- United States

- /

- Specialty Stores

- /

- NYSE:WSM

Can Williams-Sonoma's (WSM) Pop Culture Partnerships and AI Push Deepen Brand Loyalty?

Reviewed by Sasha Jovanovic

- Earlier this month, Pottery Barn, part of Williams-Sonoma, Inc., unveiled two exclusive collaborations: a holiday collection inspired by Norman Rockwell's classic American artwork and a home furnishings line themed around the film Wicked: For Good, launched in partnership with Universal Products & Experiences.

- These partnerships highlight Williams-Sonoma's focus on artist-driven and pop culture-centered collections, enhancing its appeal to both nostalgic shoppers and fans of contemporary entertainment.

- We'll explore how Williams-Sonoma's adoption of AI-driven customer service could shape its investment narrative going forward.

This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

Williams-Sonoma Investment Narrative Recap

To be a shareholder in Williams-Sonoma, you need to believe in its ability to consistently draw customers through product innovation, exclusive collaborations, and operational efficiency, despite a premium market position and headwinds in the housing market. While the recent Pottery Barn collaborations with Norman Rockwell and Wicked: For Good show Williams-Sonoma's ongoing push for cultural resonance, they do not materially shift the company's most important near-term catalyst: driving margin gains and digital growth, or address the main risk of margin pressure from tariffs and consumer retrenchment. The announcement of Williams-Sonoma’s AI-driven customer service initiative stands out as most relevant, as it directly targets efficiency and margin improvement, potentially saving US$40 million annually and reinforcing the company's push toward digital transformation. As these technology advancements shape the path forward, their success could have a direct bearing on the company’s ability to offset external cost pressures. In contrast, investors should be aware that even as the company leverages technology, sudden shifts in global tariffs remain a material threat to profitability and...

Read the full narrative on Williams-Sonoma (it's free!)

Williams-Sonoma's outlook anticipates $8.7 billion in revenue and $1.2 billion in earnings by 2028. This is based on an expected annual revenue growth rate of 3.4% and a $0.1 billion earnings increase from the current $1.1 billion.

Uncover how Williams-Sonoma's forecasts yield a $204.32 fair value, a 7% upside to its current price.

Exploring Other Perspectives

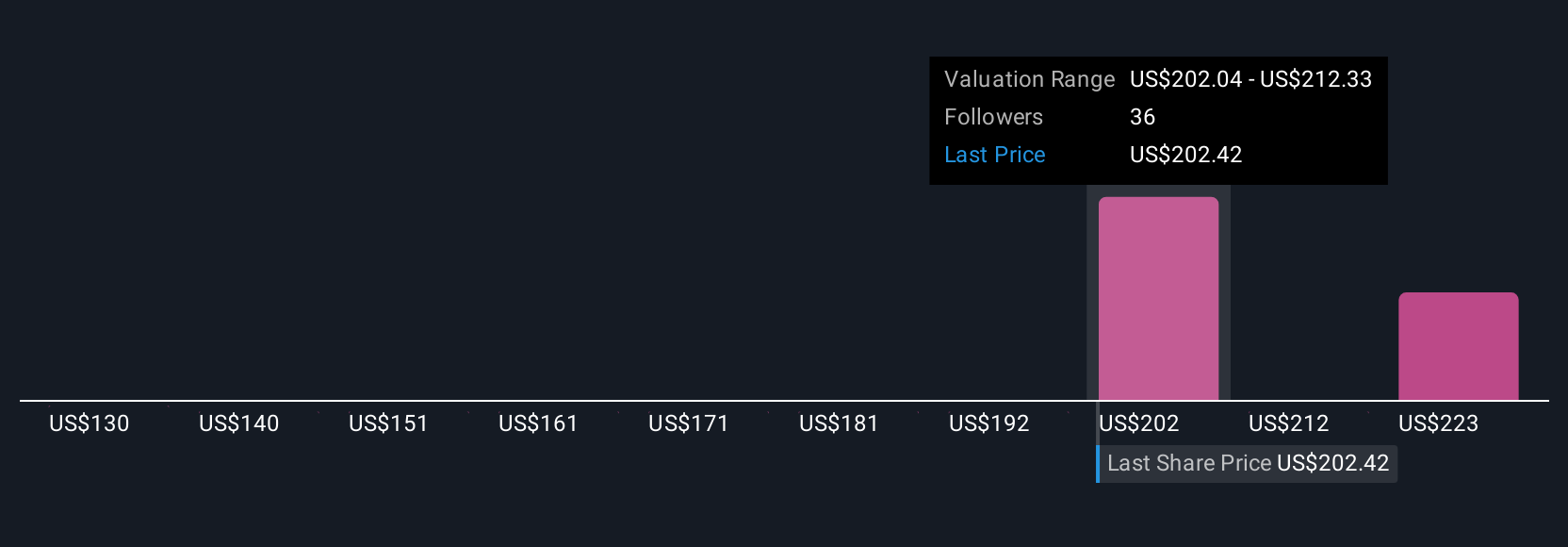

Three distinct fair value estimates from the Simply Wall St Community span US$204.32 to US$233.23. While you see a tight clustering in community forecasts, persistent uncertainties around operating margins and tariff exposure could drive wider divergence in future outlooks; explore multiple perspectives before making your own assessment.

Explore 3 other fair value estimates on Williams-Sonoma - why the stock might be worth just $204.32!

Build Your Own Williams-Sonoma Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Williams-Sonoma research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Williams-Sonoma research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Williams-Sonoma's overall financial health at a glance.

Want Some Alternatives?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The latest GPUs need a type of rare earth metal called Terbium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Williams-Sonoma might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WSM

Williams-Sonoma

Operates as an omni-channel specialty retailer of various products for home.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives