- United States

- /

- Specialty Stores

- /

- NYSE:KMX

CarMax (KMX): Assessing Valuation as Shares Slide Nearly 50% Year-to-Date

Reviewed by Simply Wall St

See our latest analysis for CarMax.

CarMax’s share price has tumbled in recent months, with a 90-day return of -26.31% and a year-to-date drop of nearly 50%. This sustained downward momentum puts the one-year total shareholder return at -43.42%, highlighting continued investor caution amid uncertainty in the used car market and concerns around longer-term growth potential.

If the shifts at CarMax have prompted you to rethink your strategy, now is an ideal moment to broaden your search and discover See the full list for free.

With shares trading well below analyst price targets and profit growth remaining positive, investors face a key question: is CarMax undervalued at these levels, or is the market already factoring in everything about its future growth prospects?

Most Popular Narrative: 25% Undervalued

According to the most widely followed narrative, CarMax appears significantly discounted relative to its stated fair value, with the latest close well below the consensus target. Market participants are closely eyeing management’s digital and financial expansion moves as core drivers behind future upside.

The ongoing enhancements to their digital tools are expected to further integrate online and in-store sales. Expansion in the company's vehicle sourcing capabilities, particularly through dealer channels and improved consumer experience, is intended to support unit volume growth and improve gross profit margins by lowering vehicle acquisition costs.

Want to unravel the logic behind this discounted valuation? The heart of this forecast is bold assumptions about CarMax’s future margins, revenue mix, and profitability pace. Which specific growth levers and margin projections are turning skepticism into opportunity? Unlock the data driving this bullish valuation narrative.

Result: Fair Value of $55.5 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing declines in wholesale gross profit and competitive pressures in vehicle sourcing could quickly undermine confidence in CarMax’s recovery outlook.

Find out about the key risks to this CarMax narrative.

Another View: Market Multiples Perspective

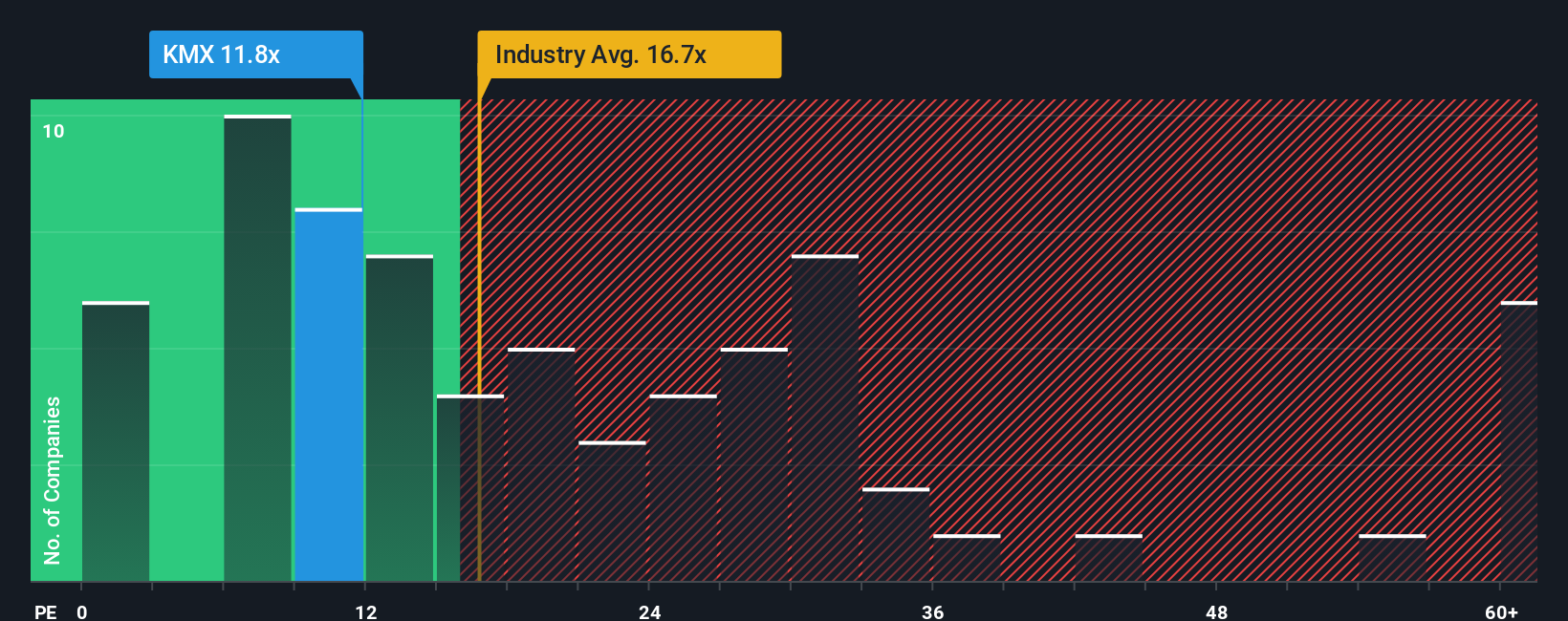

Looking through the lens of the current price-to-earnings ratio, CarMax trades at 11.7x, which is below the US market average of 18.2x and the US Specialty Retail industry standard of 16.7x. The estimated fair ratio sits at 18.4x. This discount could suggest an overlooked value opportunity, but it may also reflect lingering doubts over long-term prospects. Is the market being too cautious, or is there further risk ahead?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out CarMax for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 843 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own CarMax Narrative

If you see the story differently or want to dig into the numbers on your terms, you can quickly build your own perspective and apply your unique insights. Do it your way.

A great starting point for your CarMax research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t limit yourself to a single company when there are so many dynamic opportunities waiting. The market rewards those who act boldly and seek out fresh angles beyond the obvious picks.

- Capture major growth potential by targeting these 26 AI penny stocks, which are paving the way in artificial intelligence, automation, and digital innovation across industries.

- Boost your income stream by targeting companies with proven cash payouts through these 18 dividend stocks with yields > 3%, yielding over 3% in annual returns.

- Tap into overlooked gems with remarkable value by reviewing these 843 undervalued stocks based on cash flows, where strong fundamentals come at a bargain price point.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KMX

CarMax

Through its subsidiaries, operates as a retailer of used vehicles and related products in the United States.

Good value with proven track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026