- United States

- /

- Specialty Stores

- /

- NYSE:LAD

Lithia Motors (LAD): Profit Growth Outpaces Five-Year Trend, Reinforcing Bullish Narratives on Earnings Quality

Reviewed by Simply Wall St

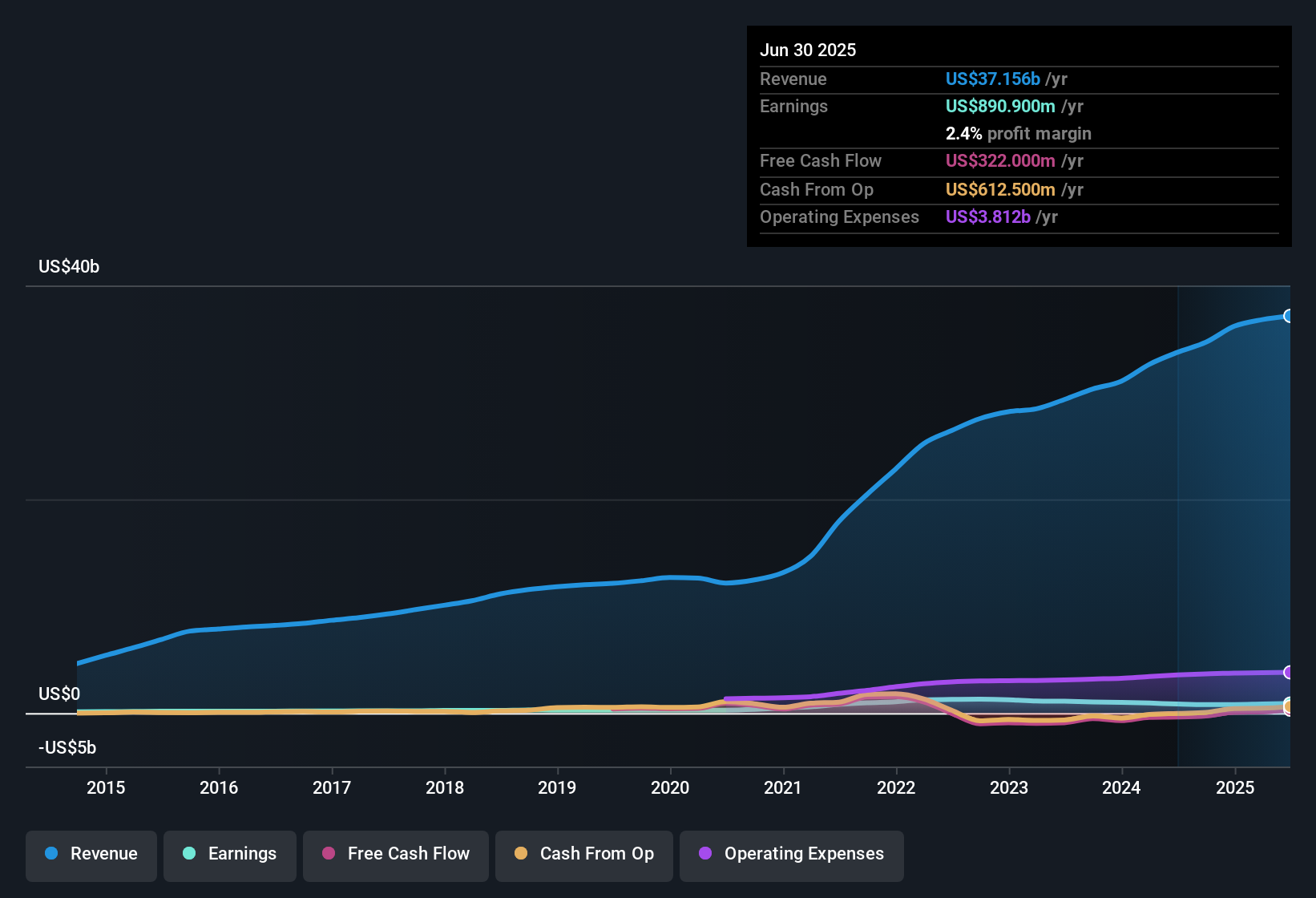

Lithia Motors (LAD) reported net profit margins of 2.4%, edging out last year’s 2.3%, while earnings growth for the year came in at 12.7%, far above its five-year average of 3.7% per year. The company’s current share price sits at $324.74, which is above one estimate of fair value at $269.27. However, the business stands out for growing profits, an attractive price-to-earnings ratio of 9.2x relative to the industry, and recent momentum in profit growth. While profitability is trending in the right direction and valuation looks compelling compared to peers, investors are likely to keep a close eye on Lithia’s financial position as they weigh the results.

See our full analysis for Lithia Motors.Now, let’s see how these latest numbers measure up against the main narratives that investors are following. Some expectations might get confirmed, while others could be upended.

See what the community is saying about Lithia Motors

Recurring Aftersales Drive Over 60% of Profits

- More than 60% of Lithia Motors’ net profit now comes from aftersales activities such as service, parts, and warranty. This provides a stable foundation for earnings that is not fully priced into the current share value.

- Analysts' consensus view points to strength here as a key reason for long-term optimism, noting:

- Aftersales revenues, supported by an aging U.S. vehicle fleet and extended replacement cycles, create predictable and high-margin streams that anchor profitability even as new-vehicle sales fluctuate.

- Consensus narrative emphasizes that the company's digital platform expansion and recurring aftersales give Lithia resilience, supporting analyst forecasts for margin growth from 2.4% today to 2.6% in three years.

- For a deeper dive into how aftersales stability shapes the big picture for Lithia, see the evidence behind analysts' expectations and read the full consensus narrative. 📊 Read the full Lithia Motors Consensus Narrative.

Acquisitions and Tech Bets Boost Growth Prospects

- Strategic dealership acquisitions and investments in technology, such as the full rollout of Pinewood.AI, are forecasted to help Lithia Motors achieve annual revenue growth of 4.7% and earnings growth of 8.8% in the coming years.

