- United States

- /

- Specialty Stores

- /

- NYSE:SIG

Signet Jewelers (SIG): Assessing Valuation as Analysts Forecast 25% EPS Drop and Tempered Revenue Growth

Reviewed by Kshitija Bhandaru

Signet Jewelers (SIG) recently drew attention after new analyst commentary projected a 25% decrease in upcoming earnings per share, along with only a slight revenue uptick. This has coincided with a cautious sentiment that is reflected in the company's low Zacks Rank.

See our latest analysis for Signet Jewelers.

The recent volatility in Signet’s share price, with a 4.27% decline in the latest session and an 18.3% year-to-date share price return, reflects shifting investor sentiment in light of softer earnings projections and persistent macro uncertainty. Despite some short-term turbulence, the company’s three-year and five-year total shareholder returns of nearly 64% and 328% are clear reminders that momentum remains substantial over the longer term.

If you’re weighing which stocks have staying power beyond the headlines, now is a great moment to broaden your research and discover fast growing stocks with high insider ownership

With shares trading at a discount to analyst price targets and a sizable intrinsic discount, investors face a pivotal question: Is Signet undervalued right now, or is the market already factoring in all future growth?

Most Popular Narrative: 12.4% Undervalued

The dominant narrative values Signet Jewelers at $105.33, placing it well above the last close of $92.31. This creates an opportunity for a compelling discussion on what drives the perceived upside and the specific trends or catalysts analysts are watching.

Expansion of service-based offerings (e.g., extended service agreements, care plans) and loyalty ecosystems is creating stable, recurring, high-margin revenue streams, strengthening free cash flow and earnings predictability.

Curious how recurring revenue streams and margin-boosting strategies factor into the bullish outlook? The real surprise lies in the profit ramp analysts are projecting for this jewelry retailer. Want to discover which financial levers are seen as the main drivers of future valuation? Dive in to see what transforms this narrative from cautious to compelling.

Result: Fair Value of $105.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, continued weakness in overall jewelry unit sales or rising tariffs could hinder the company’s outlook and present challenges to the bullish case presented by analysts.

Find out about the key risks to this Signet Jewelers narrative.

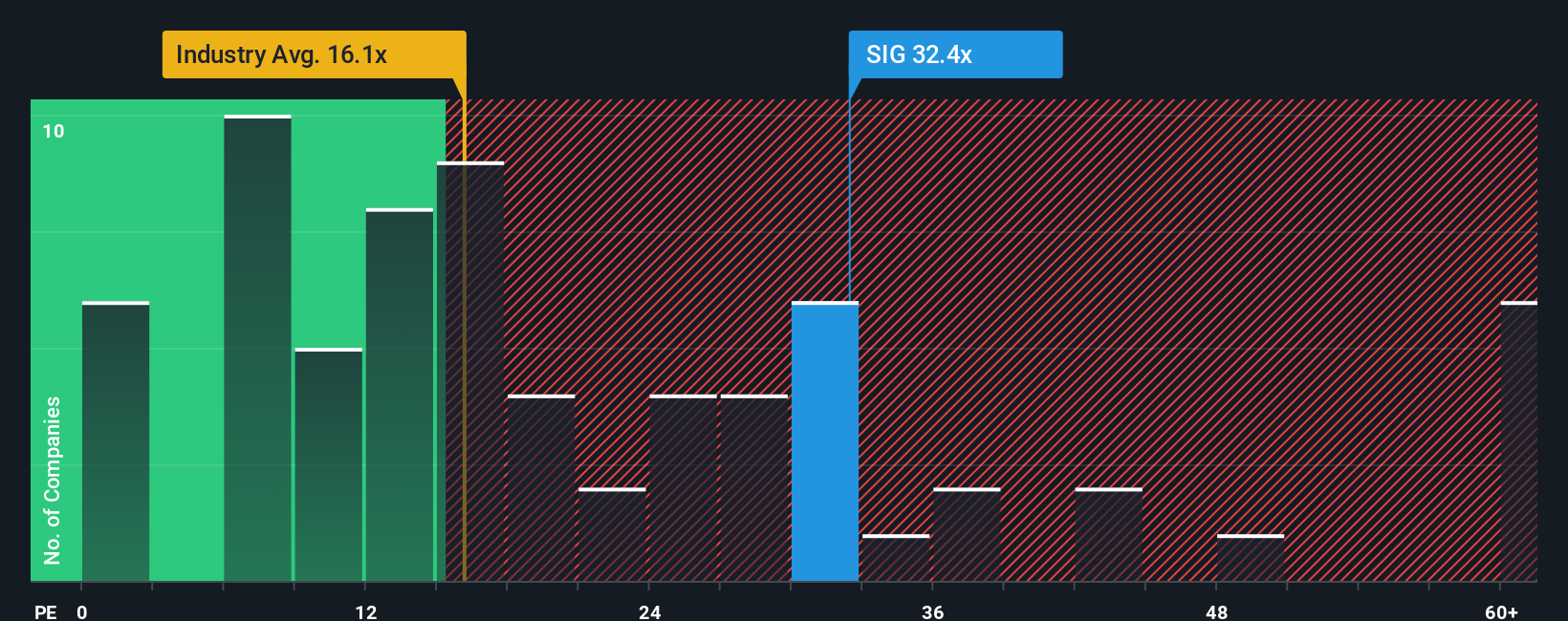

Another View: P/E Signals Valuation Risk

Looking at Signet's valuation through the lens of its price-to-earnings ratio, things appear less optimistic. Right now, the company trades at 29x earnings, noticeably higher than both the US Specialty Retail industry average (15.8x) and its peer group (14.7x). Even so, the current multiple sits just below the calculated fair ratio of 31.5x, suggesting a narrow margin of safety.

This raises the question: is this premium justified, or could shares face a reality check if sector valuations revert?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Signet Jewelers Narrative

If these perspectives do not align with your own or you prefer to dig into the numbers yourself, you can quickly shape your own conclusion in just a few minutes by using Do it your way.

A great starting point for your Signet Jewelers research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Level up your portfolio by acting on unique, data-driven screens and never miss out on exciting growth and value plays others overlook.

- Capitalize on tomorrow’s breakthroughs early by investing in these 24 AI penny stocks, which are positioned to change industries with advanced artificial intelligence applications.

- Start building wealth through steady, reliable income by browsing these 19 dividend stocks with yields > 3%, offering attractive yields above 3%.

- Get ahead of the market and find exceptional value by targeting these 892 undervalued stocks based on cash flows, which are currently overlooked based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SIG

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives