- United States

- /

- Specialty Stores

- /

- NYSE:WSM

A Look at Williams-Sonoma’s Valuation After Fresh U.S. Tariffs on Core Imports

Reviewed by Kshitija Bhandaru

Williams-Sonoma (WSM) shares fell after the U.S. introduced sweeping tariffs on imported cabinets, bathroom vanities, and upholstered furniture. These categories account for a meaningful slice of its product lineup. With these changes, investors are now weighing the possible near-term effects on margins and overall business momentum.

See our latest analysis for Williams-Sonoma.

Williams-Sonoma’s share price has faced some turbulence lately, especially after the new tariffs rattled investor sentiment. Still, despite short-term pressure, the company’s one-year total shareholder return sits at 33.7%, illustrating the resilience of its long-term story. Momentum has cooled in recent weeks, with the price at $199.43. Notably, Williams-Sonoma’s recent collaboration with artist Riley Sheehey brought some positive buzz, but hasn’t fully offset cautious investor mood stemming from tariff concerns.

If you’re curious where the next growth leaders might come from in retail and beyond, now’s a good time to broaden your lens and explore fast growing stocks with high insider ownership

With the stock still trading below analyst price targets and future growth potentially pressured by tariffs, the central question now is whether Williams-Sonoma is undervalued, or if the market already reflects all that lies ahead.

Most Popular Narrative: 2.4% Undervalued

With Williams-Sonoma’s last close at $199.43 and the most widely followed fair value estimate at $204.32, expectations suggest modest upside if current momentum holds and analysts’ scenarios play out.

Continued investment and advances in AI-powered tools and digital platforms are driving higher conversion rates, improved customer experience, and measurable productivity gains. This supports both revenue growth and expanded operating leverage at the margin level.

Want to know the secret behind this bullish price tag? The narrative banks on aggressive high-margin growth and a game-changing earnings outlook. What critical assumptions and bold projections are locked inside that full valuation? Dive in to see which financial levers truly drive this stock’s “undervalued” label.

Result: Fair Value of $204.32 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing tariff volatility and a sluggish housing market remain significant wild cards that could quickly test even the bulls' long-term assumptions.

Find out about the key risks to this Williams-Sonoma narrative.

Another View: How Do Market Multiples Stack Up?

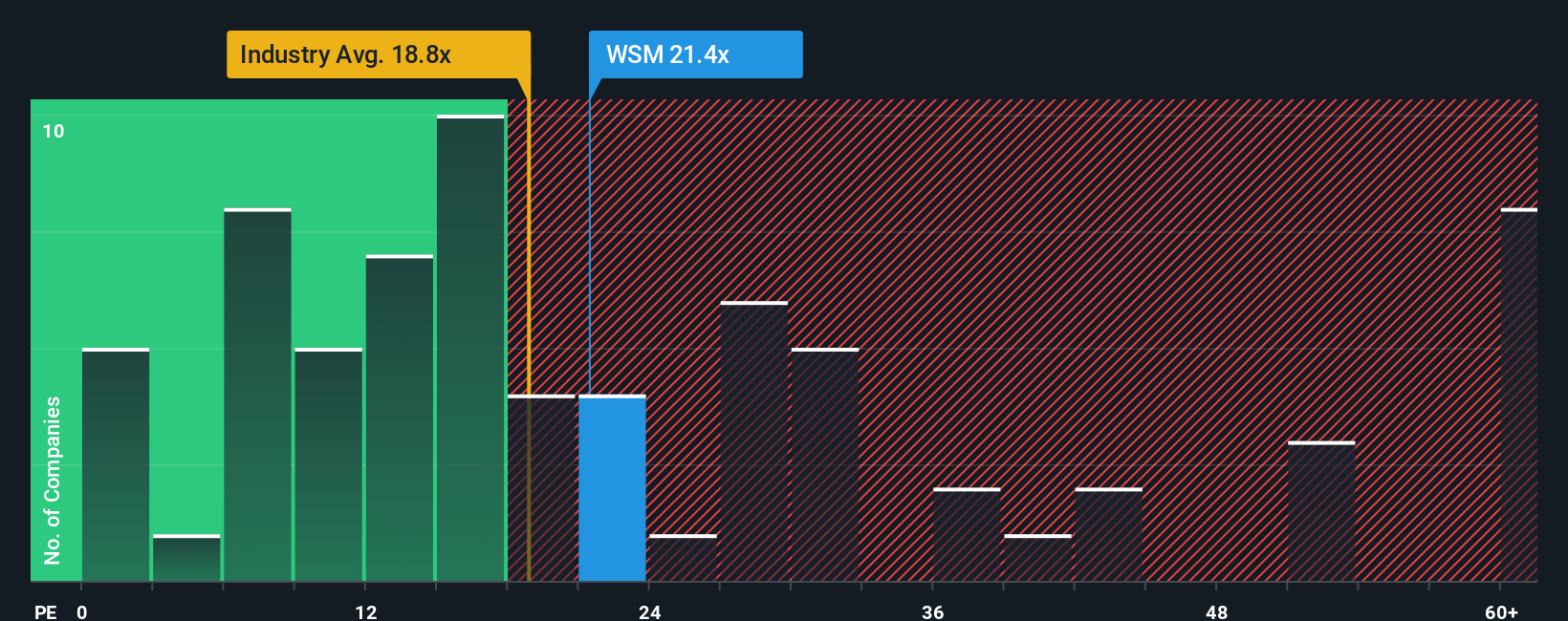

While the analyst narrative points to Williams-Sonoma being undervalued, a closer look at its price-to-earnings ratio tells a different story. At 21.6 times earnings, shares are more expensive than the US Specialty Retail industry average of 17.2 times and also trade above the fair ratio of 18.5. This introduces valuation risk if investors decide the premium is not justified. Will the market sustain this optimism, or is a realignment on the horizon?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Williams-Sonoma Narrative

If you’d rather dig into the numbers on your own terms or arrive at your own take, you can craft a custom story in minutes. Do it your way

A great starting point for your Williams-Sonoma research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t let your portfolio miss out on tomorrow’s winners. Refresh your watchlist with stocks that break the mold and fit your unique goals. Try these opportunities on for size:

- Uncover high-yielding investments that reward you with steady, above-average income by jumping into these 19 dividend stocks with yields > 3% offering yields above 3%.

- Spot the future leaders revolutionizing healthcare with AI. Jumpstart your research with these 31 healthcare AI stocks before the crowd catches on.

- Position yourself early in the next breakout by seizing these 896 undervalued stocks based on cash flows with strong cash flow signals the market hasn’t recognized yet.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Williams-Sonoma might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WSM

Williams-Sonoma

Operates as an omni-channel specialty retailer of various products for home.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives