- United States

- /

- Specialty Stores

- /

- NYSE:PAG

There Is A Reason Penske Automotive Group, Inc.'s (NYSE:PAG) Price Is Undemanding

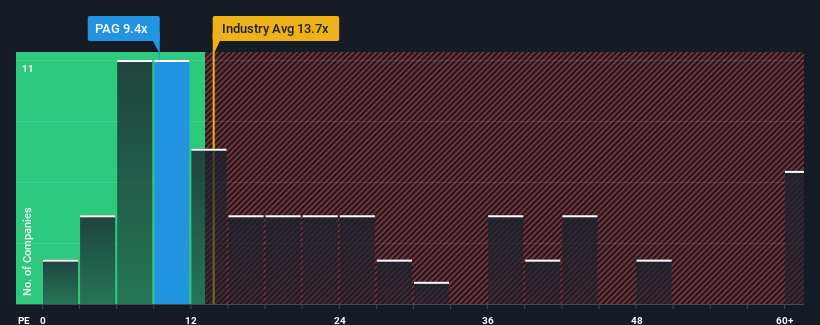

Penske Automotive Group, Inc.'s (NYSE:PAG) price-to-earnings (or "P/E") ratio of 9.4x might make it look like a buy right now compared to the market in the United States, where around half of the companies have P/E ratios above 17x and even P/E's above 33x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

With earnings that are retreating more than the market's of late, Penske Automotive Group has been very sluggish. The P/E is probably low because investors think this poor earnings performance isn't going to improve at all. You'd much rather the company wasn't bleeding earnings if you still believe in the business. Or at the very least, you'd be hoping the earnings slide doesn't get any worse if your plan is to pick up some stock while it's out of favour.

See our latest analysis for Penske Automotive Group

Is There Any Growth For Penske Automotive Group?

In order to justify its P/E ratio, Penske Automotive Group would need to produce sluggish growth that's trailing the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 7.8%. Still, the latest three year period has seen an excellent 213% overall rise in EPS, in spite of its unsatisfying short-term performance. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Looking ahead now, EPS is anticipated to slump, contracting by 4.3% per annum during the coming three years according to the ten analysts following the company. That's not great when the rest of the market is expected to grow by 13% per annum.

With this information, we are not surprised that Penske Automotive Group is trading at a P/E lower than the market. However, shrinking earnings are unlikely to lead to a stable P/E over the longer term. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

The Bottom Line On Penske Automotive Group's P/E

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Penske Automotive Group maintains its low P/E on the weakness of its forecast for sliding earnings, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

You need to take note of risks, for example - Penske Automotive Group has 4 warning signs (and 1 which makes us a bit uncomfortable) we think you should know about.

If you're unsure about the strength of Penske Automotive Group's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:PAG

Penske Automotive Group

A diversified transportation services company, operates automotive and commercial truck dealerships worldwide.

Average dividend payer and fair value.