- United States

- /

- Specialty Stores

- /

- NYSE:VVV

Valvoline (NYSE:VVV) Eyes Expansion with Franchise Growth Amid High Valuation Concerns

Reviewed by Simply Wall St

Valvoline (NYSE:VVV) is leveraging its strong brand presence and customer service excellence to drive growth, as evidenced by a 12% increase in system-wide store sales and a 17% rise in adjusted EBITDA. Recent developments include plans for significant expansion with 160 to 185 new stores by fiscal year 2025 and a focus on franchise growth. This report will explore Valvoline's competitive advantages, challenges, growth opportunities, and external threats impacting its performance.

Click here to discover the nuances of Valvoline with our detailed analytical report.

Competitive Advantages That Elevate Valvoline

Valvoline's market position is significantly bolstered by its well-recognized brand, a point emphasized by Lori Flees, President and CEO. This brand strength is pivotal in fostering customer loyalty and driving sales growth. Financially, the company has demonstrated solid performance with a 12% increase in system-wide store sales, reaching $3.1 billion, and a 17% rise in adjusted EBITDA to $443 million. CFO Mary Meixelsperger noted an improvement in the adjusted EBITDA margin by 100 basis points to 27.3%, reflecting effective cost management. Valvoline's commitment to customer service excellence is also noteworthy, as evidenced by its #18 ranking in Forbes for best customer service, which underscores its dedication to providing a trusted experience.

Critical Issues Affecting the Performance of Valvoline and Areas for Growth

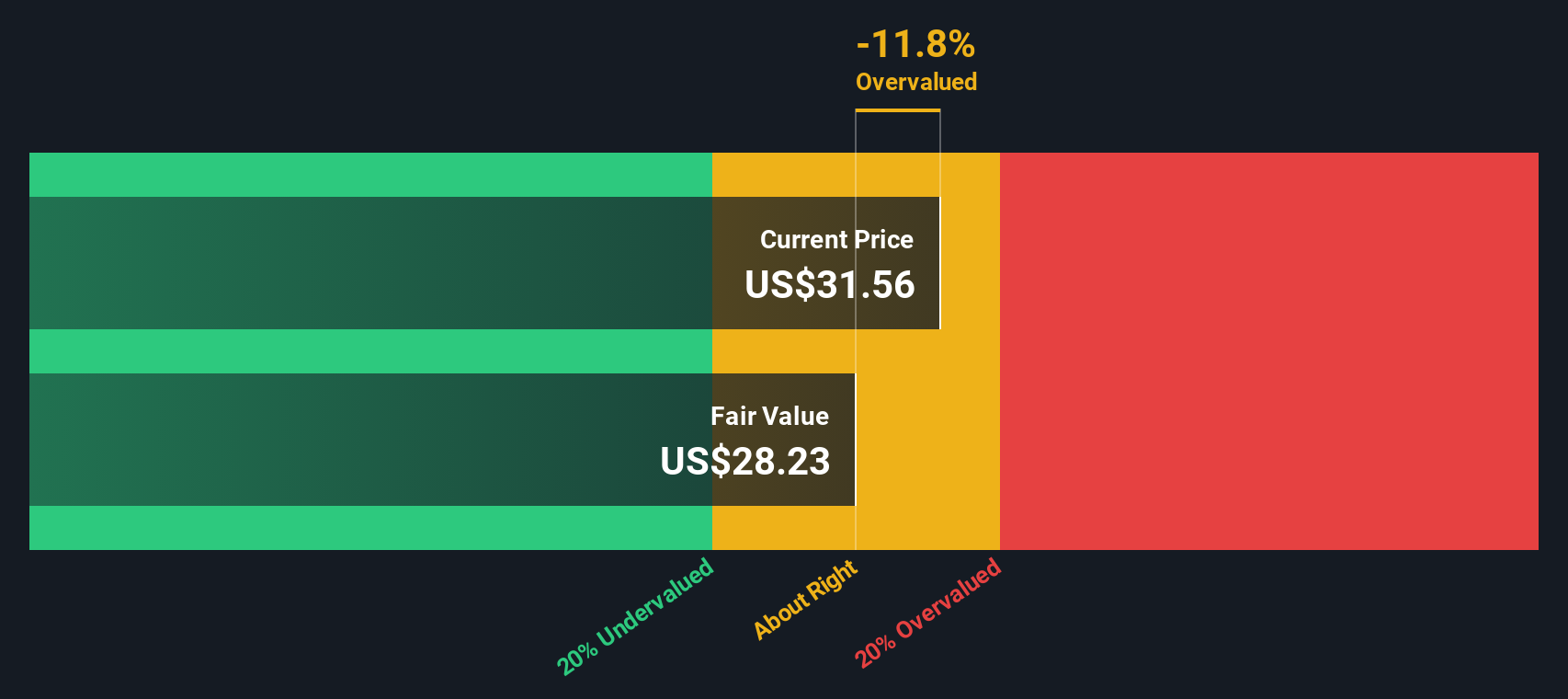

Challenges persist in meeting sales expectations, as same-store sales fell slightly below the guidance range midpoint. The company also reported a material weakness in IT general controls, acknowledged by Meixelsperger, indicating ongoing remediation efforts. Capital expenditures have exceeded expectations, suggesting potential difficulties in capital management. Furthermore, the company's current valuation is above its estimated fair value, with a high SWS Price-To-Earnings ratio compared to peers, indicating it may be overvalued. This aspect should be closely monitored to ensure alignment with growth metrics.

Emerging Markets Or Trends for Valvoline

Valvoline is poised for expansion, with plans to add 160 to 185 new stores in fiscal year 2025. Flees expressed confidence in achieving strong and sustainable growth through this expansion initiative. The company is also accelerating its franchise growth, targeting 250 new stores annually by 2027, supported by refranchising transactions and new partnerships. Additionally, the Fleet business segment is experiencing a 14% compound annual growth rate over the past three years, highlighting a promising avenue for business-to-business sales growth.

External Factors Threatening Valvoline

Intensifying competition, particularly from outside the Quick Lube segment, poses a significant threat. Flees noted that other automotive players are using oil changes to attract traffic to their service centers. Economic and regulatory risks, including potential tariffs and political changes, could impact operational costs, as discussed by Flees regarding the cost of goods sold. The tight labor market also presents challenges, with wage increases and talent competition necessitating strategic responses to maintain operational efficiency.

Explore the current health of Valvoline and how it reflects on its financial stability and growth potential.Conclusion

Valvoline's strong brand recognition and customer loyalty have driven significant financial performance, with notable increases in sales and EBITDA. However, challenges such as slightly underperforming same-store sales and IT control weaknesses highlight areas needing attention. While the company's expansion plans and franchise growth initiatives indicate promising future opportunities, the current high Price-To-Earnings ratio compared to peers suggests that investors should be cautious about potential overvaluation. This necessitates a careful balance between growth ambitions and financial prudence to maintain sustainable performance amid competitive and economic pressures.

Taking Advantage

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

```New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VVV

Valvoline

Engages in the operation and franchising of vehicle service centers and retail stores in the United States and Canada.

Proven track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives