- United States

- /

- Specialty Stores

- /

- NYSE:LAD

Is Lithia Motors Set for a Rebound After Revenue Miss and Three-Year Share Price Surge?

Reviewed by Bailey Pemberton

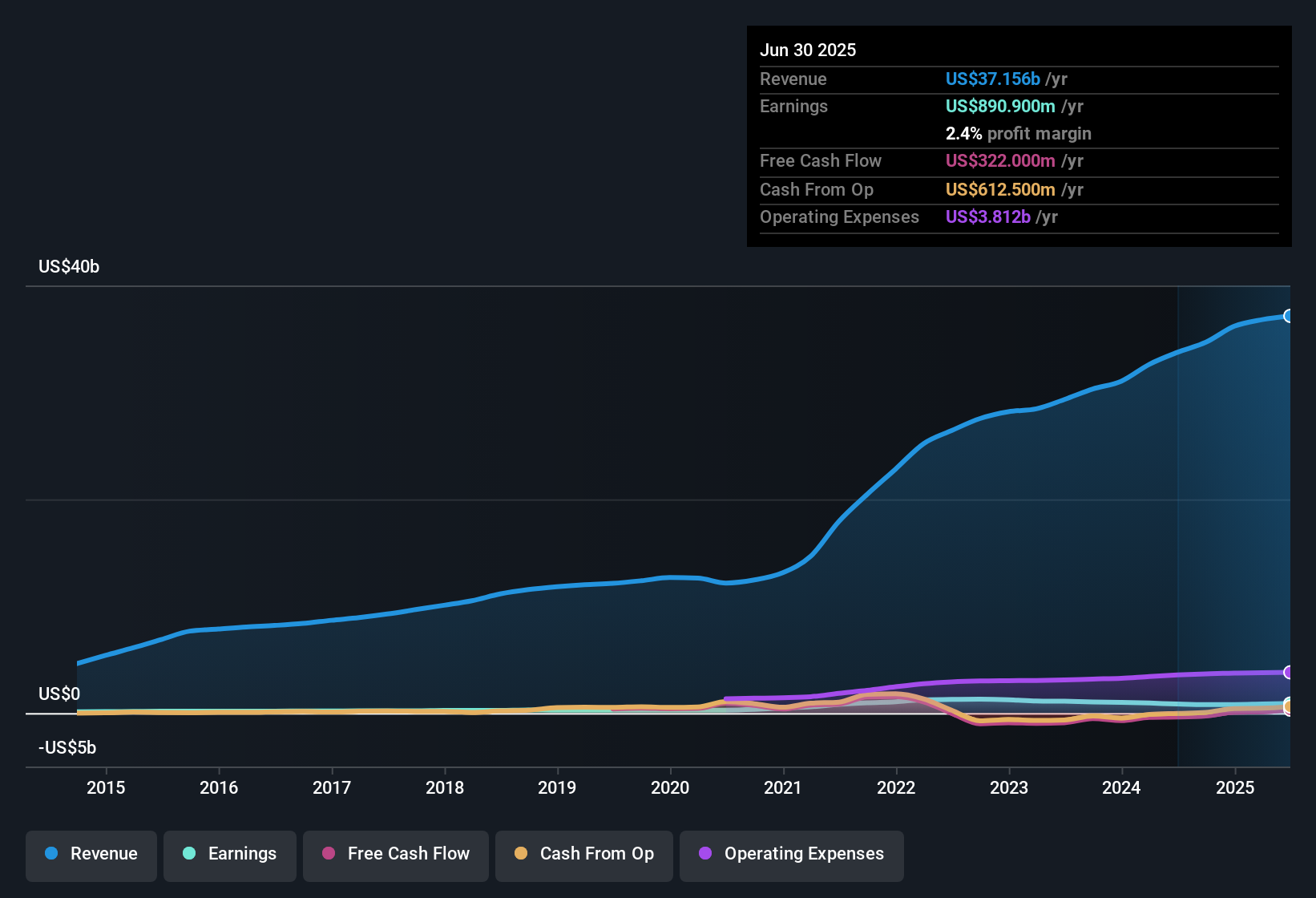

If you are eyeing Lithia Motors and weighing whether to hold, buy, or sell, you are not alone. After a modest 0.6% rise over the past week, Lithia’s share price sits at $320.96, still down 8.0% year-to-date. This tells an intriguing story. While the stock pulled back nearly 6% in the last month, the bigger picture shows a 4.1% gain over the past year and an impressive 59.8% climb over three years. That kind of multi-year momentum tends to grab attention, especially as auto retailers navigate an industry swept up by both high consumer demand and shifting market risks.

So what gives? Some of these moves reflect broader swings in the automotive sector, with investors reassessing growth prospects as interest rates and consumer trends evolve. For longer-term holders, those 3-year and 5-year returns, 59.8% and 16.7%, hint at the staying power of the business, even amid the occasional hiccup.

But performance alone does not tell the whole story, and that is where valuation comes in. Lithia Motors earns a value score of 3 out of 6 on our latest check, suggesting it stacks up as undervalued on half of the six key measures. In the next section, we will dig into what those valuation checks actually mean, and how they add up, before moving on to a smarter way of thinking about value that many investors overlook.

