Is Macy's Still an Opportunity After Board Rejects $6.6B Buyout Offer?

Reviewed by Bailey Pemberton

If you’ve been watching Macy’s stock lately, you’re not alone. Investors of all stripes are trying to decide whether now is the moment to buy, hold, or take profits, given that the share price has recently closed at $17.72. The past year has given Macy’s holders a reason to smile, with the stock climbing 20.6% in twelve months and an eye-opening 241.8% over five years. Even recent volatility hasn’t shaken the longer-term trend. While the last week saw a dip of 1.3%, the past month erased that with a gain of 3.7%, and year-to-date returns are holding strong at 7.0%.

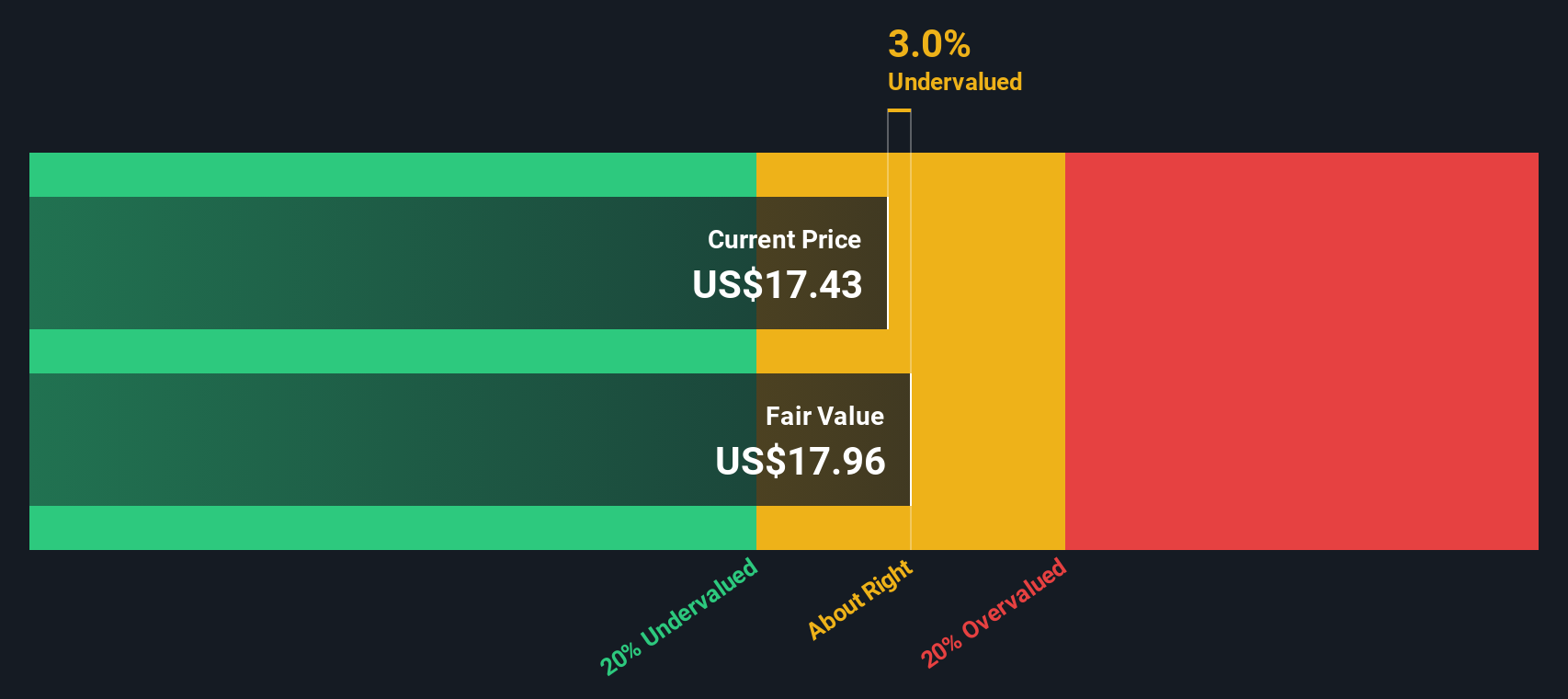

A big part of the conversation right now is about Macy’s valuation. Investors are gauging what those price moves really mean. Was it growth potential that the market missed, or a shift in risk sentiment? That question is even more relevant as we size up whether the stock’s run has left much value on the table. To help answer that, Macy’s currently clocks in with a value score of 4 out of 6 on our undervaluation checks, a solid mark that suggests it could have meaningful upside left.

So, how exactly does that value score break down, and what does it tell us about where Macy’s shares might be headed next? Let’s walk through the valuation approaches one by one. Stick around, because after we break down the numbers, I’ll share an even better way to think about Macy’s true worth.

Why Macy's is lagging behind its peers

Approach 1: Macy's Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a popular tool for estimating a company's intrinsic value by projecting future cash flows and discounting them back to today’s dollars. For Macy’s, this approach takes its recent free cash flow, which was around $457.7 million last year, and forecasts how those cash flows could evolve over the coming decade.

Analyst estimates suggest Macy’s free cash flow will peak at $683.5 million in 2027, then moderate to $441.8 million by 2035. While the trajectory includes some ups and downs, projections rely on both available analyst data for the next few years and longer-term trends modeled by Simply Wall St. All figures are expressed in $ Millions, so investors are tracking hundreds of millions in annual cash generation as Macy’s navigates the future retail landscape.

After crunching the numbers, the DCF model produces an estimated fair value of $18.42 per share for Macy’s. With the current market price at $17.72, that represents a discount of about 3.8%, indicating the stock is trading very close to its intrinsic value based on cash flow fundamentals.

Result: ABOUT RIGHT

Simply Wall St performs a valuation analysis on every stock in the world every day (check out Macy's's valuation analysis). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes.

