- United States

- /

- Specialty Stores

- /

- NYSE:WSM

A Fresh Look at Williams-Sonoma (WSM) Valuation as Shares Rally 38% Over the Past Year

Reviewed by Simply Wall St

Williams-Sonoma (WSM) shares have shown resilience over the past year, trending upwards by 38% despite some short-term pullbacks. Investors continue to weigh the company's consistent revenue and net income growth in light of broader retail sector challenges.

See our latest analysis for Williams-Sonoma.

Williams-Sonoma’s share price has been on a solid run this year, overcoming recent short-term dips to sustain an impressive 1-year total shareholder return close to 38%. Momentum continues to favor long-term holders, as the company’s steady financial performance keeps sentiment upbeat despite brief market pullbacks.

If you’re curious about what else is trending beyond big names in retail, this could be a great moment to discover fast growing stocks with high insider ownership

The big question for investors now centers on valuation, as shares trade near all-time highs with solid fundamentals. Is Williams-Sonoma still undervalued, or has the market already priced in future growth potential?

Most Popular Narrative: 8% Undervalued

With Williams-Sonoma closing at $187.99, the most widely followed narrative sets a fair value at $204.32. This places the stock nearly 8% below its suggested worth, indicating room to close the gap if forecasts play out as expected. Here is a pivotal part of that thesis.

Continued investment and advances in AI-powered tools and digital platforms are driving higher conversion rates, improved customer experience, and measurable productivity gains, supporting both revenue growth and expanded operating leverage at the margin level.

What is powering Williams-Sonoma’s premium valuation? Think relentless improvement, next-level technology, and surprising confidence in future profitability. Wonder which key metrics and leadership bets are fueling these bold price projections? Uncover the numbers and the hidden levers driving this target.

Result: Fair Value of $204.32 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, swings in global tariffs and persistent housing market weakness could undermine Williams-Sonoma’s growth trajectory if cost pressures or demand headwinds intensify.

Find out about the key risks to this Williams-Sonoma narrative.

Another View: The Multiples Lens

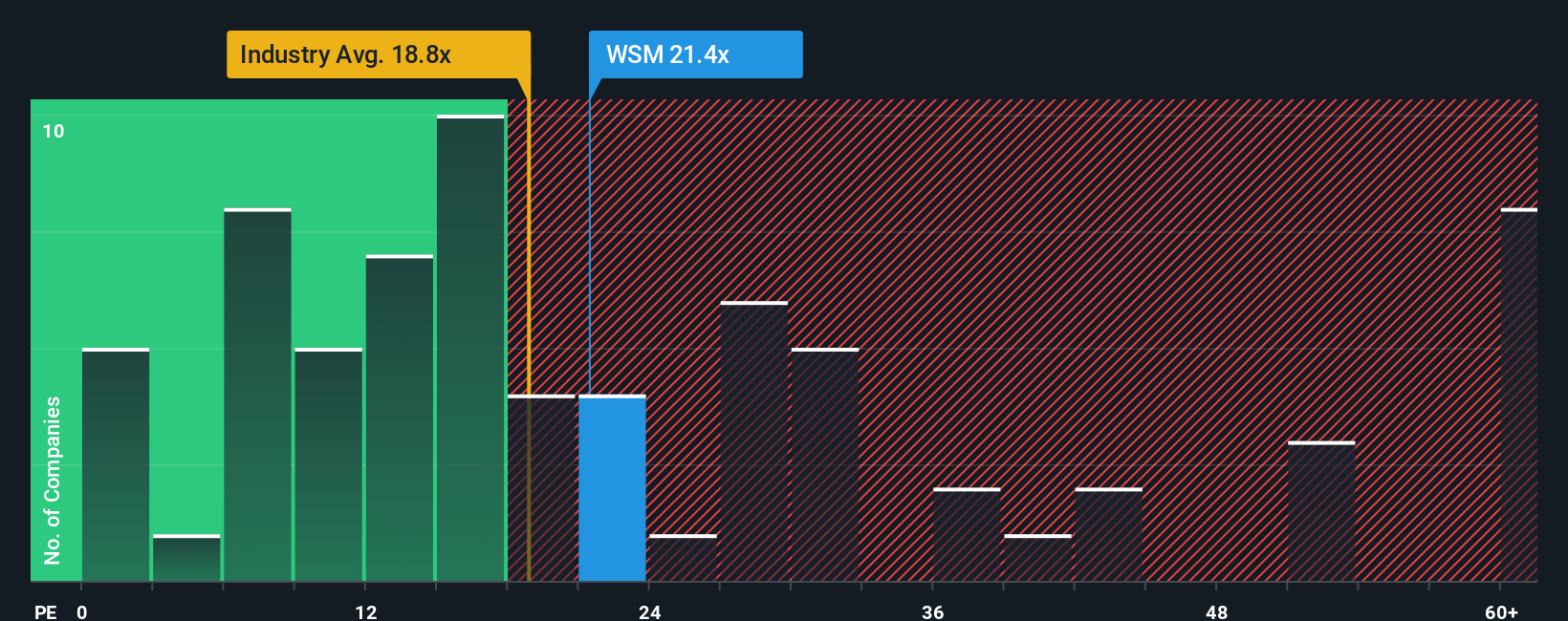

Looking through the lens of price-to-earnings, Williams-Sonoma currently trades at 20.3 times earnings. That is more expensive than the US Specialty Retail industry average of 16.8, more reasonable than the peer average of 23.4, and higher than its fair ratio of 18.4. This raises questions about whether the market is baking in lasting premium value or simply overestimating growth potential. Will this gap close, widen or flip as results come in?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Williams-Sonoma Narrative

If you see things differently or want to dig into the data on your own terms, you can craft your own take in just a few minutes. Do it your way

A great starting point for your Williams-Sonoma research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Sharpen your edge and stay ahead of the curve by searching out unique opportunities across fast-changing industries. The right stock can change your portfolio’s trajectory; don’t let these possibilities pass you by.

- Uncover the overlooked stocks with major upside by jumping into these 878 undervalued stocks based on cash flows, perfect for finding stand-out companies trading below their true worth.

- Capture the growth surge in advanced medicine when you spot winners among these 33 healthcare AI stocks, where artificial intelligence is transforming patient care and diagnostics.

- Boost your income stream by targeting these 17 dividend stocks with yields > 3%, focusing on companies delivering reliable yields above 3% to support your returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Williams-Sonoma might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WSM

Williams-Sonoma

Operates as an omni-channel specialty retailer of various products for home.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives