As the United States market grapples with concerns over AI valuations and a wave of job cuts, major stock indexes like the Nasdaq, S&P 500, and Dow Jones Industrial Average have recently experienced declines. In this uncertain environment, investors often seek opportunities in stocks perceived to be undervalued, as these may offer potential for growth when broader market conditions stabilize.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| TowneBank (TOWN) | $32.76 | $64.47 | 49.2% |

| Nicolet Bankshares (NIC) | $124.00 | $247.04 | 49.8% |

| MoneyHero (MNY) | $1.25 | $2.43 | 48.6% |

| Horizon Bancorp (HBNC) | $15.97 | $31.28 | 49% |

| Fiverr International (FVRR) | $20.56 | $40.26 | 48.9% |

| Eagle Bancorp (EGBN) | $16.52 | $33.03 | 50% |

| Duolingo (DUOL) | $260.02 | $506.04 | 48.6% |

| Crocs (CROX) | $80.23 | $157.44 | 49% |

| CF Bankshares (CFBK) | $23.41 | $45.27 | 48.3% |

| Byrna Technologies (BYRN) | $18.46 | $35.68 | 48.3% |

Here's a peek at a few of the choices from the screener.

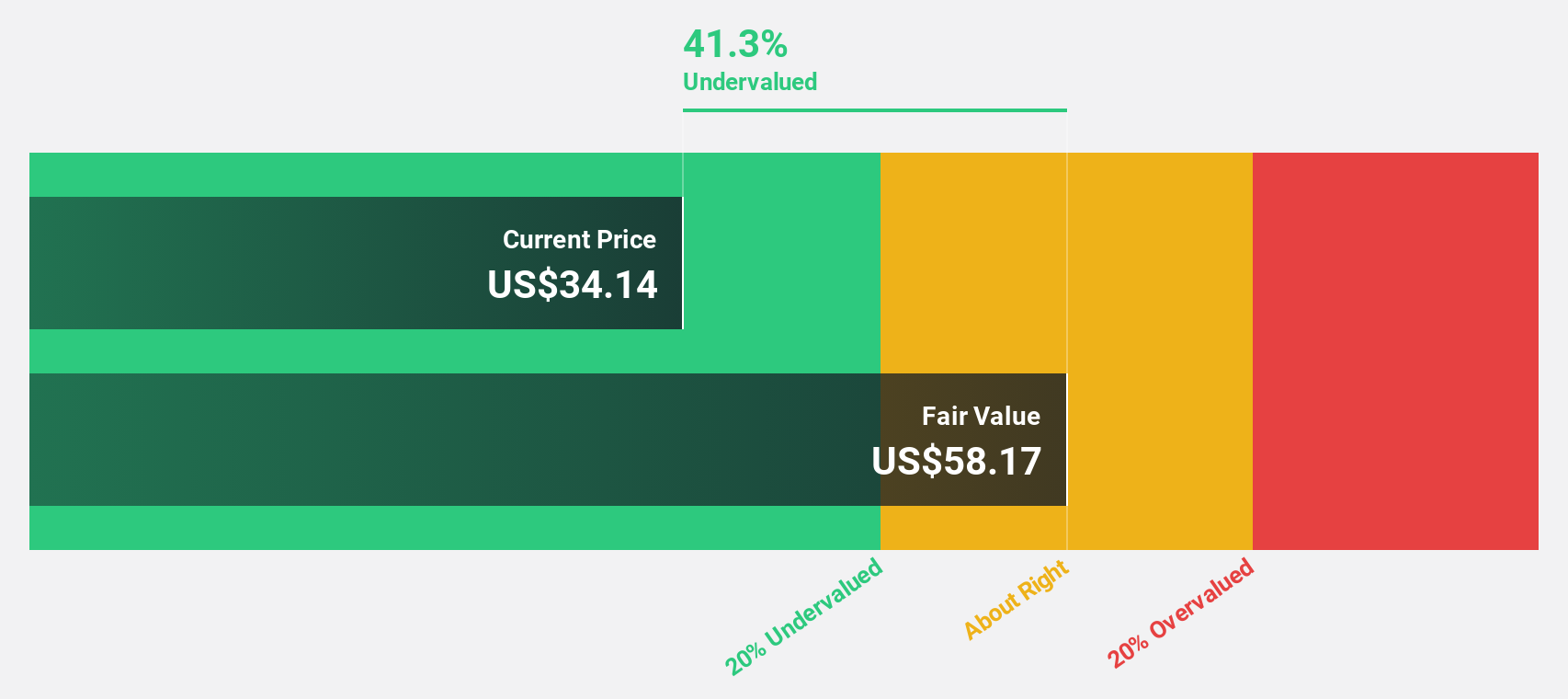

Varonis Systems (VRNS)

Overview: Varonis Systems, Inc. develops software solutions that focus on discovering and classifying critical data, remediating exposures, and detecting advanced threats using AI technology across various global regions, with a market cap of approximately $4.17 billion.

