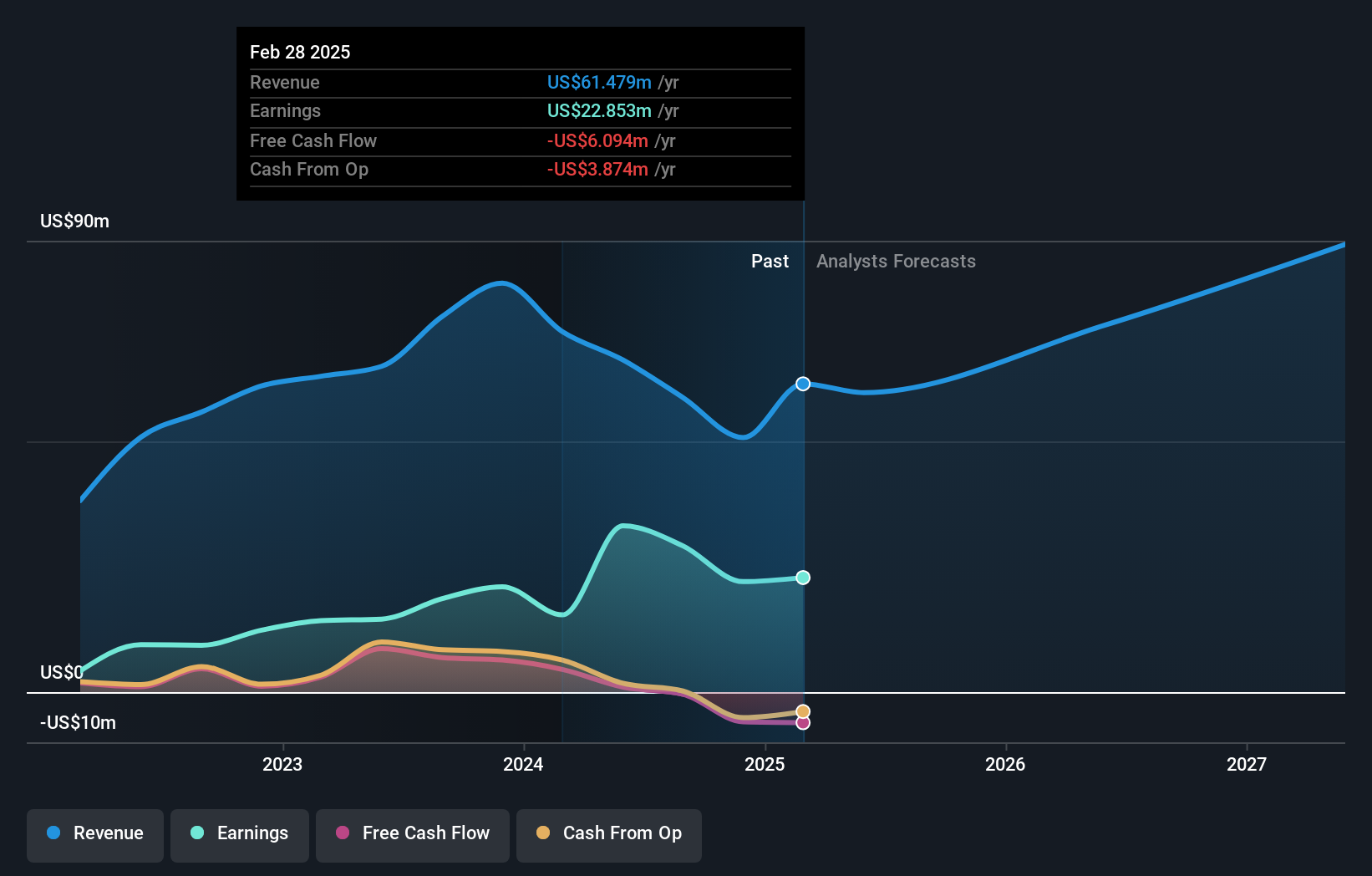

Aehr Test Systems (NasdaqCM:AEHR)

Simply Wall St Value Rating: ★★★★★★

Overview: Aehr Test Systems, Inc. offers test solutions for semiconductor devices in various forms globally and has a market capitalization of $330.68 million.

Operations: The primary revenue stream for Aehr Test Systems comes from designing, manufacturing, and marketing advanced test and burn-in products, generating $58.71 million. The company has a market capitalization of $330.68 million.

Aehr Test Systems, a nimble player in the semiconductor sector, stands out due to its impressive earnings growth of 56.7% over the past year, surpassing the industry's -3.9%. The firm is debt-free now compared to a 17.4% debt-to-equity ratio five years ago and boasts a price-to-earnings ratio of 11.5x, which is attractive against the US market's 18.8x. Despite recent shareholder dilution and volatile share prices, Aehr remains profitable with no concerns over cash runway or interest payments coverage, making it an intriguing prospect for those eyeing growth potential in semiconductors.

- Take a closer look at Aehr Test Systems' potential here in our health report.

Explore historical data to track Aehr Test Systems' performance over time in our Past section.