Approach 2: Macy's Price vs Earnings (PE Ratio) Analysis

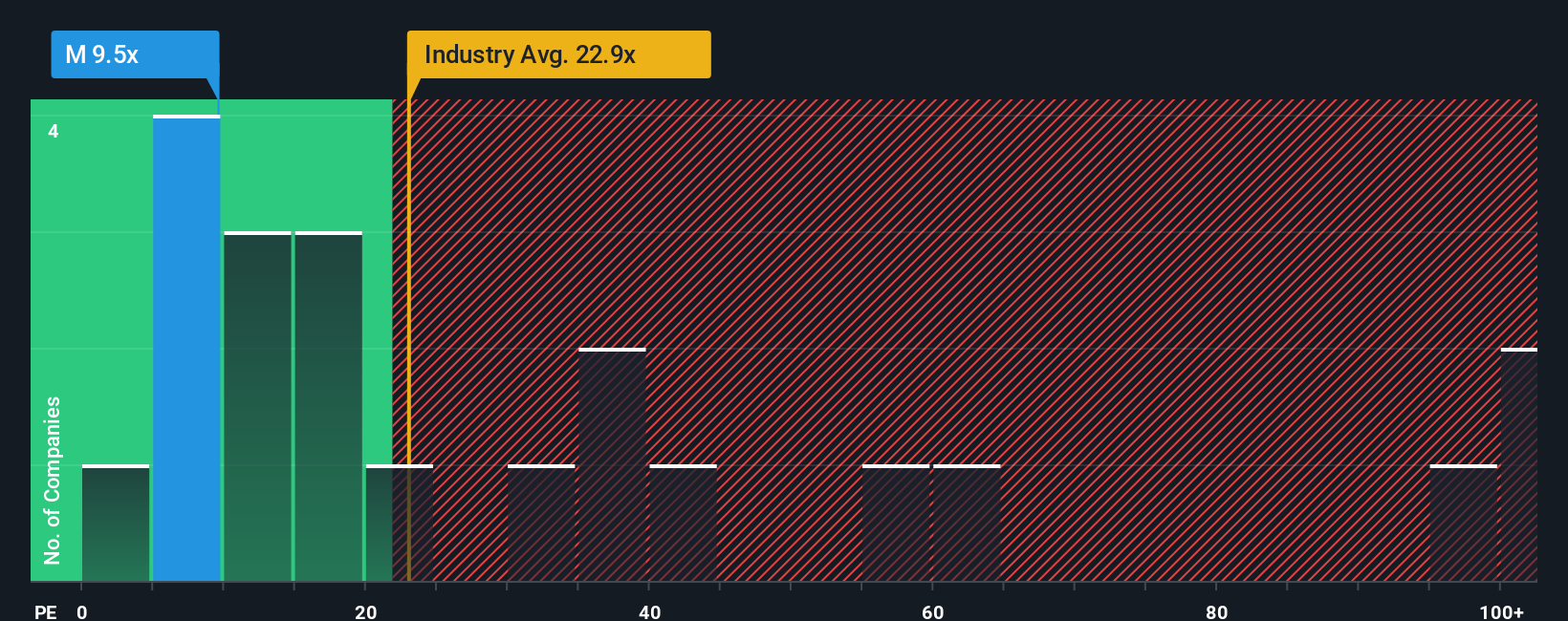

The price-to-earnings (PE) ratio is a time-tested metric for valuing profitable companies like Macy’s, because it tells investors how much they are paying today for a dollar of the company’s earnings. When a business has consistent profits, the PE ratio becomes a useful quick-check to see if shares are priced attractively or not.

A fair PE ratio for any company is shaped by factors such as its expected growth rate, risk profile, and overall stability. Generally, higher growth or safer earnings justify a higher PE, while slower growth or greater risks command a lower multiple. For context, Macy’s current PE sits at 9.6x, significantly below the Multiline Retail industry average of 22.2x, and well under the peer group average of 26.5x.

This is where Simply Wall St’s “Fair Ratio” comes into play. It is a proprietary metric that calculates what a company’s PE should be, based on tailored factors like Macy’s own growth expectations, profits, risk, industry dynamics, and market cap. Unlike blunt comparisons to peer and industry averages, the Fair Ratio customizes its benchmark to the specific company, bringing more nuance and accuracy. For Macy’s, the Fair Ratio is 16.8x. Since its actual PE is 9.6x, which is well below this benchmark, the stock appears attractively valued by this method.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Macy's Narrative

Earlier, we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is a simple and powerful tool that lets you tell the story behind your numbers. Your perspective on Macy’s future revenue, profit margins, and fair value is connected to a set of forecasts and a valuation.

Unlike static ratios or analyst models, Narratives link a company’s story directly to financial forecasts and then to a fair value. This allows you to see how your view translates into a buy or sell signal. Narratives are available for free on Simply Wall St’s Community page, alongside millions of other investors’ perspectives. They update automatically as new data or news is released, ensuring your view always reflects the latest information.