Operations: Varonis Systems generates revenue primarily from its Data Processing segment, which accounted for $608.68 million.

Estimated Discount To Fair Value: 40.4%

Varonis Systems is trading at a significant discount to its estimated fair value of US$58.76, with shares priced at US$35. Despite a volatile share price, the company shows potential for becoming profitable within three years and boasts an expected earnings growth of 38.36% annually. Recent developments include a US$150 million share repurchase program and new product launches enhancing data security capabilities, which could support future cash flow improvements despite current net losses.

- The analysis detailed in our Varonis Systems growth report hints at robust future financial performance.

- Navigate through the intricacies of Varonis Systems with our comprehensive financial health report here.

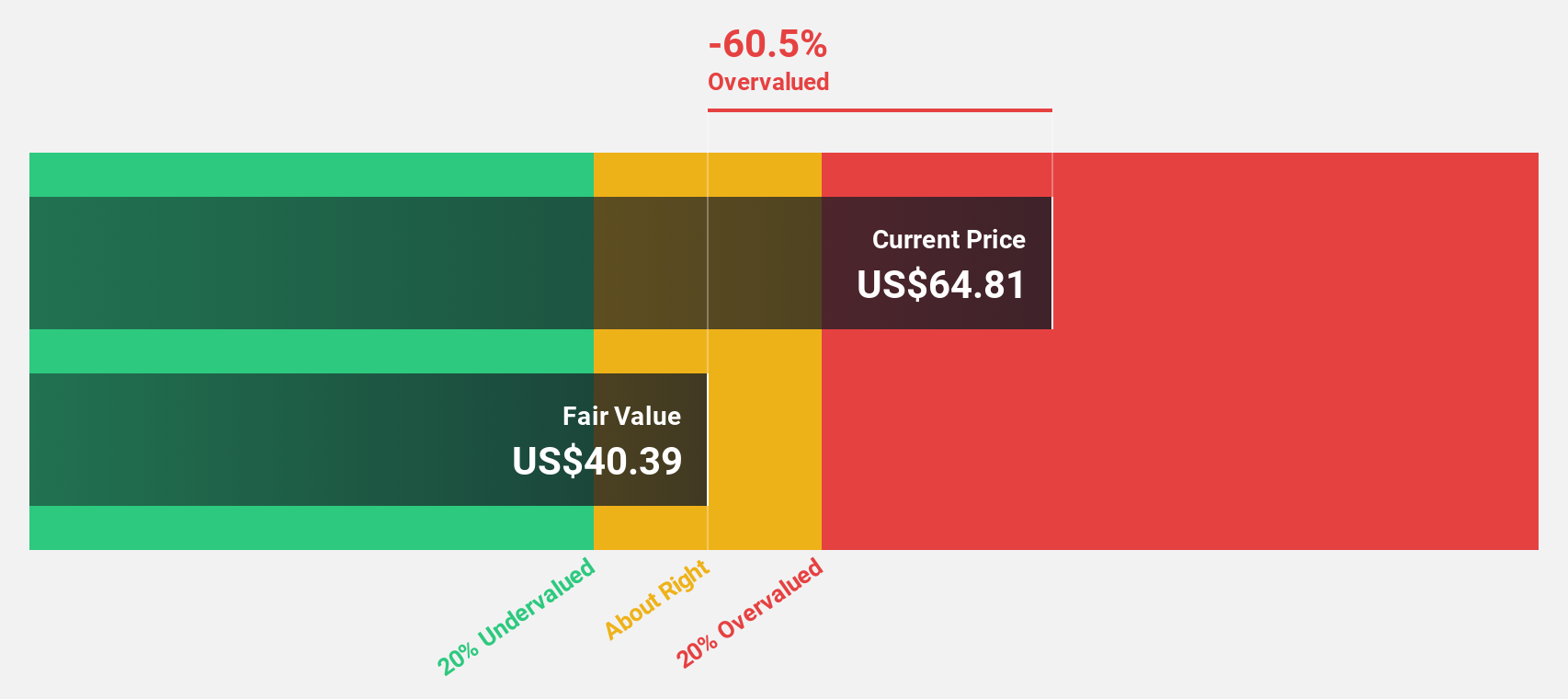

Xometry (XMTR)

Overview: Xometry, Inc. operates an AI-powered online manufacturing marketplace serving both the United States and international markets, with a market cap of $3.21 billion.

Operations: Revenue Segments (in millions of $):

Estimated Discount To Fair Value: 10.7%

Xometry is trading at US$62.67, slightly below its estimated fair value of US$70.18, suggesting it may be undervalued based on cash flows. The company raised its 2025 revenue guidance to between US$676 million and US$678 million and reported a third-quarter sales increase to US$180.72 million from last year's US$141.7 million, despite ongoing net losses. Its AI-powered platform enhancements could drive future cash flow improvements as profitability is expected within three years.