Why Lithia Motors is lagging behind its peers

Approach 1: Lithia Motors Discounted Cash Flow (DCF) Analysis

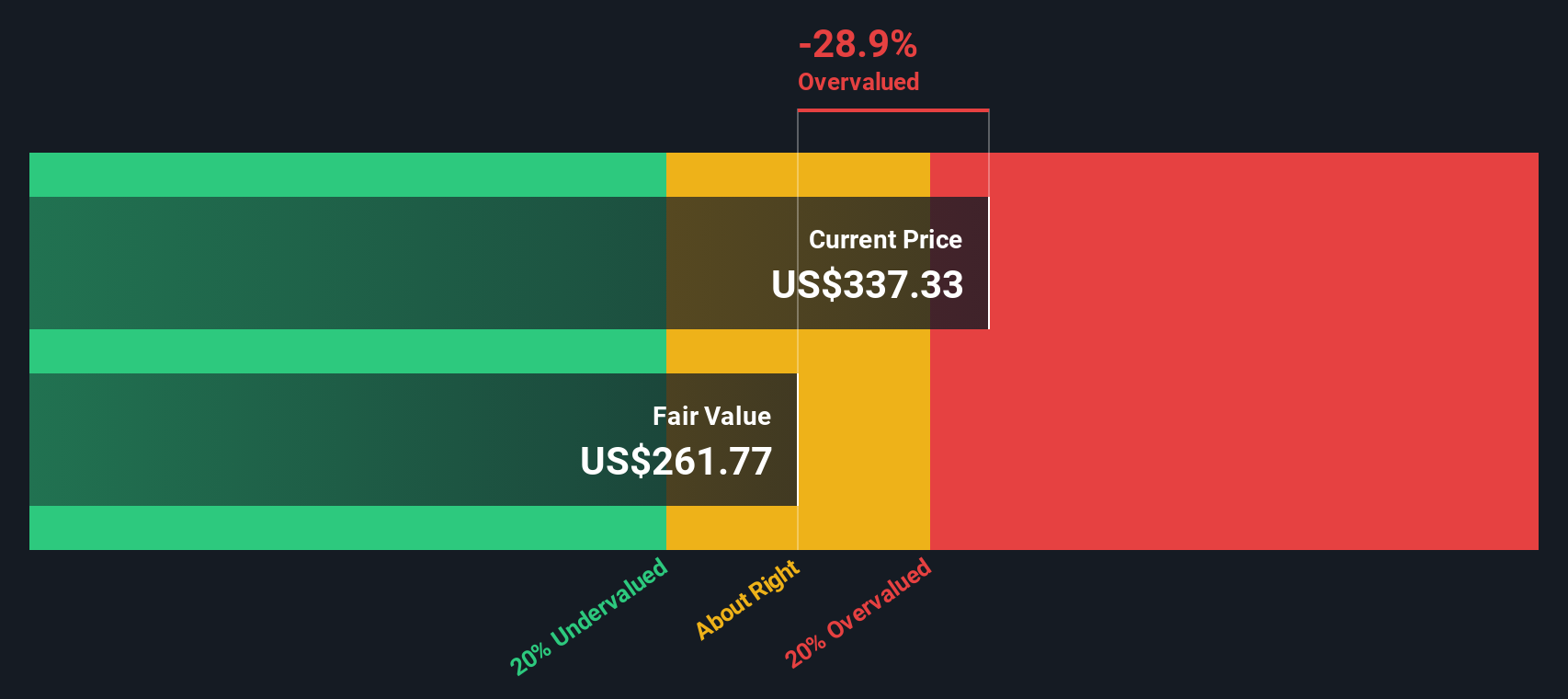

A Discounted Cash Flow (DCF) model estimates what a company is truly worth by projecting its future cash flows and then discounting those back to today's value. This approach helps investors look beyond current earnings, focusing on the underlying cash-generating ability of the business over time.

For Lithia Motors, the latest DCF model relies on the 2 Stage Free Cash Flow to Equity method. According to the data, Lithia generated $280 million in free cash flow (FCF) over the last twelve months. Analysts forecast a significant ramp-up, with projections suggesting FCF could reach $680 million by 2028. Looking further out, ten-year projections, extrapolated by Simply Wall St, anticipate cash flows continuing to climb, though with the usual caveats about the uncertainty of long-range forecasts.

This DCF analysis produces an intrinsic value of $261.77 per share. Compared to Lithia Motors' current share price of $320.96, the model signals the stock is about 22.6% overvalued. In practical terms, this valuation suggests investors are paying quite a premium today for expected future growth.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Lithia Motors may be overvalued by 22.6%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Lithia Motors Price vs Earnings

