- United States

- /

- Specialty Stores

- /

- NYSE:KMX

CarMax (KMX): Assessing Valuation Following Surprise Loan Losses and Sharpened Investor Scrutiny

Reviewed by Kshitija Bhandaru

CarMax, Inc. (KMX) is back in the spotlight after its latest quarterly report revealed a surprise $142 million provision for loan losses in its auto finance business. This development sharply reverses previous management claims about improving trends. The fallout has prompted a shareholder investigation and reignited concerns around the company's debt and ongoing sales declines.

See our latest analysis for CarMax.

After tumbling nearly 20% post-earnings, CarMax's share price has continued to trend lower, with a 30-day return of -27.45% and a year-to-date share price decline of 47.18%. Looking back over the past five years, total shareholder returns now reflect a bruising -52.83%, as momentum remains firmly under pressure and recent events have only heightened risk perceptions.

If you want to explore a wider landscape of the automotive market, this is a perfect moment to check out See the full list for free.

With sentiment at a low and a significant gap to analyst price targets, the big question is whether CarMax's steep drop is now an entry point, or if markets already reflect a challenging road ahead for growth.

Most Popular Narrative: 25.8% Undervalued

CarMax’s most followed narrative views the current price as a steep discount to its fair value assessment, with a sizable valuation gap compared to the recent $42.90 close. This sets the stage for a deeper look at what supporters see as the company’s path to renewed growth.

CarMax's growth in digital sales channels, including an increase in omnichannel sales, positions the company to expand its market share and boost revenue in the future. The ongoing enhancements to their digital tools are expected to further integrate online and in-store sales.

What is really driving this valuation call? The narrative is built on bold expectations for margin expansion and a meaningful turnaround in earnings. It forecasts a scenario where operational upgrades and strategic investments could upend today’s gloom. Want to know which financial levers matter most? Unlock the full story inside.

Result: Fair Value of $57.79 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent declines in wholesale profit per unit and elevated loan loss provisions could challenge the bullish case for a rapid turnaround in CarMax’s fortunes.

Find out about the key risks to this CarMax narrative.

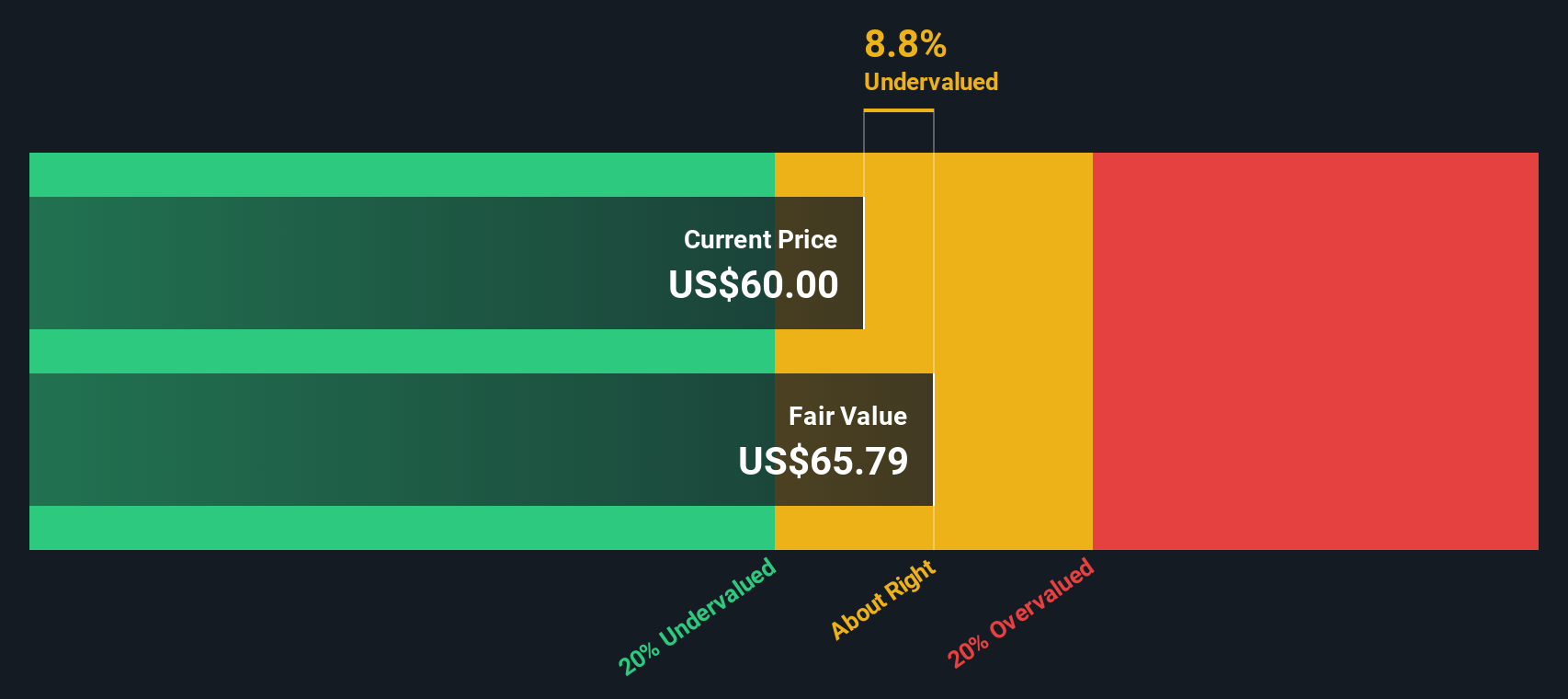

Another View: Testing the Undervaluation with Our DCF Model

While some see CarMax as undervalued based on traditional multiples, our SWS DCF model suggests a more conservative picture, estimating the company's fair value at $39.76, which is actually below the current share price. Could this signal limited near-term upside, or are there hidden drivers the market is missing?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out CarMax for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own CarMax Narrative

If you have a different perspective, or want to dig deeper into CarMax’s story, you can craft your own analysis in just a few minutes by using Do it your way.

A great starting point for your CarMax research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors always keep an eye out for fresh opportunities in fast-moving markets. Don’t let the next winner pass you by. Use these powerful tools to uncover your edge today:

- Tap into the next wave of market disruptors with these 24 AI penny stocks, targeting artificial intelligence innovation before it hits the mainstream.

- Capture potential gains from hidden value by searching these 878 undervalued stocks based on cash flows to spot underpriced gems that could be overlooked by the crowd.

- Build a stream of reliable income with these 18 dividend stocks with yields > 3%, offering top shares with robust dividend yields to strengthen your portfolio’s returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KMX

CarMax

Through its subsidiaries, operates as a retailer of used vehicles and related products in the United States.

Proven track record and fair value.

Similar Companies

Market Insights

Community Narratives