- Consensus narrative notes:

- Market share gains are accelerating thanks to disciplined M&A in high-growth U.S. regions and upgrades to Lithia’s omnichannel retail platforms, which are broadening reach and driving both top-line and margin expansion.

- Advancements in captive finance operations are positioned to diversify revenue streams and contribute more strongly to free cash flow growth, with the digital retail platform expected to bolster customer retention and recurring sales.

Valuation Signals: Discount to Peers, Premium to DCF Fair Value

- Lithia’s price-to-earnings ratio stands at 9.2x, making it lower than its industry (16.7x) and closest peers (12.6x). Today’s share price of $324.74 is above the DCF fair value estimate of $269.27 and below the consensus analyst target price of $387.71.

- Consensus narrative underlines this point:

- While valuation multiples look compelling compared to retail peers, the market appears cautious due to ongoing concerns about Lithia’s financial position and margin pressure. This highlights the importance of monitoring cost controls and profitability improvements.

- Consensus price targets assume continued margin and earnings expansion, but investors will be watching whether these assumptions hold up as digital initiatives develop and acquisitions are integrated.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Lithia Motors on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have your own angle on the numbers? In just a few minutes, you can turn your insights into a personalized narrative. Do it your way

A great starting point for your Lithia Motors research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Despite Lithia Motors’ strong profit momentum, persistent concerns about its financial position and margin pressures could challenge future earnings expansion.

If robust financial health is a priority, our solid balance sheet and fundamentals stocks screener (1984 results) highlights companies with stronger balance sheets and lower risk of margin stress in uncertain times.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LAD

Lithia Motors

Operates as an automotive retailer in the United States, the United Kingdom, and Canada.

Solid track record and fair value.

Similar Companies

Market Insights

Community Narratives