- United States

- /

- Specialty Stores

- /

- NYSE:KMX

CarMax (KMX) Faces Leadership Shakeup and Legal Scrutiny: Is Management Credibility at a Crossroads?

Reviewed by Sasha Jovanovic

- CarMax recently announced the termination of CEO Bill Nash, with David McCreight appointed as interim CEO effective December 1, 2025, following disappointing earnings guidance that revealed an expected 8% to 12% decline in comparable store unit sales and lower projected earnings per share.

- This leadership transition comes amid multiple securities class action lawsuits alleging CarMax misrepresented its recent growth, which is claimed to have been driven by temporary customer behavior related to tariff speculation rather than underlying business fundamentals.

- We'll examine how the abrupt CEO departure and ongoing legal scrutiny could alter CarMax's investment narrative and future outlook.

These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

CarMax Investment Narrative Recap

To own CarMax stock, an investor needs to believe that the company can stabilize and grow its used car sales by leveraging its digital and omnichannel capabilities, while managing credit risk and margin pressures. The recent CEO departure and legal challenges have become the most important short-term catalysts and risks, potentially affecting leadership stability and investor confidence in execution, making these developments material for the near-term outlook.

The most relevant announcement to these events is CarMax’s third quarter earnings guidance, which projects an 8%-12% decline in comparable store sales and lower earnings per share, partly due to non-recurring expenses from the leadership change. This guidance underscores how operational performance and management transitions are intertwined as key catalysts for investor sentiment.

However, in contrast, there is an important risk all investors should be aware of related to ...

Read the full narrative on CarMax (it's free!)

CarMax's outlook foresees $29.8 billion in revenue and $919.9 million in earnings by 2028. This scenario is based on analysts’ expectations of 1.3% annual revenue growth and a $361.4 million earnings increase from current earnings of $558.5 million.

Uncover how CarMax's forecasts yield a $54.64 fair value, a 57% upside to its current price.

Exploring Other Perspectives

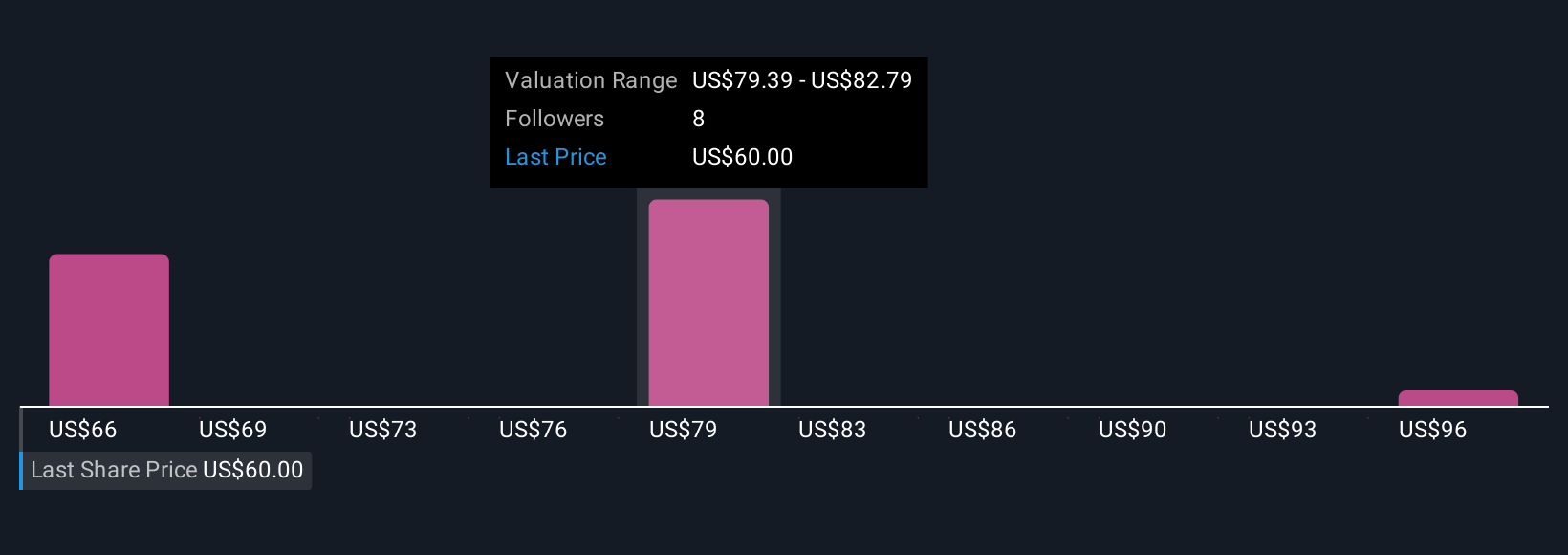

The Simply Wall St Community submitted 5 separate fair value estimates for CarMax, ranging widely from US$41.17 to US$99.80 per share. Given earnings pressure and leadership changes cited above, consider how your outlook compares and explore these varying perspectives for further insight.

Explore 5 other fair value estimates on CarMax - why the stock might be worth just $41.17!

Build Your Own CarMax Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CarMax research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free CarMax research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CarMax's overall financial health at a glance.

Curious About Other Options?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KMX

CarMax

Through its subsidiaries, operates as a retailer of used vehicles and related products in the United States.

Undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives