- United States

- /

- Specialty Stores

- /

- NYSE:RH

RH (RH) Valuation in Focus After Tariffs News and Analyst Downgrades

Reviewed by Kshitija Bhandaru

RH faced a wave of analyst downgrades after President Trump announced new tariffs on imported furniture components. The company’s recent earnings also missed expectations, which raises questions about its near-term momentum and resilience.

See our latest analysis for RH.

The tariffs news and disappointing earnings sparked a swift sell-off, with RH’s share price retreating as investors recalibrated expectations around margins and future growth. While the stock’s recent momentum has faded, its 1-year total shareholder return of -0.39% highlights lackluster performance over both the short and long term. This reflects ongoing uncertainty about sustainable growth and resilience in the face of new industry headwinds.

If you’re weighing how policy shifts impact different companies, this could be the perfect time to broaden your next investment search and discover fast growing stocks with high insider ownership

With shares trading notably below analyst price targets and at a significant discount to estimated intrinsic value, investors are left to wonder if RH now offers an attractive entry point or if the market is rightly cautious about its growth outlook.

Most Popular Narrative: 22.3% Undervalued

With RH’s last close at $203.79 and the most widely-followed narrative assigning fair value at $262.25, the gap spotlights a bold optimism not seen in recent trading. This narrative places future catalysts and strategic bets at the heart of its upside view.

RH's platform expansion, including the opening of 7 Design Galleries and 2 Outdoor Galleries in 2025, is expected to create new opportunities for revenue growth and brand exposure across multiple markets, potentially boosting overall sales revenue. The introduction of new product lines, such as the RH Outdoor Sourcebook and RH Interiors Sourcebook, along with a significant brand extension planned for fall 2025, may enhance product differentiation and drive increased demand, positively impacting future revenues.

Want a peek behind the forecast? This narrative’s push for a higher fair value relies on aggressive expansion plans and game-changing product launches. The real surprise is how it re-imagines RH’s revenue growth and margins. Ready to see what kind of performance could drive that optimistic target?

Result: Fair Value of $262.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, tariff uncertainty and a weakening housing market could limit RH’s ability to hit ambitious revenue and margin targets within the forecasted timeframe.

Find out about the key risks to this RH narrative.

Another Perspective: Market-Based Ratios Tell a Different Story

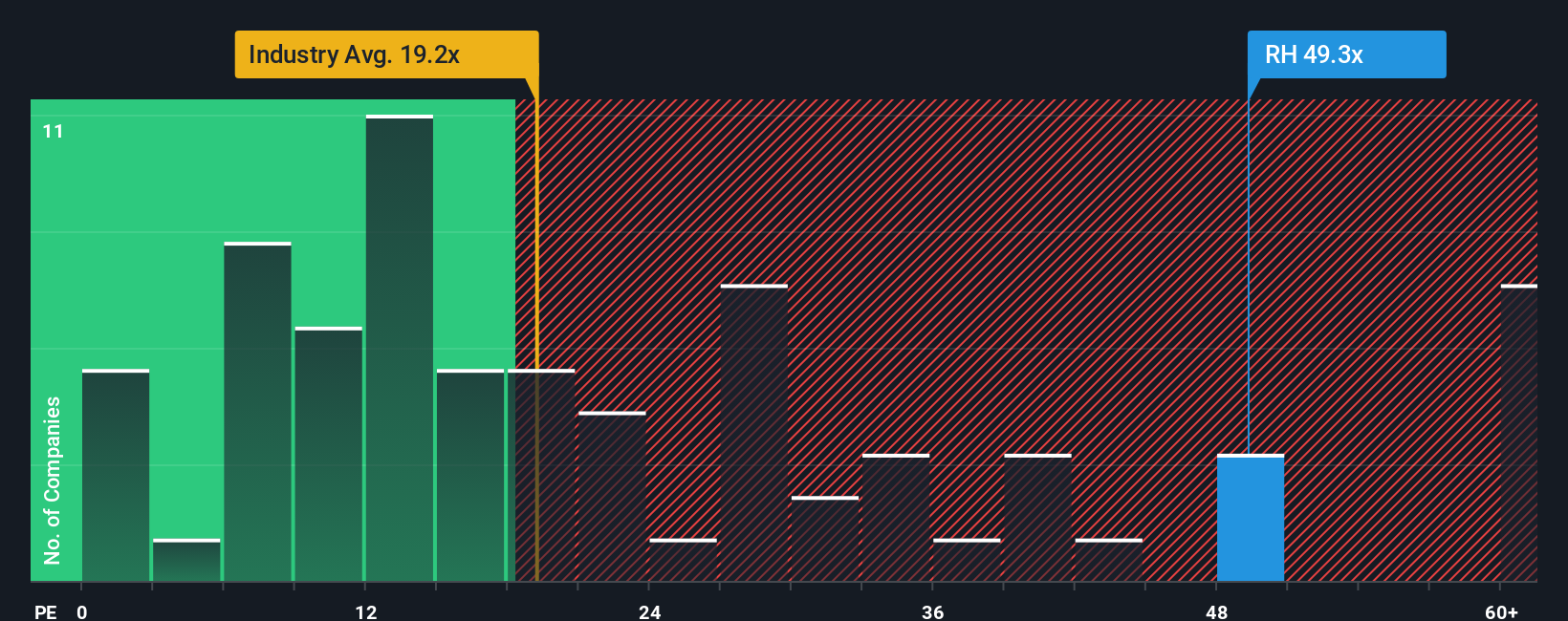

When looking at RH's valuation through the lens of its price-to-earnings ratio, a different picture appears. RH trades at 35.8 times earnings, double the US Specialty Retail industry average of 17.3 and above the peer average of 22.9. However, this is close to its fair ratio of 37.5, which suggests less room for upward movement. Does this premium point to hidden strengths, or signal greater downside risk if expectations are missed?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own RH Narrative

If you have a different perspective or want to dig into the numbers on your own, you can craft a unique RH story in just a few minutes. Do it your way

A great starting point for your RH research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t limit your research to just one stock. Push your portfolio further and spot tomorrow’s leaders using curated screeners on Simply Wall Street.

- Find steady income by checking out the companies offering reliable yields through these 19 dividend stocks with yields > 3% for smarter long-term compounding.

- Catch the next wave of innovation by tapping into these 24 AI penny stocks, where tech breakthroughs are changing industries at lightning speed.

- Seize value opportunities and uncover hidden gems with these 900 undervalued stocks based on cash flows which are currently trading at a discount to their true potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RH

RH

Operates as a retailer and lifestyle brand in the home furnishings market in the United States, Canada, the United Kingdom, Germany, Belgium, and Spain.

Reasonable growth potential with slight risk.

Similar Companies

Market Insights

Community Narratives