Jumia Technologies' (NYSE:JMIA) Latest Partnership Won't Solve the Largest Ongoing Problem

In the last 12 months, Jumia Technologies(NYSE: JMIA) investors went through a lot of pain as the stock lost 90% of its value from its peak.

While the sector lost some steam (especially in the latter part of the year), the company certainly didn't help by missing expectations on the last 4 out of 5 earnings reports. Yet, the African market has undoubtedly great potential, and the latest partnership with UPS might be the catalyst to turn the boat around.

See our latest analysis for Jumia Technologies

Positive Catalyst: Partnership with the UPS

Jumia just announced a partnership with United Parcel Service (NYSE: UPS). UPS will offer various solutions for the delivery, collection, and payment options. The collaboration will start in Kenya, Morocco, and Nigeria, with a future expansion to other African countries.

The news sent the shares rally up to 25%, as the market sees synergies between the two companies. The African market has a growing population of 1.4 billion, while Jumia now has a robust global partner in UPS.

However, the company still has to address its escalating marketing costs. According to the latest earnings report, sales & advertising expenses grew 150% Y/Y, fueling the more profound EBITDA loss, which now has a projection of negative US$200-220m for FY2022.

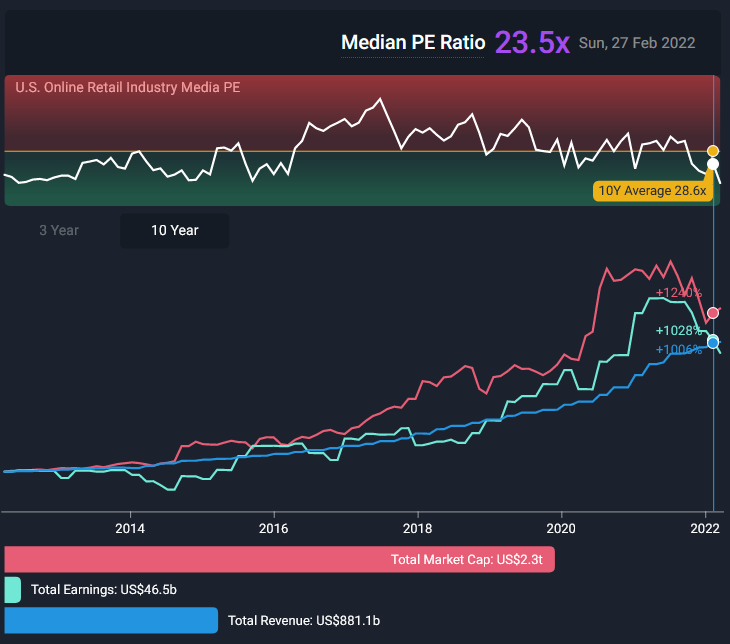

The following chart depicts the rise and correction of the U.S. online retail industry. For more information, check out the industry page on our platform.

What About the Cash Burn?

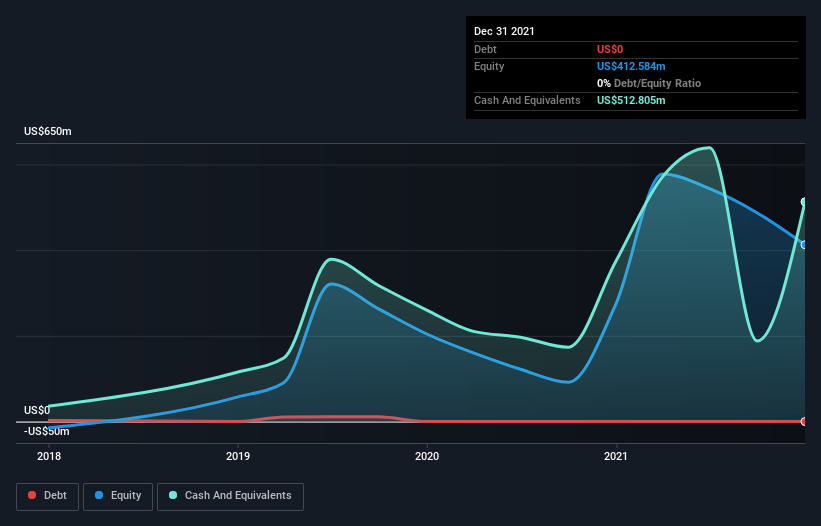

Considering the facts, it is evident that the company is not yet close to profitability. While the yearly loss of nearly 20% of the market cap might raise some eyebrows, investors might be pleased to hear that JMIA is debt-free. Furthermore, shareholders have not been meaningfully diluted in the past year.

As it stands, the company has around US$513m in cash, sufficient for over 2.5 years at this pace. Depicted below, you can see how its cash holdings have changed.

Conclusion: High-Risk / High-Reward With Enough Runway

While the partnership with UPS is a positive development that might improve operational costs, it won't impact the growing marketing costs that look to be a driver behind the ongoing losses.

With active users and total orders recording solid growth (29% and 40%), investors should closely watch for the marketing expenses trends to evaluate the value-added behind such costs. Overall, JMIA as a potential multi-bagger remains a high-risk investment, but at least it has enough of a cash runway to prove the shorts wrong.

Readers need to have a sound understanding of business risks before investing in a stock. We've spotted 2 warning signs for Jumia Technologies that potential shareholders should consider before putting money into a stock.

If you would prefer to check out another company with better fundamentals, do not miss this free list of interesting companies, that have a HIGH return on equity and low debt or this list of stocks that are all forecast to grow.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.

About NYSE:JMIA

Jumia Technologies

Operates an e-commerce platform in West Africa, North Africa, East Africa, Europe, the United Arab Emirates, and internationally.

Excellent balance sheet low.