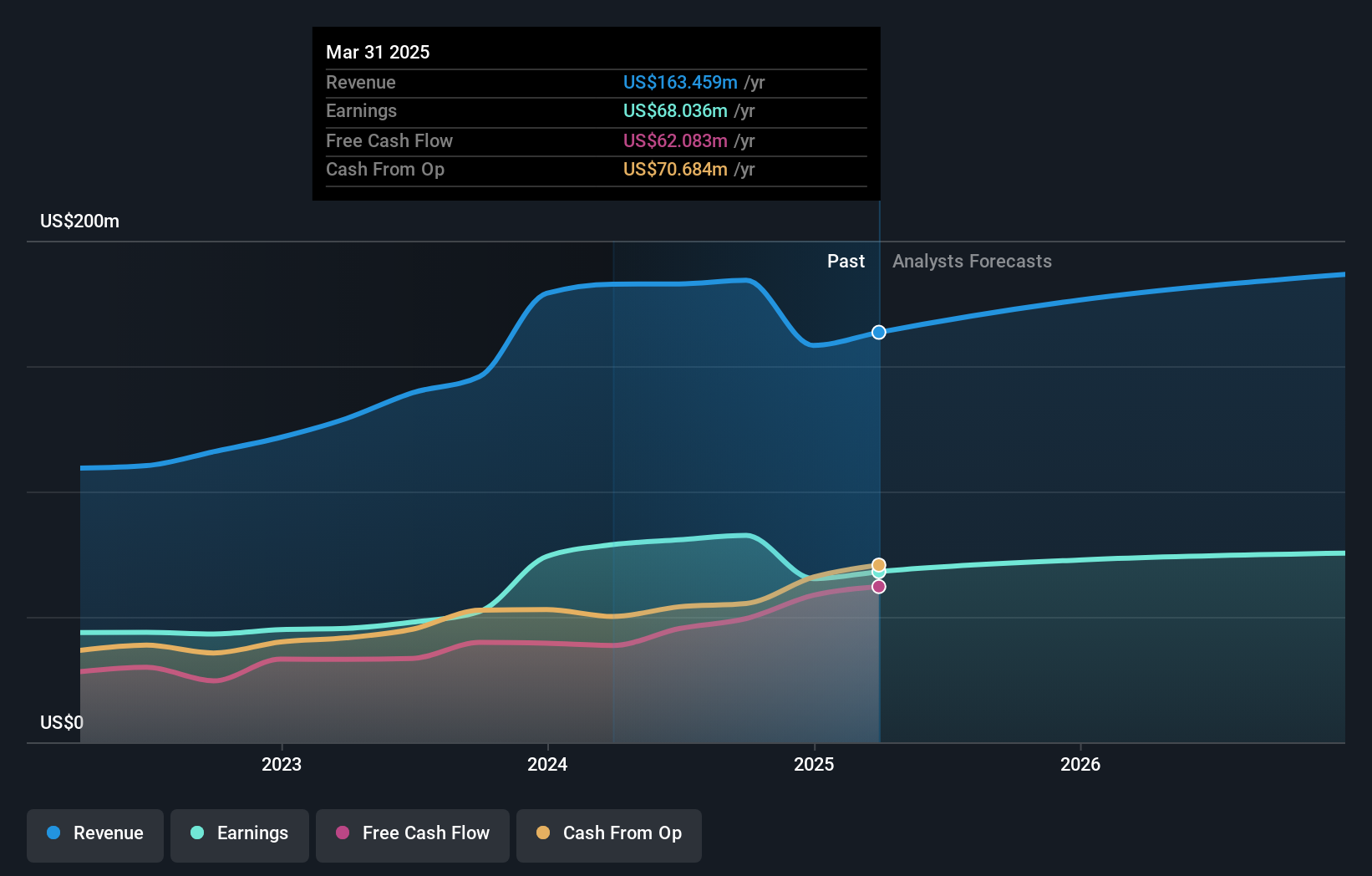

Bank First (NasdaqCM:BFC)

Simply Wall St Value Rating: ★★★★★★

Overview: Bank First Corporation operates as a holding company for Bank First, N.A., with a market cap of $1.03 billion.

Operations: Bank First generates revenue primarily from its consumer and commercial financial institution services, totaling $184.22 million.

Bank First, with total assets of US$4.3 billion and equity of US$628.9 million, offers a compelling mix of stability and growth potential. The bank's deposits stand at US$3.5 billion against loans totaling US$3.4 billion, reflecting a strong balance sheet backed by low-risk funding sources making up 95% of liabilities. Its allowance for bad loans is robust at 405%, ensuring prudent risk management while maintaining high-quality earnings growth—58% over the past year compared to the industry’s negative trend. Recent strategic moves include a notable board appointment and an increased dividend payout by 50% from last year, signaling confidence in its financial health and future prospects.

- Get an in-depth perspective on Bank First's performance by reading our health report here.

Examine Bank First's past performance report to understand how it has performed in the past.