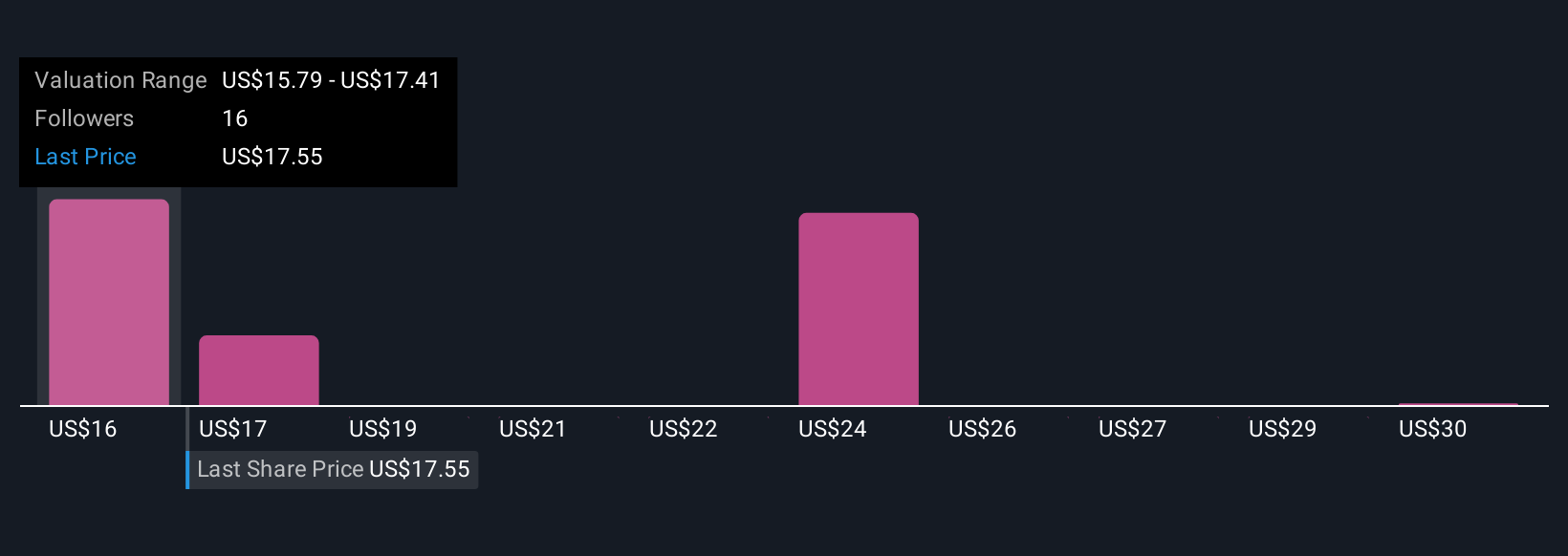

For example, one Macy’s Narrative might emphasize the huge value in its real estate and strong digital sales, leading to a fair value of $24.43. Another could focus on ongoing store closures and margin pressures, estimating fair value at $15.79, or even as low as $6.00.

By comparing your Narrative’s fair value to Macy’s current price, you can make more informed decisions about when to buy, sell, or hold. Your unique story and the numbers you believe in can help guide your decision making.

For Macy's, however, we'll make it really easy for you with previews of two leading Macy's Narratives:

Fair Value: $24.43

Undervalued by approximately 27.5%

Revenue Growth Rate: 5.6%

- Macy’s owns substantial real estate and plans to raise $600 to $750 million from property sales over the next three years, providing additional liquidity for investment and debt reduction.

- The company stands as one of the largest e-commerce retailers in the US, generating over $7 billion annually in digital sales and building a media network to further monetize online traffic.

- Despite turnaround efforts and store closures, the underlying business health remains a key concern, with ongoing risks if no takeover occurs and persistent declines in sales and margins over the past decade.

Fair Value: $15.79

Overvalued by approximately 12.2%

Revenue Growth Rate: -6.1%

- Omni-channel investments and store portfolio optimization are improving efficiency and margins, with expanded product offerings supporting broader revenue growth and customer diversification.

- Macy’s continues to face competitive headwinds from e-commerce, persistent margin pressures, and high reliance on discretionary consumer spending, making it vulnerable to economic shifts and digital competition.

- While analysts forecast earnings growth and higher profit margins by 2028, their consensus price target suggests the stock is trading just above fair value, reflecting skepticism about robust long-term recovery.

Do you think there's more to the story for Macy's? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:M

Macy's

An omni-channel retail organization, operates stores, websites, and mobile applications in the United States.

Solid track record and good value.

Similar Companies

Market Insights

Community Narratives