Kohl's (NYSE:KSS) Reports US$15.4 Billion Sales and US$109 Million Net Income in 2025

Reviewed by Simply Wall St

Kohl's (NYSE:KSS) reported a challenging fiscal year with significant declines in sales and net income, impacting its financial performance considerably. However, despite a broad market downturn of 4.6% over the last week, Kohl's shares saw a weekly gain of 6%, marking a surprising positive price move for the retailer amidst an otherwise negative economic backdrop. This deviation comes amidst broader market volatility fueled by recent tariff announcements from the Trump administration, which prompted general declines across major indexes like the Dow Jones and S&P 500. Notably, while many industries suffered from these tariff-driven uncertainties, Kohl's stock movement could reflect a localized investor sentiment shifting following the fiscal report, overshadowing broader market pressures. As the overall market continues to grapple with possible recessionary fears, Kohl's stock movement underscores how company-specific events can sometimes sway investor sentiment, contributing to unexpected price movements despite larger economic challenges.

Click here to discover the nuances of Kohl's with our detailed analytical report.

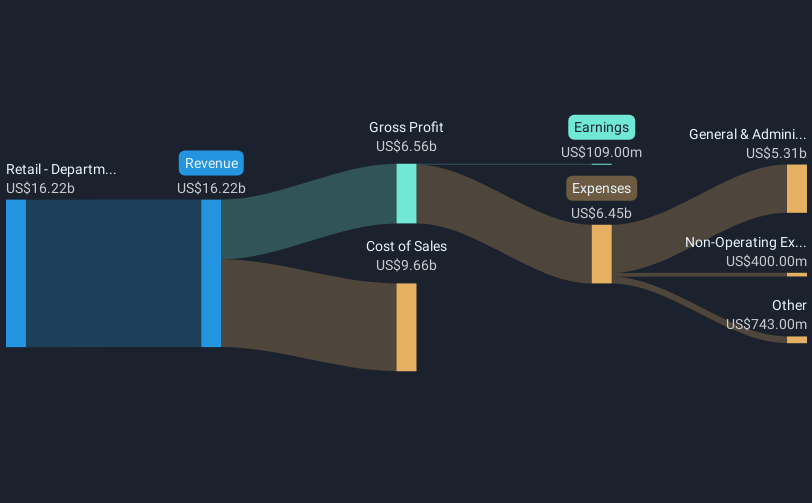

The last 5 years have seen Kohl's deliver a total shareholder return of 17.75%. Over this period, the retailer has faced declining earnings, with profits decreasing annually by 9.9%. This slump contrasts with the broader US Multiline Retail industry, which saw an 18.2% return in the past year, highlighting the challenges Kohl's has faced relative to its peers. The earnings decline was highlighted in the March 11, 2025 results, where Kohl's reported a drop in sales to US$15.38 billion, down from US$16.59 billion the previous year, and net income fell to US$109 million from US$317 million.

Additionally, unstable dividend distributions and investor pressures for strategic changes compounded investor uncertainty. Despite several declared dividends of US$0.50 per share throughout 2024, the erratic repurchase activity, as evidenced by a reported pause in the buyback program, reflected uncertainties in capital allocation strategies. Executive changes, like the upcoming departure of CEO Tom Kingsbury in January 2025, alongside new board additions, have also shaped investor sentiment as the company navigates turnaround efforts.

- Discover whether Kohl's is fairly priced, undervalued, or overvalued in our comprehensive valuation breakdown.

- Explore the potential challenges for Kohl's in our thorough risk analysis report.

- Is Kohl's part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Kohl's, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Kohl's might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KSS

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives