- United States

- /

- Specialty Stores

- /

- NYSE:HD

Home Depot (NYSE:HD) Reports Q1 Sales Rise to US$39,856 Million Despite Lower Net Income

Reviewed by Simply Wall St

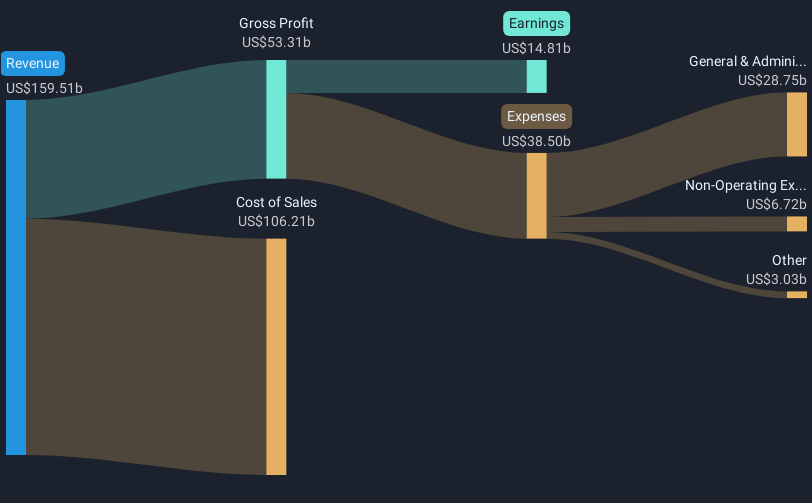

Home Depot (NYSE:HD) reported a solid increase in first-quarter sales, reaching USD 39,856 million, though net income and earnings per share slipped slightly. In the past month, shares rose by 6.85%, despite the company's slight miss in profit estimates. The increase aligns with the broader market trends, where the S&P 500 experienced consecutive gains. Home Depot's termination of a $2.0 billion revolving credit facility and arrangement of new $7.0 billion credit agreements likely added weight to their financial strategy amid the market's overall positive movement. The market's strong performance, countered by the company's slight earnings decrease, reflects continued investor confidence.

We've identified 1 possible red flag for Home Depot that you should be aware of.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

The recent financial maneuvers by Home Depot, including the arrangement of new US$7 billion credit agreements, play a strategic role in their efforts to bolster financial flexibility. The termination of a US$2 billion revolving credit facility aligns with broader market trends and seems to support the company's expansion and investment plans, particularly regarding the Pro ecosystem and store expansions. Over the past five years, Home Depot's total shareholder return, including dividends, was 76.87%, a considerable achievement that reflects its long-term value creation.

In the previous year, Home Depot matched the overall US market's performance, with both delivering an 11.7% return. However, it lagged behind the US Specialty Retail industry, which saw a return of 16.7%. This healthcare disparity might signal the company's growth challenges amid ongoing macroeconomic uncertainties and pressures on high-value projects. The next years could potentially see Home Depot addressing these concerns, particularly if its forecasted 3.7% annual revenue growth sustains investor confidence.

The recent operational and financial steps may impact earnings forecasts, especially in light of a US$423.65 analyst price target, which is 15.2% above the current share price of US$359.38. This indicates that analysts see significant upside potential. Still, achieving these targets would require overcoming factors like high interest rates and market constraints. As Home Depot seeks to enhance its growth trajectory, the balancing of these elements will be crucial for future performance considerations.

Unlock comprehensive insights into our analysis of Home Depot stock in this financial health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Home Depot might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HD

Home Depot

Operates as a home improvement retailer in the United States and internationally.

Established dividend payer with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives