- United States

- /

- Specialty Stores

- /

- NYSE:RH

RH (RH): Exploring Valuation After Shares Slide Ahead of Projected Earnings Growth

Reviewed by Simply Wall St

RH (RH) just turned a few heads after its stock slid 6% in the latest trading session, outpacing the broader market’s decline. The move comes at an interesting time, as analysts still anticipate a sharp jump in earnings and revenue in the next quarterly report. Investors might wonder if this recent dip is a genuine warning sign, or simply a symptom of the wider mood in the retail sector.

So far in 2025, RH stock hasn’t found its footing, with shares down about 38% year to date. Even as some in the market are eyeing its projected revenue and profit growth, the stock’s longer-term track record has been underwhelming; returns have lagged over both the past year and the three-year stretch. Still, RH’s shares are trading at a discount to peers, which may catch the attention of value-focused investors, especially as company fundamentals remain solid.

After such a sharp sell-off and with earnings around the corner, is this dip the chance to buy RH at a discount, or is the market already accounting for all that potential growth?

Most Popular Narrative: 5% Undervalued

According to the community narrative, RH shares are considered slightly undervalued based on analysts’ expectations for future earnings, profit margins, and other business fundamentals.

RH's platform expansion, including the opening of 7 Design Galleries and 2 Outdoor Galleries in 2025, is expected to create new opportunities for revenue growth and brand exposure across multiple markets. This could potentially boost overall sales revenue.

The introduction of new product lines, such as the RH Outdoor Sourcebook and RH Interiors Sourcebook, along with a significant brand extension planned for fall 2025, may enhance product differentiation and drive increased demand, which could positively impact future revenues.

What secret assumptions are hiding behind that modest discount? The biggest surprise in this narrative is the bold growth targets for both earnings and profit margins. Want to know what future projections could move the needle, and what financial leap of faith powers this fair value? You will have to dig deeper to uncover the full story behind these eye-catching estimates.

Result: Fair Value of $257.24 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, a shaky housing market or ongoing tariff uncertainties could quickly undermine these optimistic earnings projections and challenge RH’s anticipated growth.

Find out about the key risks to this RH narrative.Another View: Valuation Using Earnings Multiples

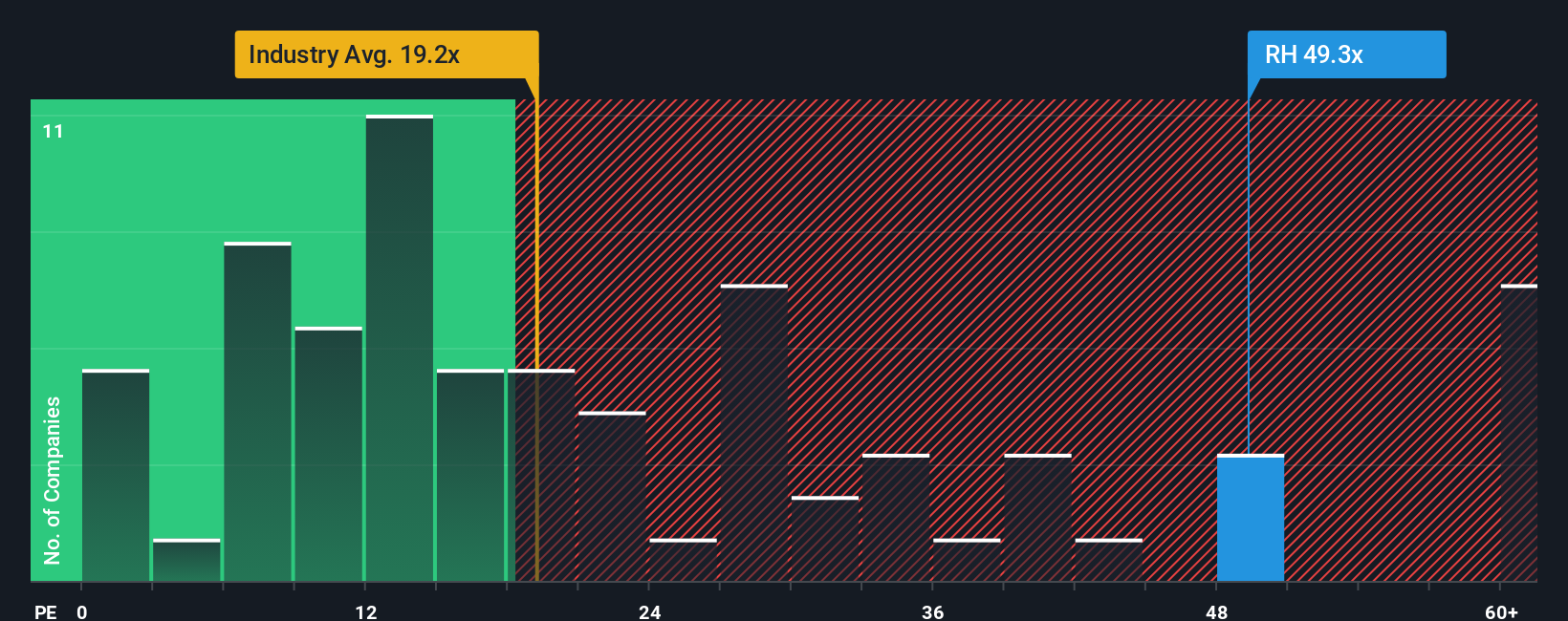

Looking at RH through the lens of its earnings valuation, a different story emerges. Compared to similar companies, the stock appears expensive at present. Is the market overly optimistic, or could something cause these numbers to change?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own RH Narrative

If you see things differently or want to draw your own conclusions, you can piece together a fresh perspective in just a few minutes. do it your way.

A great starting point for your RH research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

If you want even more ways to boost your portfolio, now is the perfect moment to step up your search. Don’t settle for the obvious choices. Some of the market’s best opportunities are out there waiting to be found with the right tools. Take action and put yourself on track for smarter investing today. These unique opportunities may not be available for long.

- Boost your income potential with stocks offering yields above 3% by checking out dividend stocks with yields > 3% and discover companies that keep rewarding their shareholders.

- Spot businesses harnessing artificial intelligence in real-time healthcare solutions by trying healthcare AI stocks for a look at cutting-edge innovators in this booming space.

- Uncover stocks that could be undervalued based on cash flow analysis by using undervalued stocks based on cash flows, giving you a smarter edge on finding value before the crowd does.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RH

RH

Operates as a retailer and lifestyle brand in the home furnishings market in the United States, Canada, the United Kingdom, Germany, Belgium, and Spain.

Reasonable growth potential with low risk.

Similar Companies

Market Insights

Community Narratives