- United States

- /

- Specialty Stores

- /

- NYSE:LAD

How Investors May Respond To Lithia Motors (LAD) $600 Million Bond Offering and Southeast Acquisitions

Reviewed by Simply Wall St

- Earlier this month, Lithia Motors completed a US$600 million fixed-income offering of 5.500% senior unsecured notes due 2030, while also announcing new acquisitions in the Southeast region and celebrating its first appearance on the Fortune Global 500 list at position 434.

- The successful bond issuance and dealership expansion highlight Lithia's focus on capital strength and growth in profitable markets with an enhanced luxury and import brand mix.

- We'll examine how the completion of the US$600 million bond offering could influence Lithia Motors' investment narrative and future growth plans.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Lithia Motors Investment Narrative Recap

To be a shareholder in Lithia Motors right now, you’ll need confidence in the company’s ability to execute growth through acquisitions, manage operational efficiency, and deliver consistent earnings in a changing retail environment. The recent US$600 million fixed-income offering expands financial flexibility but doesn’t fundamentally shift the most important short-term catalyst, whether Lithia can drive sustained profit growth from its aftersales services, and may not lessen the top risk around high SG&A costs and margin pressure.

The fresh acquisition of luxury and import dealerships in the Southeast is highly relevant, especially as Lithia focuses on expanding in regions and segments with higher profit potential. While these additions align with Lithia’s expansion narrative, the real test will be capturing efficiencies and improving performance at the store level, which remains essential for supporting both top-line and margin growth.

However, it’s important investors also consider that, unlike the boost these acquisitions bring to growth, persistent pressure on SG&A costs has yet to be fully addressed...

Read the full narrative on Lithia Motors (it's free!)

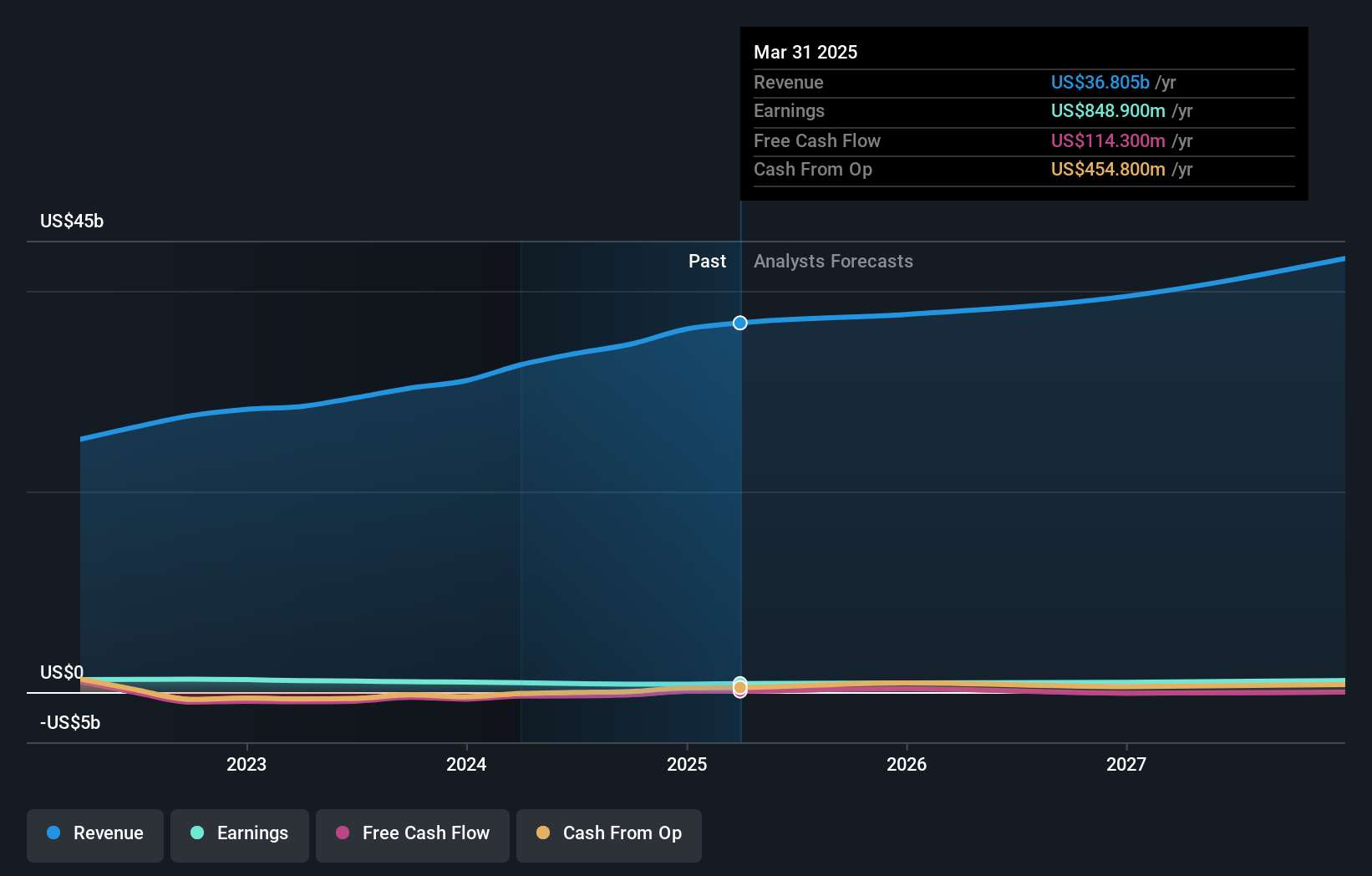

Lithia Motors is projected to reach $43.4 billion in revenue and $1.1 billion in earnings by 2028. This assumes a 5.3% annual revenue growth rate and an earnings increase of $209 million from the current $890.9 million.

Uncover how Lithia Motors' forecasts yield a $381.93 fair value, a 14% upside to its current price.

Exploring Other Perspectives

Two views from the Simply Wall St Community set Lithia Motors' fair value between US$261.77 and US$381.93, highlighting broad differences in expectations. Consider how store-level profitability and margin management remain in focus as you explore these opinions from fellow investors.

Explore 2 other fair value estimates on Lithia Motors - why the stock might be worth as much as 14% more than the current price!

Build Your Own Lithia Motors Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Lithia Motors research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Lithia Motors research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Lithia Motors' overall financial health at a glance.

Interested In Other Possibilities?

Our top stock finds are flying under the radar-for now. Get in early:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Explore 25 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LAD

Lithia Motors

Operates as an automotive retailer in the United States, the United Kingdom, and Canada.

Fair value with acceptable track record.

Similar Companies

Market Insights

Community Narratives