- United States

- /

- Specialty Stores

- /

- NYSE:KMX

What CarMax (KMX)'s Federal Securities Investigation Means For Shareholders

Reviewed by Sasha Jovanovic

- In late October 2025, Kessler Topaz Meltzer & Check, LLP initiated an investigation into CarMax, Inc. for potential federal securities law violations after the company reported significant revenue and profit declines for its fiscal second quarter.

- This legal review highlights growing investor concerns around the company's recent financial disclosures and overall corporate governance amid a challenging period.

- We'll now explore how the federal securities investigation, prompted by recent financial reporting declines, shifts CarMax's investment narrative outlook.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

CarMax Investment Narrative Recap

To own CarMax shares today, an investor needs confidence in the company's ability to expand its digital sales channels and enhance unit volume growth, both of which have been identified as major business catalysts. The recent federal securities investigation, triggered by revenue and profit declines and a sharp drop in share price, places heightened scrutiny on short-term financial reporting and company governance, though its immediate effect on core digital growth catalysts appears limited; the largest risk remains further pressure on profit margins from tightening inventory acquisition costs.

Among CarMax’s recent actions, the company’s ongoing share repurchase initiative stands out as relevant, especially given current market and legal uncertainties. These buybacks signal management’s ongoing efforts to enhance shareholder value, but also raise questions about capital allocation at a time when visibility into future profit trends is being challenged by both legal reviews and weaker earnings.

In contrast, any shift in wholesale unit margins or inventory acquisition costs could impact results faster than many investors expect…

Read the full narrative on CarMax (it's free!)

CarMax's outlook anticipates $29.8 billion in revenue and $919.9 million in earnings by 2028. This is based on a 1.3% annual revenue growth rate and a $361.4 million increase in earnings from the current $558.5 million.

Uncover how CarMax's forecasts yield a $55.50 fair value, a 23% upside to its current price.

Exploring Other Perspectives

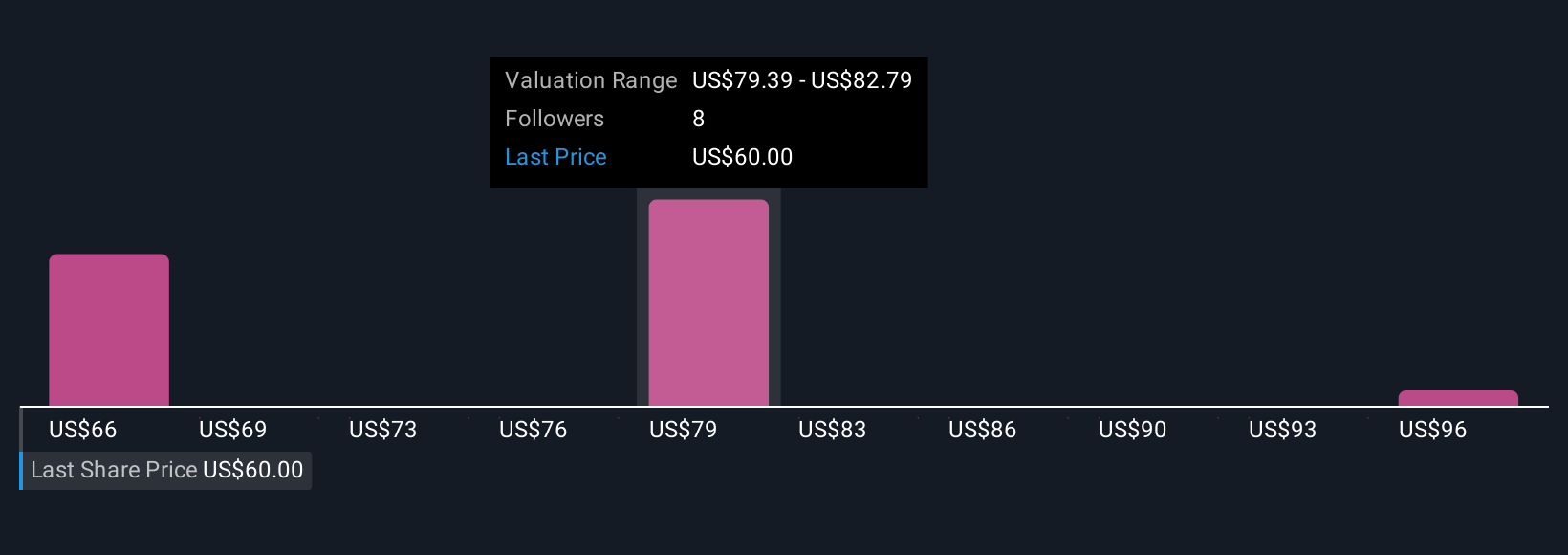

Five Simply Wall St Community fair value estimates for CarMax range from US$39.76 up to US$99.80 per share. While some see upside, the risk that shrinking profit margins will persist remains an important consideration for those seeking alternative views.

Explore 5 other fair value estimates on CarMax - why the stock might be worth 12% less than the current price!

Build Your Own CarMax Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CarMax research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free CarMax research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CarMax's overall financial health at a glance.

Curious About Other Options?

Our top stock finds are flying under the radar-for now. Get in early:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KMX

CarMax

Through its subsidiaries, operates as a retailer of used vehicles and related products in the United States.

Proven track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives