- United States

- /

- Specialty Stores

- /

- NYSE:SAH

Does Dividend Hike and Q2 Loss Shift the Bull Case for Sonic Automotive (SAH)?

Reviewed by Simply Wall St

- Sonic Automotive's board approved a 9% increase to its quarterly dividend and reported second-quarter 2025 results, including a rise in revenue to US$3,657.2 million but a net loss of US$45.6 million, along with updates on its share repurchase program.

- Despite moving from net income to a net loss for the quarter, the company raised its dividend and continued share buybacks, signaling ongoing commitment to shareholder returns during a period of operational challenges.

- We'll examine how Sonic Automotive's decision to boost its dividend impacts its investment narrative amid shifting profitability.

Sonic Automotive Investment Narrative Recap

For investors evaluating Sonic Automotive, the key belief centers on the company's ability to balance automotive retail growth and operational execution against ongoing industry and macroeconomic pressures. The recent mix of a 9% dividend increase, higher quarterly revenue, but a swing to net loss, does little to shift the most immediate catalyst, execution in parts and service growth, while reaffirming that margin stability remains the biggest risk in the near term.

The 9% dividend increase stands out among recent announcements, underlining Sonic's continued focus on shareholder returns even after a challenging earnings quarter. The move is particularly interesting given the reported net loss, drawing attention to how management prioritizes capital allocation when profitability fluctuates.

By contrast, investors should be aware that if same-store used vehicle volumes continue to decline due to supply challenges and affordability concerns...

Read the full narrative on Sonic Automotive (it's free!)

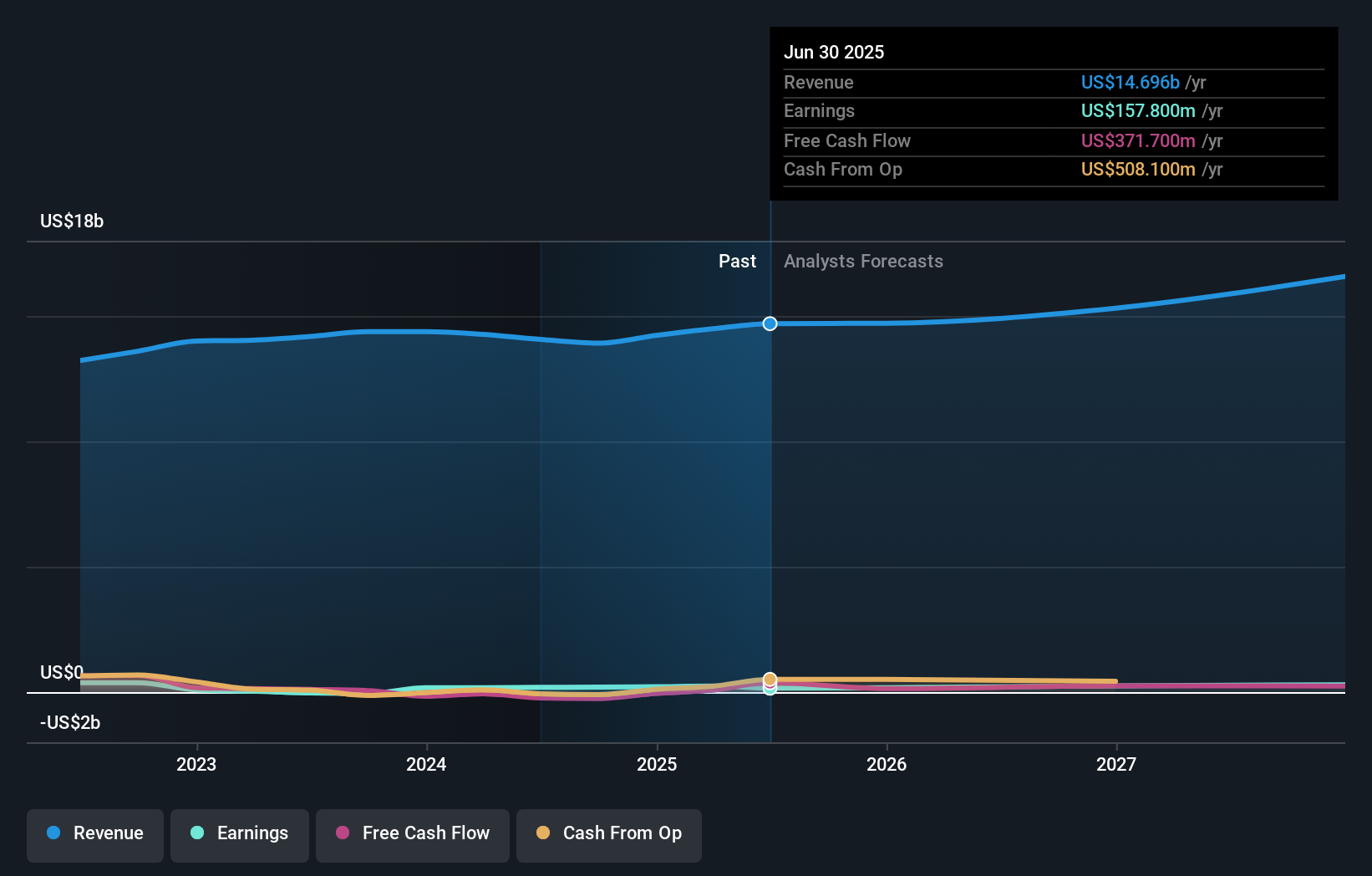

Sonic Automotive's outlook projects $17.0 billion in revenue and $291.7 million in earnings by 2028. This reflects a 5.6% annual revenue growth rate and a $47.1 million increase in earnings from the current level of $244.6 million.

Exploring Other Perspectives

Three members of the Simply Wall St Community estimate Sonic Automotive's fair value from US$38.43 to US$75.52. While some anticipate stronger parts and service growth, many recognize supply volatility could shape future results, explore additional viewpoints to inform your assessment.

Build Your Own Sonic Automotive Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sonic Automotive research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Sonic Automotive research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sonic Automotive's overall financial health at a glance.

Interested In Other Possibilities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SAH

Sonic Automotive

Operates as an automotive retailer in the United States.

Established dividend payer with limited growth.

Similar Companies

Market Insights

Community Narratives