- United States

- /

- Specialty Stores

- /

- NYSE:VVV

Valvoline (VVV) Valuation Check After New Growth Targets and Yelp ‘Most Loved’ Recognition

Reviewed by Simply Wall St

Valvoline (VVV) just laid out an upbeat growth roadmap, pairing margin expansion targets with faster store openings, while its Instant Oil Change chain grabbed the top automotive retail spot on Yelp’s 2025 Most Loved Brands list.

See our latest analysis for Valvoline.

Even with the upbeat growth roadmap and Yelp recognition, Valvoline’s share price return has been under pressure, with a recent 90 day share price return of negative 23.7 percent and a 1 year total shareholder return of negative 17.7 percent. This suggests sentiment has lagged fundamentals but could turn if execution on new builds and tuck in acquisitions delivers.

If this kind of steady, service led growth story interests you, it is worth also exploring other auto related opportunities using our screener for auto manufacturers to see how they stack up on growth and returns.

With shares down double digits over the past year, yet trading about 25 percent below the average analyst target, the key question now is whether Valvoline is mispriced or if the market already sees its growth coming.

Most Popular Narrative Narrative: 20.7% Undervalued

With the narrative fair value sitting well above Valvoline's last close of $31.03, the story leans toward mispricing, setting up a punchy growth thesis.

Analysts are assuming Valvoline's revenue will grow by 10.8% annually over the next 3 years.

Analysts assume that profit margins will shrink from 16.4% today to 13.0% in 3 years time.

Want to see why slower margins still back a richer future price tag? This narrative leans on compounding revenue, rising earnings power, and a surprisingly punchy future multiple. Curious which assumptions have to hit for that to work?

Result: Fair Value of $39.15 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, faster EV adoption and persistent margin pressure from higher labor and interest costs could challenge the upbeat earnings trajectory implied in this narrative.

Find out about the key risks to this Valvoline narrative.

Another Lens on Valvoline's Value

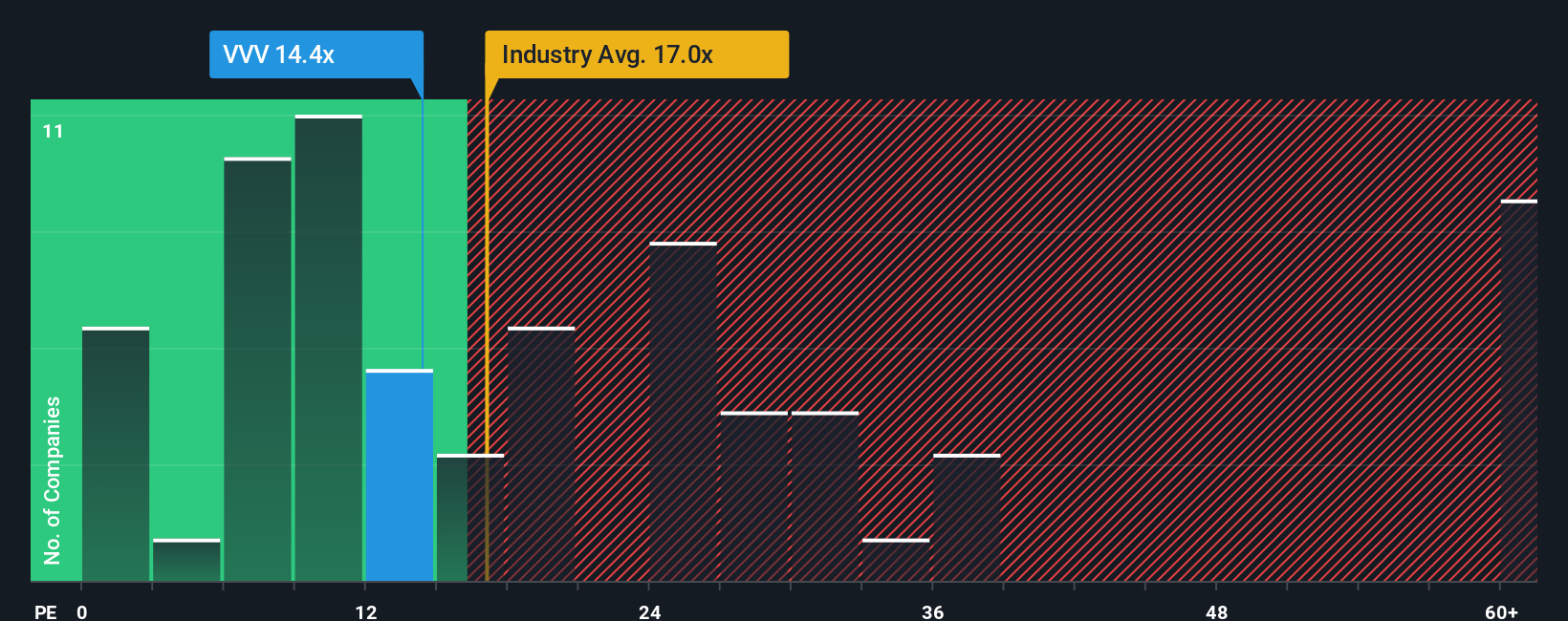

While the narrative fair value points to upside, our valuation ratio view is less forgiving. Valvoline trades on a 18.4x price to earnings ratio, richer than its 14.6x fair ratio and well above the 12.2x peer average, even if still below the 20.2x industry level. That premium hints more at execution risk than easy upside, so what has to go right for the market to keep paying up?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Valvoline Narrative

If this view does not quite match your own, or you would rather dig into the numbers yourself, you can build a full narrative from scratch in just a few minutes: Do it your way

A great starting point for your Valvoline research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more high conviction ideas?

Before the market’s next move leaves you watching from the sidelines, use the Simply Wall St screener to uncover fresh opportunities that fit your strategy.

- Capture mispriced potential by targeting companies trading below intrinsic value with these 903 undervalued stocks based on cash flows that still show solid cash flow strength.

- Ride the next wave of innovation by focusing on frontier technologies and breakthrough platforms through these 27 quantum computing stocks positioned at the edge of computing.

- Lock in powerful income streams by zeroing in on reliable payers using these 13 dividend stocks with yields > 3% that can support compounding returns over time.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VVV

Valvoline

Provides automotive preventive maintenance through its retail stores in the United States and Canada.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)