- United States

- /

- Specialty Stores

- /

- NYSE:MUSA

There's Reason For Concern Over Murphy USA Inc.'s (NYSE:MUSA) Price

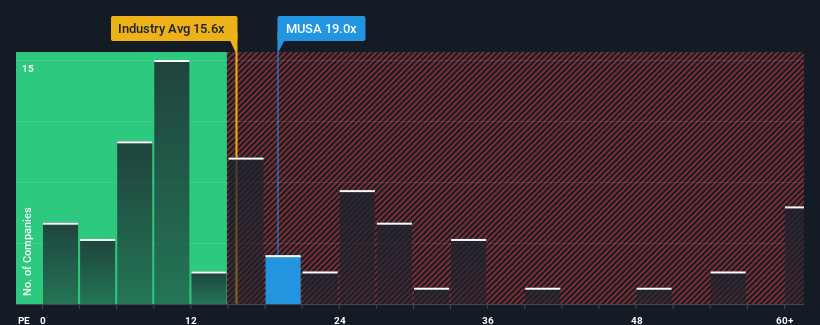

There wouldn't be many who think Murphy USA Inc.'s (NYSE:MUSA) price-to-earnings (or "P/E") ratio of 19x is worth a mention when the median P/E in the United States is similar at about 18x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Murphy USA's negative earnings growth of late has neither been better nor worse than most other companies. The P/E is probably moderate because investors think the company's earnings trend will continue to follow the rest of the market. You'd much rather the company wasn't bleeding earnings if you still believe in the business. In saying that, existing shareholders probably aren't too pessimistic about the share price if the company's earnings continue tracking the market.

Check out our latest analysis for Murphy USA

Does Growth Match The P/E?

The only time you'd be comfortable seeing a P/E like Murphy USA's is when the company's growth is tracking the market closely.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 3.0%. Still, the latest three year period has seen an excellent 130% overall rise in EPS, in spite of its unsatisfying short-term performance. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Turning to the outlook, the next three years should generate growth of 6.6% each year as estimated by the seven analysts watching the company. That's shaping up to be materially lower than the 10% per annum growth forecast for the broader market.

With this information, we find it interesting that Murphy USA is trading at a fairly similar P/E to the market. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as this level of earnings growth is likely to weigh down the shares eventually.

The Key Takeaway

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Murphy USA currently trades on a higher than expected P/E since its forecast growth is lower than the wider market. Right now we are uncomfortable with the P/E as the predicted future earnings aren't likely to support a more positive sentiment for long. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Murphy USA that you need to be mindful of.

You might be able to find a better investment than Murphy USA. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:MUSA

Murphy USA

Engages in marketing of retail motor fuel products and convenience merchandise.

Slightly overvalued with limited growth.

Similar Companies

Market Insights

Community Narratives