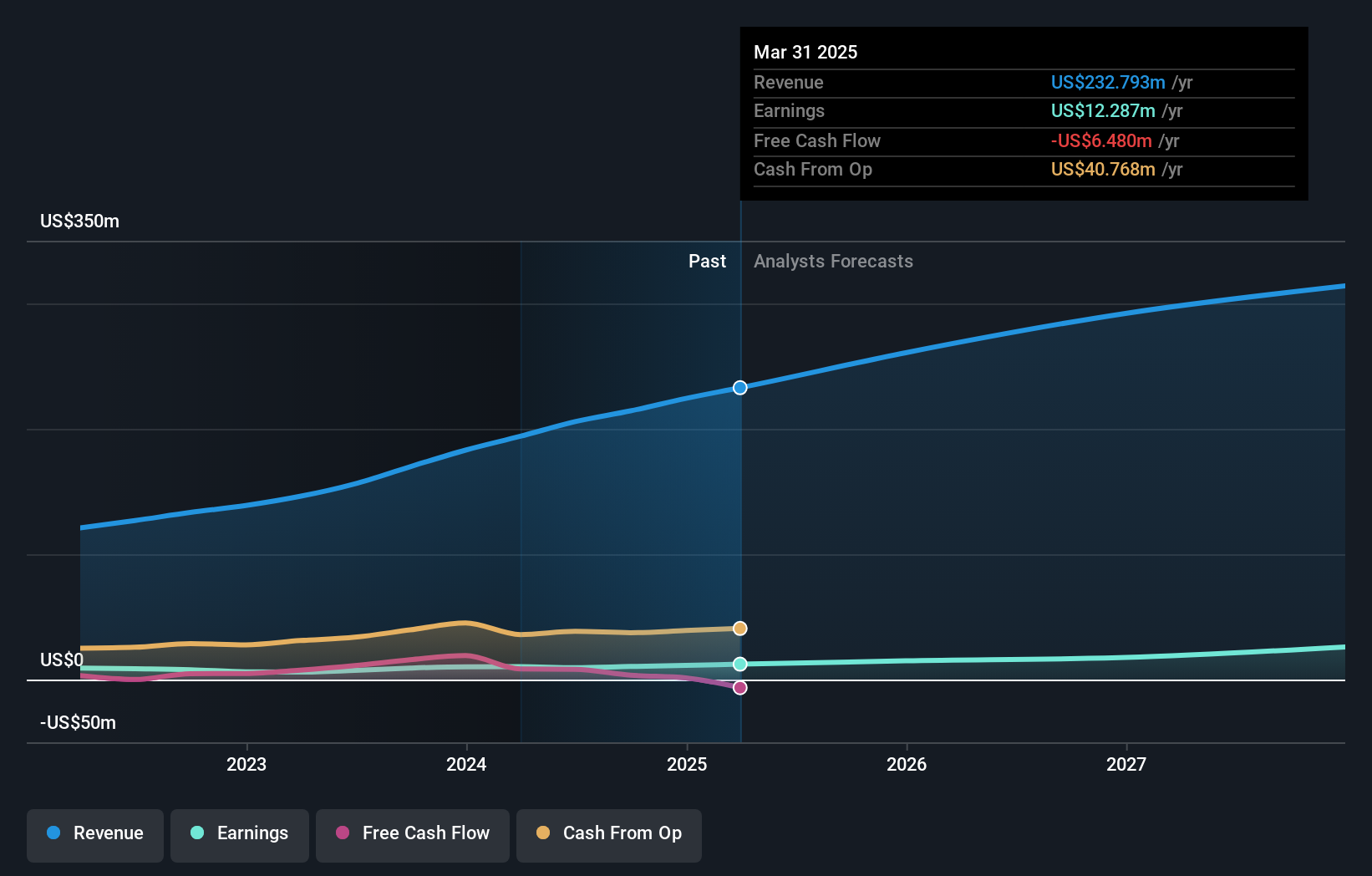

Viemed Healthcare (NasdaqCM:VMD)

Simply Wall St Value Rating: ★★★★★★

Overview: Viemed Healthcare, Inc. offers home medical equipment and post-acute respiratory healthcare services across the United States, with a market capitalization of approximately $335.24 million.

Operations: Viemed Healthcare generates revenue primarily from its Sleep and Respiratory Disorders Sector, amounting to $214.30 million. The company's financial performance is influenced by its gross profit margin trends over time.

Viemed Healthcare, a nimble player in the healthcare sector, has shown promising growth with earnings climbing 13% over the past year, outpacing the industry average of 10%. The company reported third-quarter sales of US$58 million and net income of US$3.88 million, reflecting a solid increase from last year's figures. With its debt to equity ratio significantly reduced to 3.5% from 23% five years ago and interest payments well covered by EBIT at nearly 20 times, Viemed demonstrates robust financial health. However, regulatory changes and equipment recalls pose challenges that could impact future performance despite positive revenue forecasts.

Key Takeaways

- Discover the full array of 229 US Undiscovered Gems With Strong Fundamentals right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bank First might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:BFC

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives