Macy’s (M) Trailing EPS Rebound to $1.79 Tests Bearish Revenue-Decline Narrative Ahead of Q3

Reviewed by Simply Wall St

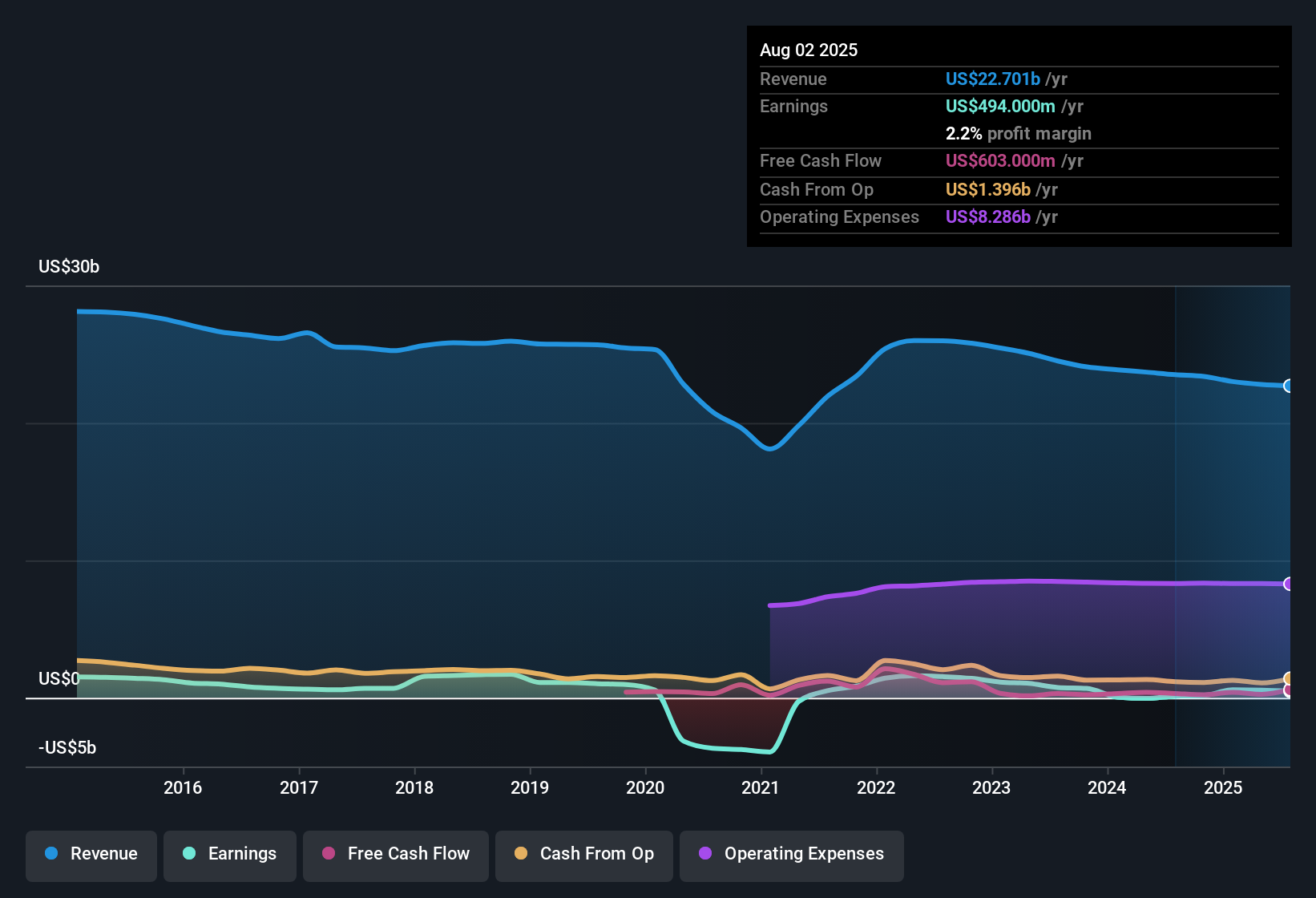

Macy's (M) just turned in another steady quarter, with Q2 2026 revenue of about $5.0 billion, basic EPS of $0.32, and net income of $87 million setting the tone for its upcoming Q3 2026 readout. Over the last few quarters the top line has hovered around the $4.8 billion to $5.1 billion range while EPS moved from $0.10 in Q3 2025 to $0.14 in Q1 2026 and then to $0.32 in Q2 2026, giving investors a clearer view of how profitability is tracking through the cycle. With trailing 12 month EPS at $1.79 and net income at $494 million, the story heading into Q3 is all about how much of that improved margin profile Macy’s can sustain.

See our full analysis for Macy's.Now that the headline numbers are on the table, the next step is to see how they line up with the big narratives around Macy’s, from profit resilience to long term growth pressure.

See what the community is saying about Macy's

TTM net income climbs to $494 million

- Over the last twelve months, Macy's generated $494 million of net income on $22.7 billion of revenue, up from $124 million on $23.5 billion a year earlier, pointing to much stronger profitability even on a slightly smaller sales base.

- What stands out for bullish investors is how this higher profitability lines up with the omni channel and store optimization story, where

- net margin improved to 2.2 percent from 0.5 percent as Macy's trims weaker locations and focuses investment on better performing stores and digital, matching the idea that "Reimagine 125" and portfolio pruning are lifting returns per square foot, and

- luxury and off price banners like Bloomingdale's and Bluemercury plus private label refreshes aim to support future earnings, which fits with forecasts for earnings to grow about 7.7 percent per year even though revenue is expected to contract.

Revenue forecast dips 5.5 percent a year

- Looking ahead, revenue is projected to decline roughly 5.5 percent per year over the next three years, even as earnings are forecast to rise to about $663 million from $494 million today. This assumes Macy's can keep expanding margins while the top line shrinks.

- Bears focus on this negative sales trajectory and see it clashing with the heavy investment plan, because

- ongoing store closures and soft unit demand could reinforce that revenue decline, especially as Macy's remains dependent on discretionary spending that can weaken in tougher macro conditions, and

- greater pressure from pure play e commerce and direct to consumer brands may make it harder for omni channel upgrades and private label initiatives to fully offset the forecast revenue drop.

Share price trails DCF fair value

- With the stock around $22.46, Macy's trades below the DCF fair value estimate of about $27.67 and on a price to earnings multiple of 12.2 times, compared with roughly 20.1 times for the global multiline retail industry and 22.9 times for peers.

- For bullish investors, this discount looks like a margin of safety, but the narrative also has to square with balance sheet and payout trade offs, since

- the company carries relatively high debt and an unstable dividend record, which makes that low multiple partly a reflection of risk rather than just mispricing, and

- the revenue decline forecast means the market may be waiting to see if projected margin expansion to about 3.6 percent can actually show up in reported numbers before closing the valuation gap.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Macy's on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Spot something in the numbers that others might be missing, turn that into a clear, data backed view in just minutes, then Do it your way.

A great starting point for your Macy's research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

Macy's improving margins sit alongside shrinking sales, elevated leverage, and an uneven dividend record, leaving some investors uneasy about the durability of its turnaround.

If those balance sheet and payout risks give you pause, shift your focus to companies with stronger cushions and reliability by checking solid balance sheet and fundamentals stocks screener (1938 results) right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:M

Macy's

An omni-channel retail organization, operates stores, websites, and mobile applications in the United States.

Solid track record and good value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026