- United States

- /

- Specialty Stores

- /

- NYSE:W

Shareholders in Wayfair (NYSE:W) have lost 83%, as stock drops 15% this past week

It's not a secret that every investor will make bad investments, from time to time. But it should be a priority to avoid stomach churning catastrophes, wherever possible. It must have been painful to be a Wayfair Inc. (NYSE:W) shareholder over the last year, since the stock price plummeted 83% in that time. While some investors are willing to stomach this sort of loss, they are usually professionals who spread their bets thinly. Notably, shareholders had a tough run over the longer term, too, with a drop of 66% in the last three years. Shareholders have had an even rougher run lately, with the share price down 55% in the last 90 days. We really feel for shareholders in this scenario. It's a good reminder of the importance of diversification, and it's worth keeping in mind there's more to life than money, anyway.

With the stock having lost 15% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

Check out our latest analysis for Wayfair

Given that Wayfair didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Wayfair's revenue didn't grow at all in the last year. In fact, it fell 14%. That looks pretty grim, at a glance. The market obviously agrees, since the share price tanked 83%. Holders should not lose the lesson: loss making companies should grow revenue. Of course, extreme share price falls can be an opportunity for those who are willing to really dig deeper to understand a high risk company like this.

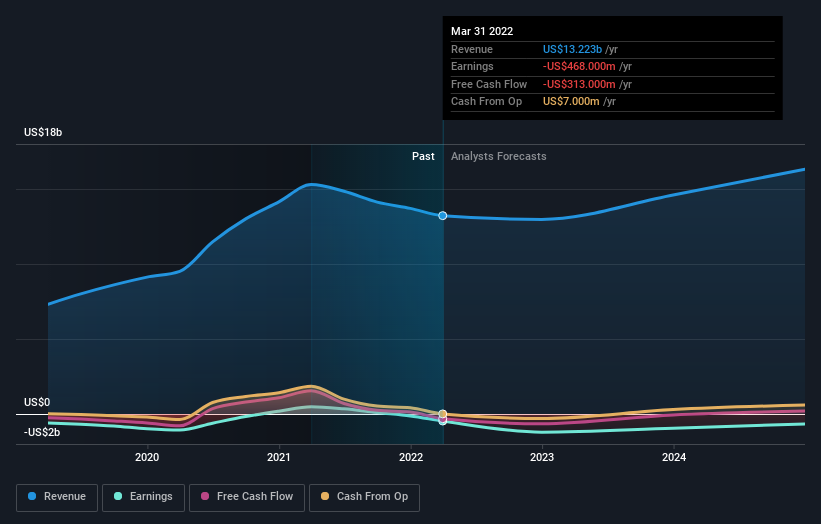

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

It's good to see that there was some significant insider buying in the last three months. That's a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. So we recommend checking out this free report showing consensus forecasts

A Different Perspective

We regret to report that Wayfair shareholders are down 83% for the year. Unfortunately, that's worse than the broader market decline of 18%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 6% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. It's always interesting to track share price performance over the longer term. But to understand Wayfair better, we need to consider many other factors. For instance, we've identified 3 warning signs for Wayfair (2 can't be ignored) that you should be aware of.

Wayfair is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Wayfair might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:W

Wayfair

Engages in the e-commerce business in the United States and internationally.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026