- United States

- /

- Specialty Stores

- /

- NYSE:LAD

Lithia Motors (LAD) Is Down 11.9% After Upbeat Q2 2025 Guidance Has The Bull Case Changed?

Reviewed by Simply Wall St

- Earlier this month, Lithia Motors released new earnings guidance for the second quarter of 2025, projecting revenues between US$9.4 billion and US$9.6 billion and net income per diluted share of US$9.70 to US$10.00, representing an increase of 23% to 27% compared to the same period in 2024.

- The company also indicated that its performance outlook is expected to significantly exceed market expectations, highlighting momentum in both revenue and profitability growth.

- Next, we'll examine how Lithia Motors' stronger earnings outlook may influence analysts' projections for the business and its investment case.

Lithia Motors Investment Narrative Recap

To be a shareholder in Lithia Motors, you have to believe in the company's ability to sustain margin expansion and deliver consistent earnings growth, despite risks like tariffs and economic uncertainty. The recent upgrade in earnings guidance highlights strong revenue growth and profitability momentum, which could support confidence in the company’s near-term trajectory; however, it does not eliminate the underlying sensitivity to tariff impacts and inventory management, which remain material risks in the short term.

A recent acquisition of two Mercedes-Benz dealerships in June 2025 is particularly relevant, as it underpins Lithia’s revenue guidance and aligns with its ongoing expansion strategy. These additions not only bolster the company's position in high-performing regions but also support the catalyst of expanding market presence, potentially making revenue growth targets more achievable.

By contrast, investors should be aware that rapid changes in leadership could still present operational risks if...

Read the full narrative on Lithia Motors (it's free!)

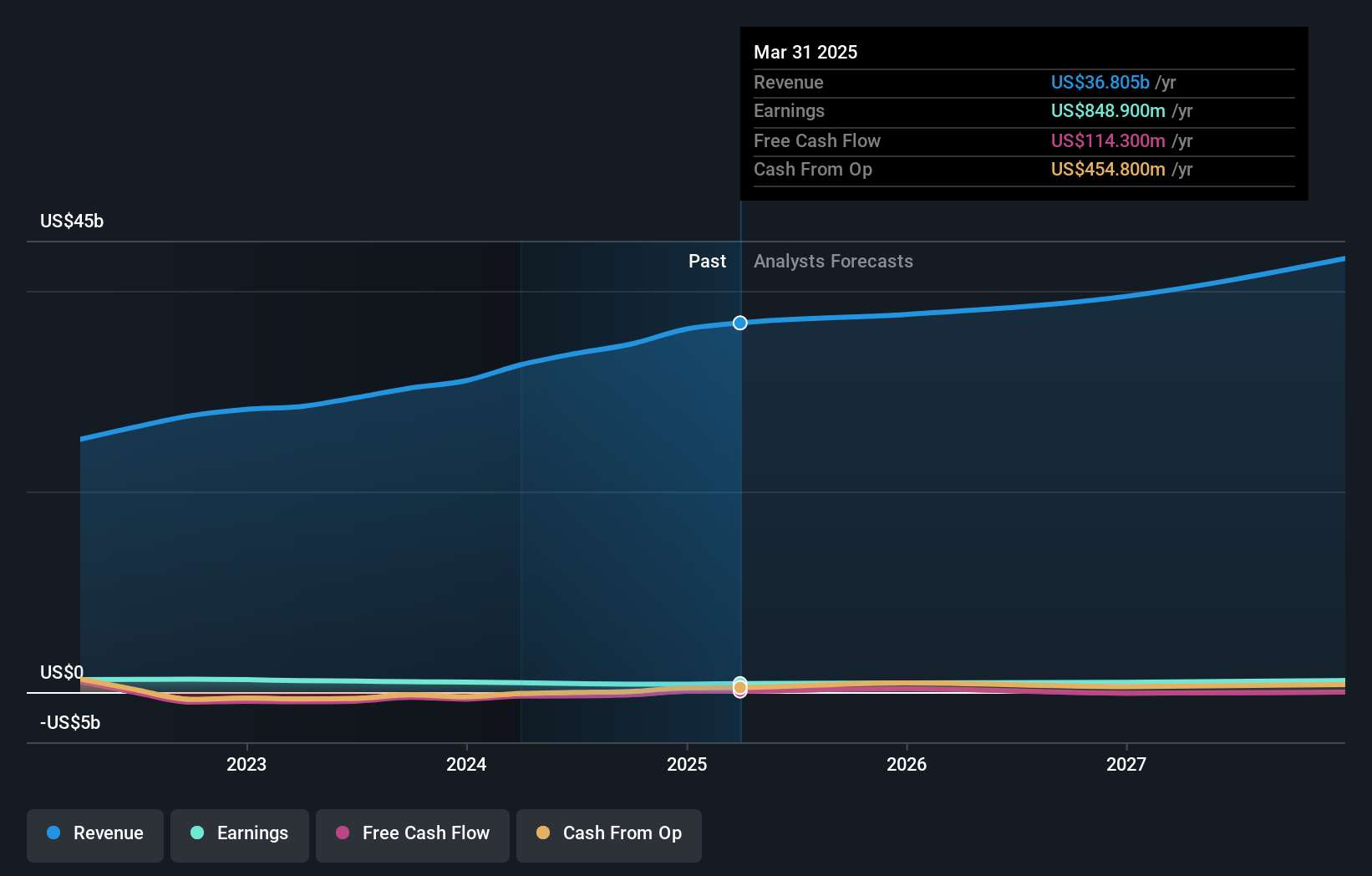

Lithia Motors' outlook anticipates $43.8 billion in revenue and $1.2 billion in earnings by 2028. This scenario requires 5.9% annual revenue growth and a rise in earnings of $351 million from the current $848.9 million.

Uncover how Lithia Motors' forecasts yield a $383.07 fair value, a 24% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community includes 1 retail investor perspective, all estimating Lithia Motors’ fair value at US$383.07. While earnings guidance points to robust short-term momentum, you should consider how ongoing exposure to tariff-related risks could affect longer-term outcomes.

Explore another fair value estimate on Lithia Motors - why the stock might be worth just $383.07!

Build Your Own Lithia Motors Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Lithia Motors research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Lithia Motors research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Lithia Motors' overall financial health at a glance.

No Opportunity In Lithia Motors?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 26 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LAD

Lithia Motors

Operates as an automotive retailer in the United States, the United Kingdom, and Canada.

Very undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives