Savers Value Village, Inc. (NYSE:SVV) Stocks Pounded By 30% But Not Lagging Market On Growth Or Pricing

Savers Value Village, Inc. (NYSE:SVV) shares have had a horrible month, losing 30% after a relatively good period beforehand. For any long-term shareholders, the last month ends a year to forget by locking in a 60% share price decline.

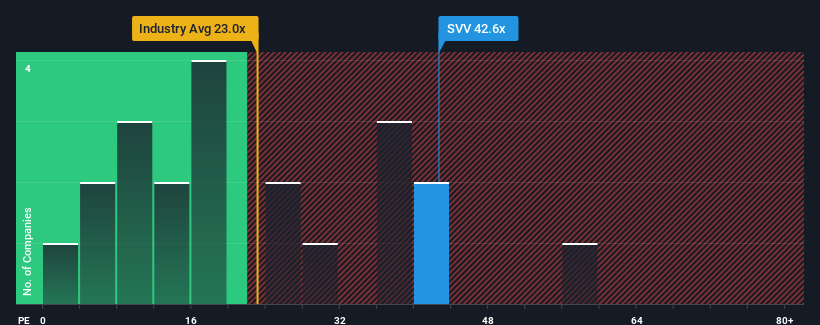

Even after such a large drop in price, Savers Value Village's price-to-earnings (or "P/E") ratio of 42.6x might still make it look like a strong sell right now compared to the market in the United States, where around half of the companies have P/E ratios below 18x and even P/E's below 10x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

Savers Value Village could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. It might be that many expect the dour earnings performance to recover substantially, which has kept the P/E from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for Savers Value Village

How Is Savers Value Village's Growth Trending?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Savers Value Village's to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 48%. This means it has also seen a slide in earnings over the longer-term as EPS is down 69% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Turning to the outlook, the next year should generate growth of 82% as estimated by the eight analysts watching the company. That's shaping up to be materially higher than the 14% growth forecast for the broader market.

With this information, we can see why Savers Value Village is trading at such a high P/E compared to the market. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What We Can Learn From Savers Value Village's P/E?

Savers Value Village's shares may have retreated, but its P/E is still flying high. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Savers Value Village maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

Before you take the next step, you should know about the 2 warning signs for Savers Value Village (1 is concerning!) that we have uncovered.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:SVV

Savers Value Village

Sells second-hand merchandise in retail stores in the United States, Canada, and Australia.

Moderate growth potential and slightly overvalued.

Market Insights

Community Narratives