- United States

- /

- Specialty Stores

- /

- NYSE:RH

RH (RH): Evaluating Shareholder Value After a 22% Monthly Share Price Decline

Reviewed by Kshitija Bhandaru

See our latest analysis for RH.

RH’s share price has lost significant ground this year, with a 30-day share price return of -22% and a year-to-date decline of nearly 56%. Momentum has clearly faded, as recent volatility and tumbling investor confidence have overshadowed longer-term hopes of a turnaround. Even the one-year total shareholder return is down almost 50%.

If you’re rethinking where the next opportunity might come from, it could be the perfect time to broaden your horizons and discover fast growing stocks with high insider ownership

With the share price well below analyst targets and fundamentals showing some improvement, is RH now a bargain for value hunters or is the market already pricing in any potential rebound in growth?

Most Popular Narrative: 33.5% Undervalued

Compared to RH’s last closing price of $174.27, the most widely followed narrative calculates a fair value of $262.25. With such a large gap, expectations for future growth and margin expansion are front and center for investors weighing upside potential.

RH's platform expansion, including the opening of 7 Design Galleries and 2 Outdoor Galleries in 2025, is expected to create new opportunities for revenue growth and brand exposure across multiple markets. This could potentially boost overall sales revenue. The introduction of new product lines, such as the RH Outdoor Sourcebook and RH Interiors Sourcebook, along with a significant brand extension planned for fall 2025, may enhance product differentiation and drive increased demand, positively impacting future revenues.

Curious what powers this valuation? The real driver is not just retail expansion. The narrative is betting on a major transformation in margins and profitability, tied to bold expectations for growth, efficiency and future market positioning. Dive into the full story to see which financial forecasts are shaking up the value equation.

Result: Fair Value of $262.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks such as a struggling housing market and persistent tariff uncertainties could easily disrupt the optimistic outlook embedded in current analyst forecasts.

Find out about the key risks to this RH narrative.

Another View: How Do Valuation Ratios Stack Up?

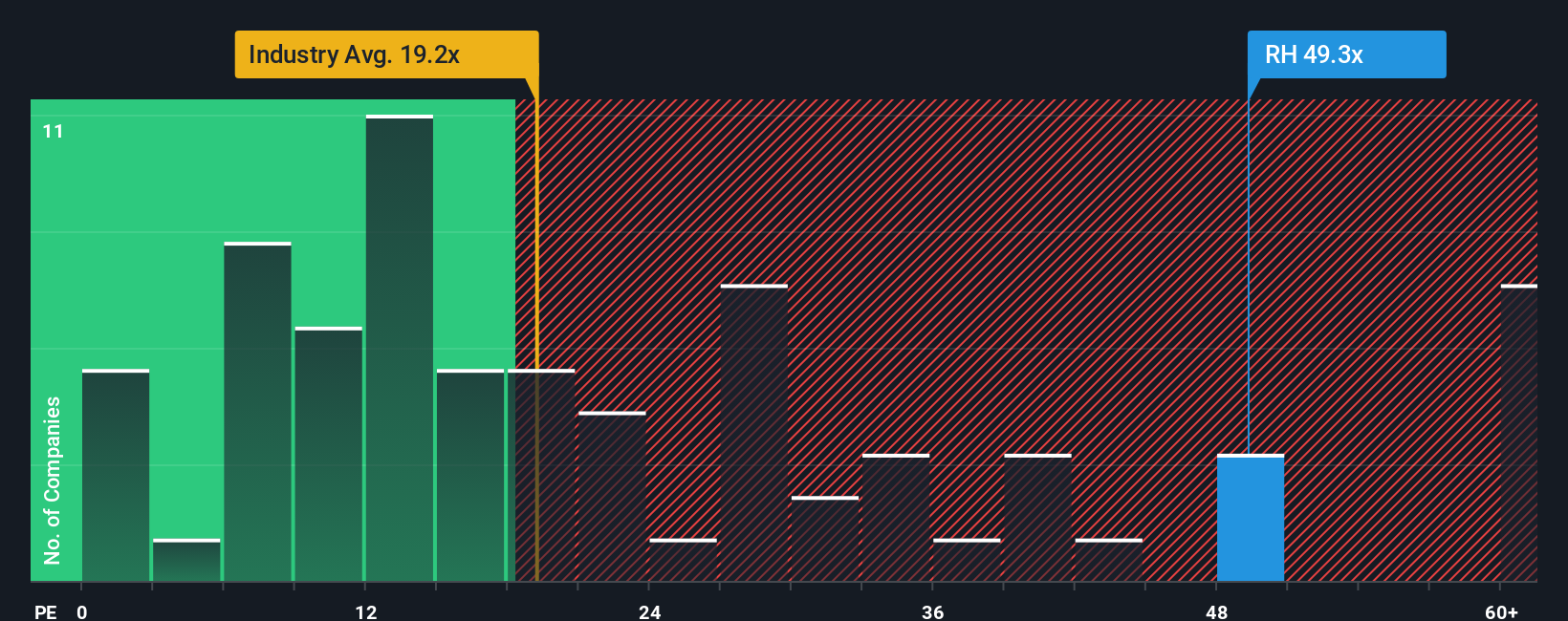

Looking at where RH trades today, the price-to-earnings ratio stands at 30.6x, which is much higher than both the US Specialty Retail industry average (16.1x) and its peer group (16.7x). Even compared to the fair ratio of 36.6x, RH looks elevated. This gap signals substantial valuation risk if the market loses faith in future earnings growth. Could this premium be justified, or will it catch up with sector norms?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own RH Narrative

Not convinced by these perspectives, or want to shape your own? You can dig into the numbers and craft a unique narrative in just a few minutes: Do it your way

A great starting point for your RH research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let opportunity pass you by. Take charge of your portfolio with fresh, high-potential angles from our screeners and uncover what others might overlook.

- Uncover growth stories before the crowd by tapping into these 3601 penny stocks with strong financials, which combine early-stage potential with robust financials.

- Capture emerging trends in healthcare innovation, including AI-driven breakthroughs, when you check out these 33 healthcare AI stocks.

- Lock in recurring income streams by searching for these 18 dividend stocks with yields > 3%, offering attractive yields above 3% for steady returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RH

RH

Operates as a retailer and lifestyle brand in the home furnishings market in the United States, Canada, the United Kingdom, Germany, Belgium, and Spain.

Reasonable growth potential with slight risk.

Similar Companies

Market Insights

Community Narratives