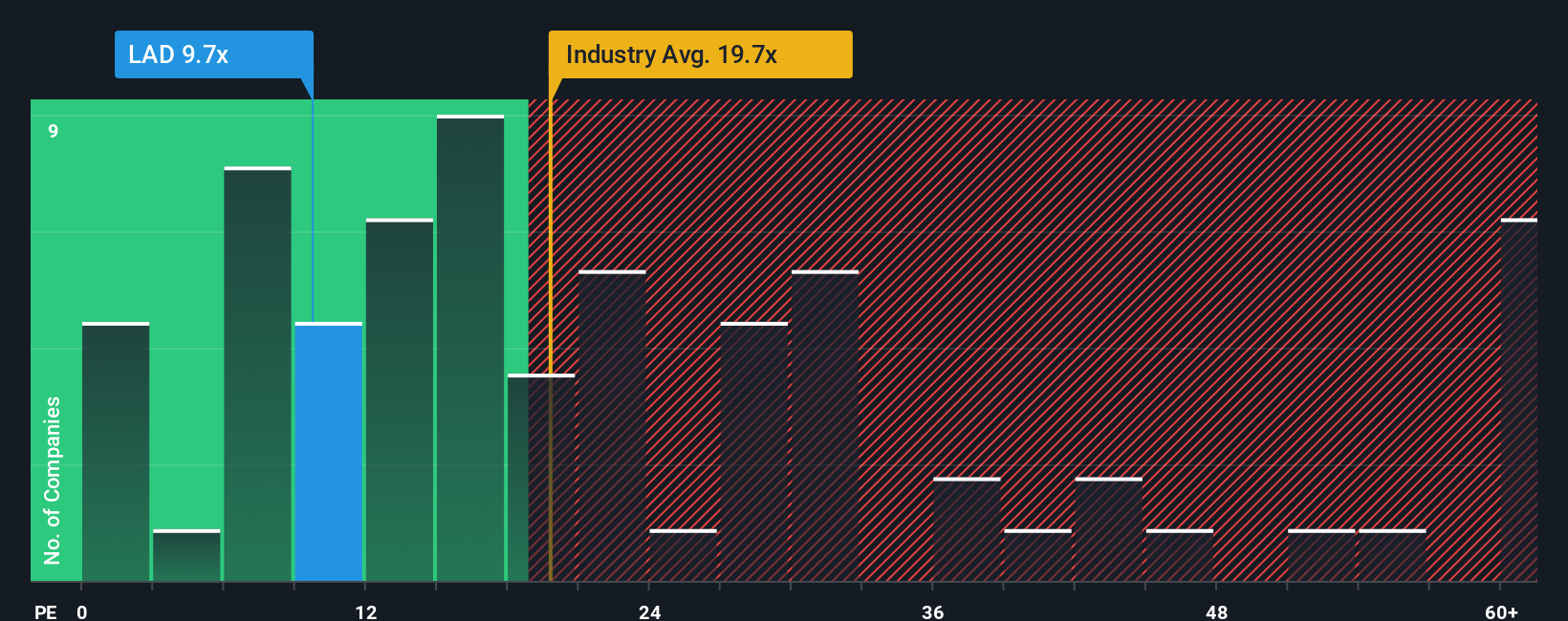

For profitable companies like Lithia Motors, the Price-to-Earnings (PE) ratio is a time-tested way to gauge valuation. The PE ratio compares a company's share price to its earnings per share, allowing investors to see how much they are paying for each dollar of profit.

What makes a “normal” or “fair” PE ratio is influenced by both growth expectations and risk. Companies expected to grow earnings quickly or operating with lower risk typically command higher PE ratios. Those facing uncertain prospects or industry headwinds may deserve a lower multiple.

Lithia Motors is currently trading at a PE of 9.2x. This is noticeably below the Specialty Retail industry average of 17.3x, and also below the average for its direct peers, which stands at 13.2x. On the surface, this could make Lithia look like a bargain.

However, a more tailored measure is the Simply Wall St “Fair Ratio.” This proprietary metric goes beyond peer or industry comparisons by factoring in company-specific traits like earnings growth, profit margins, risk profile, industry trends, and market cap. For Lithia Motors, the Fair Ratio stands at 16.5x. This suggests that given its fundamentals, the company could justify a higher valuation multiple than it currently has.

Comparing the Fair Ratio to the actual PE, Lithia Motors trades substantially below what its underlying performance would suggest. This points to an undervalued stock based on earnings potential and risk-adjusted prospects.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Lithia Motors Narrative

Earlier, we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives, a dynamic tool that links your perspective on a company’s story with a financial forecast and a fair value estimate. Rather than just relying on static numbers, a Narrative allows you to frame why you believe Lithia Motors is headed in a certain direction, capture assumptions about future revenue and profits, and instantly see what the business is worth under your scenario. Narratives are available to all investors on Simply Wall St’s Community page, making it easy for anyone to build, share, and update their own thesis as new information (like earnings or major news) emerges. By comparing your Narrative’s Fair Value to the current share price, you can decide if it is time to buy, hold, or sell while recognizing that each investor’s story may differ. For example, one Narrative might expect robust growth from aftersales and digital expansion and assign a fair value above $500, while another, more cautious view might project margin pressures and set fair value closer to $310, all from the same platform and updated live as new data comes in.

Do you think there's more to the story for Lithia Motors? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LAD

Lithia Motors

Operates as an automotive retailer in the United States, the United Kingdom, and Canada.

Fair value with acceptable track record.

Similar Companies

Market Insights

Community Narratives