- United States

- /

- Specialty Stores

- /

- NYSE:LAD

How Investors May Respond To Lithia Motors (LAD) US$600 Million Bond Raise and Dealership Acquisitions

Reviewed by Simply Wall St

- Earlier this month, Lithia Motors completed a US$600 million fixed-rate senior unsecured bond offering due October 2030 and announced several dealership acquisitions in the Southeast region, expanding its luxury and import portfolio.

- With its first-ever inclusion on the Fortune Global 500 and continuing leadership in automotive retail, Lithia has reinforced its market position while enhancing its financial flexibility to support ongoing growth initiatives.

- We'll explore how Lithia's recent US$600 million debt raise supports the company's acquisition-driven expansion and evolving investment outlook.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

Lithia Motors Investment Narrative Recap

To be a shareholder in Lithia Motors, you need to believe in the company's ability to deliver consistent earnings growth through disciplined acquisitions and operational efficiency, despite pressures from rising dealership prices and elevated SG&A expenses. Lithia’s recent US$600 million bond raise and Southeast luxury dealership acquisitions reinforce its market expansion efforts, but do not meaningfully alter the core short-term catalyst, continued access to profitable, accretive deals, or the primary risk of shrinking accretion from further M&A. The impact of these moves appears material only if Lithia sustains deal quality as competition for targets intensifies.

Lithia’s headline news, the acquisition of high-volume Southeast stores, is particularly relevant, as it boosts scale in a key growth region. This increased presence could enhance aftersales revenue, which remains one of the most important drivers for the company’s margin expansion and earnings resilience. Such acquisitions fit directly into Lithia’s acquisition-led strategy, yet also bring upfront costs, integration demands, and greater exposure to dealership pricing trends affecting overall profitability.

However, investors should be aware that while acquisitions fuel growth, the growing risk to margins from persistent SG&A pressure remains...

Read the full narrative on Lithia Motors (it's free!)

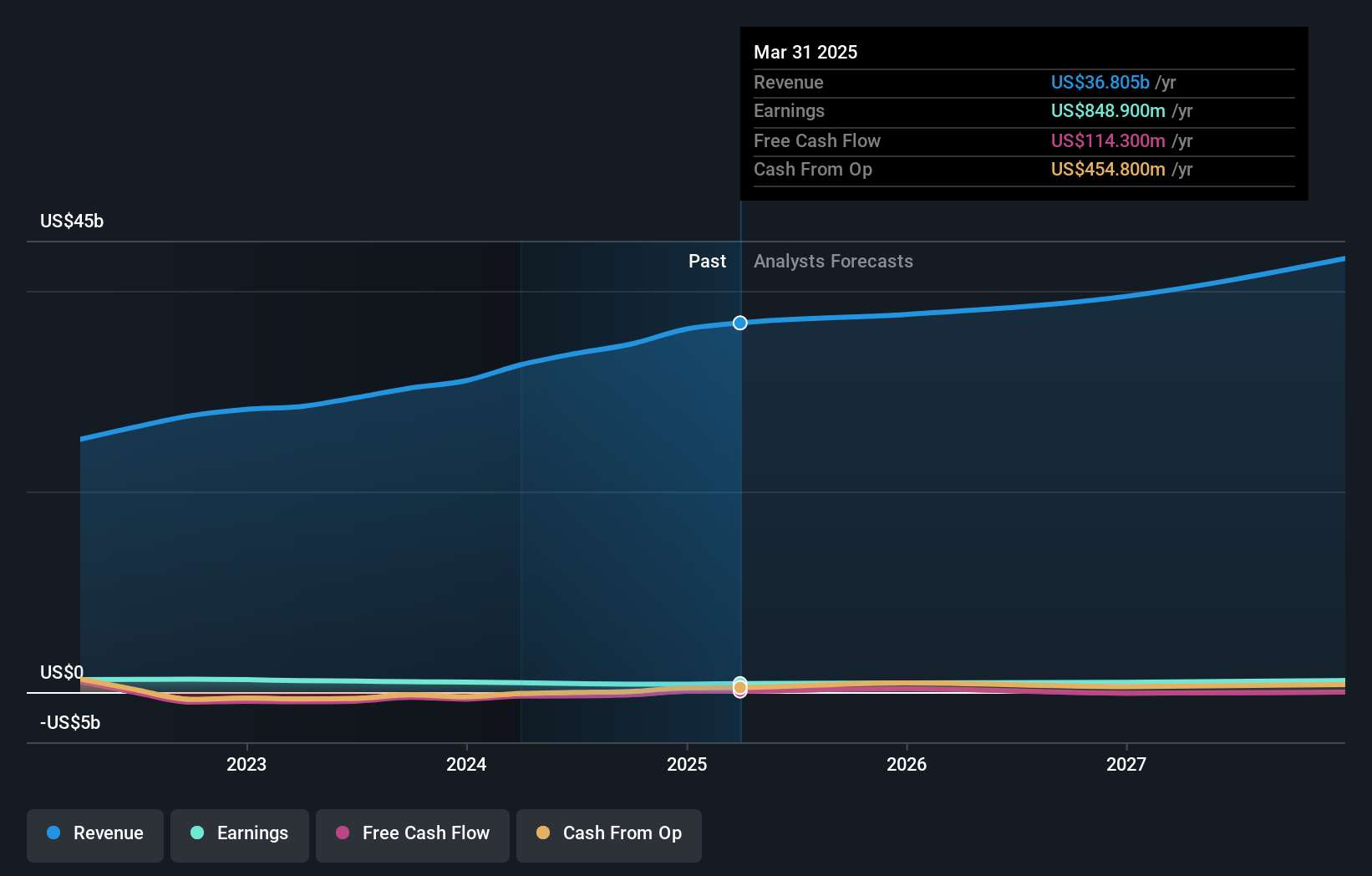

Lithia Motors' outlook anticipates $43.4 billion in revenue and $1.1 billion in earnings by 2028. This assumes 5.3% annual revenue growth and a $209 million increase in earnings from the current $890.9 million.

Uncover how Lithia Motors' forecasts yield a $381.93 fair value, a 15% upside to its current price.

Exploring Other Perspectives

Two fair value estimates from the Simply Wall St Community span from US$261.77 to US$381.93, illustrating the wide range in investor expectations. With margin pressures persisting as acquisitions accelerate, you may want to compare these diverse viewpoints to your outlook on future profitability and cost discipline.

Explore 2 other fair value estimates on Lithia Motors - why the stock might be worth 21% less than the current price!

Build Your Own Lithia Motors Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Lithia Motors research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Lithia Motors research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Lithia Motors' overall financial health at a glance.

Contemplating Other Strategies?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are the new gold rush. Find out which 30 stocks are leading the charge.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LAD

Lithia Motors

Operates as an automotive retailer in the United States, the United Kingdom, and Canada.

Fair value with acceptable track record.

Similar Companies

Market Insights

Community Narratives