- According our earnings growth report, there's an indication that Xometry might be ready to expand.

- Take a closer look at Xometry's balance sheet health here in our report.

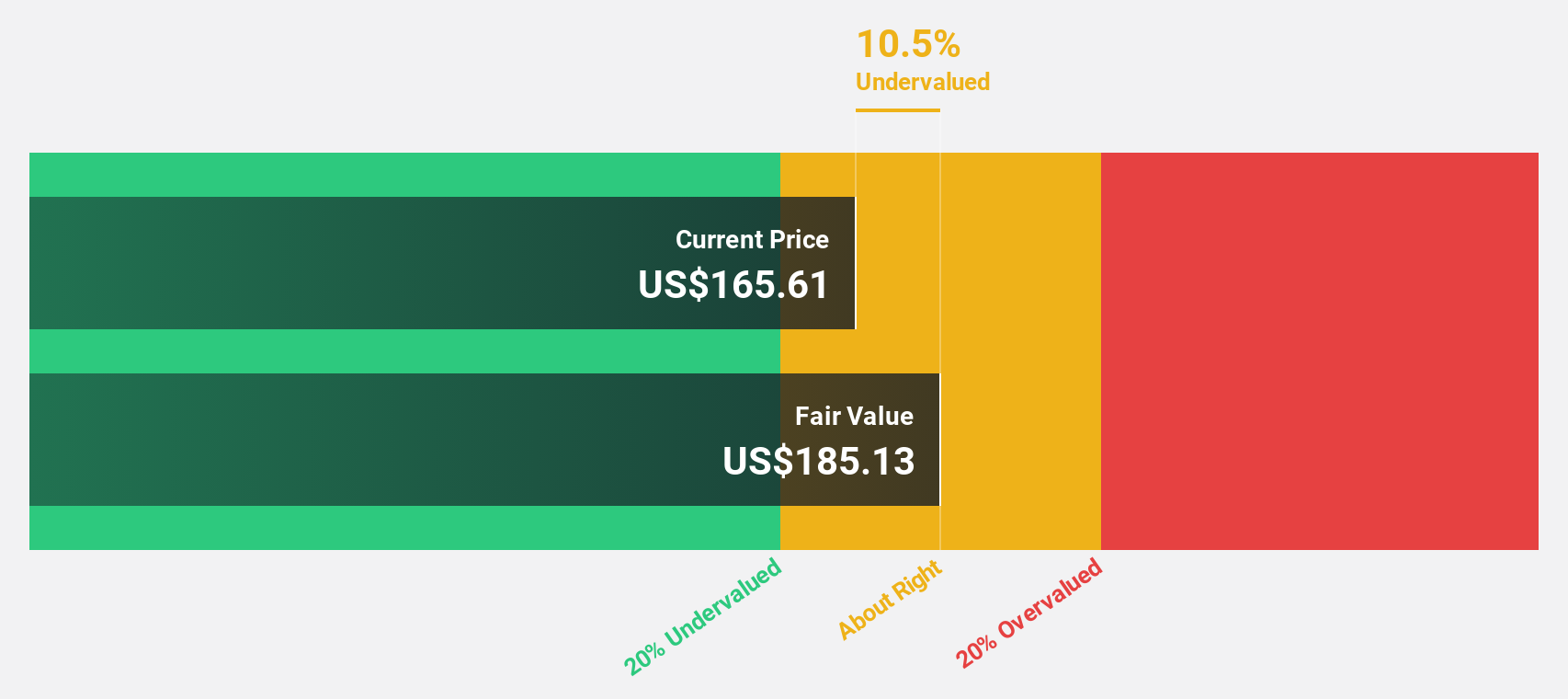

Sea (SE)

Overview: Sea Limited operates as a consumer internet company through its subsidiaries in Southeast Asia, Latin America, the rest of Asia, and internationally, with a market cap of approximately $92.66 billion.

Operations: Sea Limited generates its revenue from various segments, including digital entertainment, e-commerce, and digital financial services across Southeast Asia, Latin America, and other international markets.

Estimated Discount To Fair Value: 45.5%

Sea is trading at US$157.76, significantly below its estimated fair value of US$289.38, indicating potential undervaluation based on cash flows. Recent earnings show strong growth with net income reaching US$809.02 million for the half-year ending June 2025, up from US$58.2 million a year ago. Analysts forecast Sea's earnings to grow by 29.8% annually, outpacing the broader U.S. market's expected growth rate of 15.8%.

- The growth report we've compiled suggests that Sea's future prospects could be on the up.

- Dive into the specifics of Sea here with our thorough financial health report.

Summing It All Up

- Gain an insight into the universe of 169 Undervalued US Stocks Based On Cash Flows by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SE

Sea

Through its subsidiaries, operates as a consumer internet company in Southeast Asia, Latin America, the rest of Asia, and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives