- United States

- /

- Specialty Stores

- /

- NYSE:LAD

Lithia Motors (LAD): Evaluating Valuation After Strong Q3 Earnings, Dividends, and Share Buybacks

Reviewed by Simply Wall St

Lithia Motors (NYSE:LAD) delivered a solid update this week, reporting third-quarter earnings and revenue that both surpassed Wall Street forecasts. The company also confirmed its dividend and continued with its share buyback program, signaling confidence in its financial footing.

See our latest analysis for Lithia Motors.

Lithia Motors’ upbeat earnings, continued buybacks, and a confirmed dividend have helped keep investor sentiment steady, even as the stock’s latest share price hovers at $311.87. While the year-to-date share price return is down around 10%, long-term performance remains compelling, with a 1-year total shareholder return of 3% and a remarkable 61% over three years. This suggests the company’s fundamentals are still resonating with patient investors despite recent volatility.

If you’re looking for fresh ideas beyond the major auto retailers, consider broadening your search and check out See the full list for free.

Given the stronger-than-expected earnings, robust buybacks, and a healthy dividend, investors must now determine whether Lithia Motors’ current valuation reflects the company’s future prospects or if there is still room for upside.

Most Popular Narrative: 18.3% Undervalued

Lithia Motors’ most-watched narrative points to a fair value notably higher than its last close of $311.87. This suggests a possible disconnect between expectations and the current trading price. With fair value based on forward-looking growth, major narrative drivers deserve attention.

Strategic acquisitions, technology upgrades, and expanded captive finance operations drive efficiency, market share gains, and revenue diversification beyond current market expectations.

Curious what powers this bullish outlook? One key assumption could completely alter how you value LAD. Want to peek under the hood at the profit margin expansion and bold revenue growth that shape this future payoff? Discover what really justifies the sizable valuation gap.

Result: Fair Value of $381.93 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, elevated acquisition costs or prolonged margin pressure could challenge Lithia's profit expansion narrative. This may make future earnings growth less certain for investors.

Find out about the key risks to this Lithia Motors narrative.

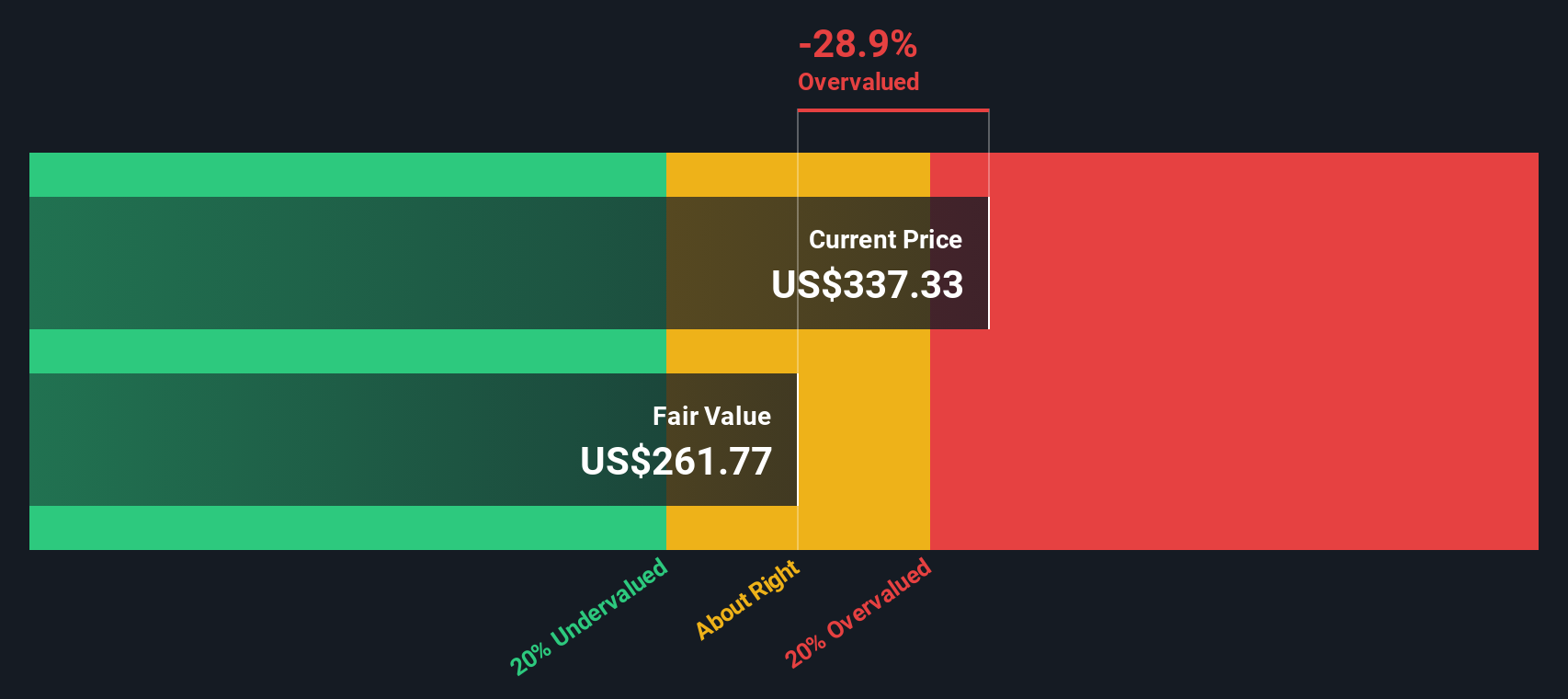

Another View: Sizing Upside Downside with SWS DCF Model

While analysts see upside when comparing today’s price to future multiples, our SWS DCF model tells a different story. Using future cash flows, the DCF model suggests Lithia Motors may be trading above its estimated fair value. This casts doubt on how much room there is for upward price movement.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Lithia Motors for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Lithia Motors Narrative

If you see things differently, or prefer to dig into the numbers yourself, you can craft your own narrative in a matter of minutes. Do it your way

A great starting point for your Lithia Motors research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

If you want to uncover real opportunities before the crowd, unlock our screeners. Missing out could mean overlooking tomorrow’s top performers as they break out.

- Boost your potential for strong returns with these 879 undervalued stocks based on cash flows, connecting you to companies the market may be overlooking right now.

- Capture steady income streams and grow your wealth by reviewing these 17 dividend stocks with yields > 3% yielding impressive payouts above 3%.

- Get ahead of AI-driven trends by checking out these 25 AI penny stocks. These innovators could transform entire industries in the years to come.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LAD

Lithia Motors

Operates as an automotive retailer in the United States, the United Kingdom, and Canada.

Good value with acceptable track record.

Similar Companies

Market Insights

Community Narratives