- United States

- /

- Specialty Stores

- /

- NYSE:RH

After Leaping 27% RH (NYSE:RH) Shares Are Not Flying Under The Radar

Despite an already strong run, RH (NYSE:RH) shares have been powering on, with a gain of 27% in the last thirty days. Looking back a bit further, it's encouraging to see the stock is up 28% in the last year.

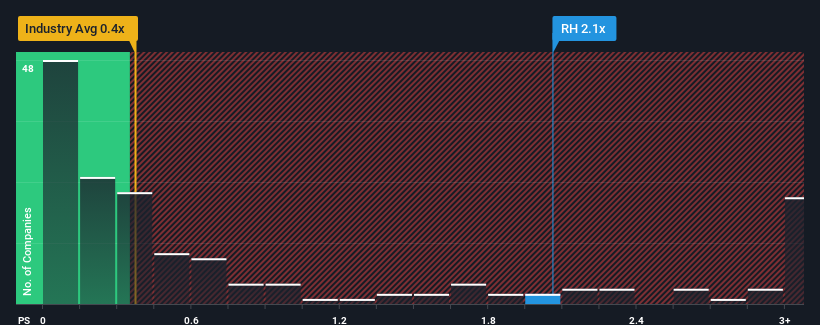

Following the firm bounce in price, given close to half the companies operating in the United States' Specialty Retail industry have price-to-sales ratios (or "P/S") below 0.4x, you may consider RH as a stock to potentially avoid with its 2.1x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for RH

How Has RH Performed Recently?

While the industry has experienced revenue growth lately, RH's revenue has gone into reverse gear, which is not great. One possibility is that the P/S ratio is high because investors think this poor revenue performance will turn the corner. If not, then existing shareholders may be extremely nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on RH.Do Revenue Forecasts Match The High P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as high as RH's is when the company's growth is on track to outshine the industry.

Retrospectively, the last year delivered a frustrating 4.1% decrease to the company's top line. The last three years don't look nice either as the company has shrunk revenue by 13% in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Looking ahead now, revenue is anticipated to climb by 9.5% per annum during the coming three years according to the analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 5.7% each year, which is noticeably less attractive.

With this in mind, it's not hard to understand why RH's P/S is high relative to its industry peers. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From RH's P/S?

The large bounce in RH's shares has lifted the company's P/S handsomely. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our look into RH shows that its P/S ratio remains high on the merit of its strong future revenues. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

Plus, you should also learn about these 6 warning signs we've spotted with RH (including 2 which make us uncomfortable).

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:RH

RH

Operates as a retailer and lifestyle brand in the home furnishings market in the United States, Canada, the United Kingdom, Germany, Belgium, and Spain.

Reasonable growth potential with slight risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026