- United States

- /

- Machinery

- /

- NYSE:KMT

Carter's And 2 Top US Dividend Stocks For Your Portfolio

Reviewed by Simply Wall St

As the U.S. stock market experiences a rally with major indices nearing record highs, investors are closely examining earnings reports that have fueled recent gains. In this dynamic environment, dividend stocks can offer a stable income stream and potential for growth, making them an appealing choice for those looking to balance risk and reward in their portfolios.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| WesBanco (NasdaqGS:WSBC) | 4.63% | ★★★★★★ |

| Interpublic Group of Companies (NYSE:IPG) | 4.68% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.10% | ★★★★★★ |

| Columbia Banking System (NasdaqGS:COLB) | 4.99% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 5.38% | ★★★★★★ |

| CompX International (NYSEAM:CIX) | 4.48% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 5.74% | ★★★★★★ |

| Ennis (NYSE:EBF) | 4.75% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.92% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.82% | ★★★★★★ |

Click here to see the full list of 143 stocks from our Top US Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

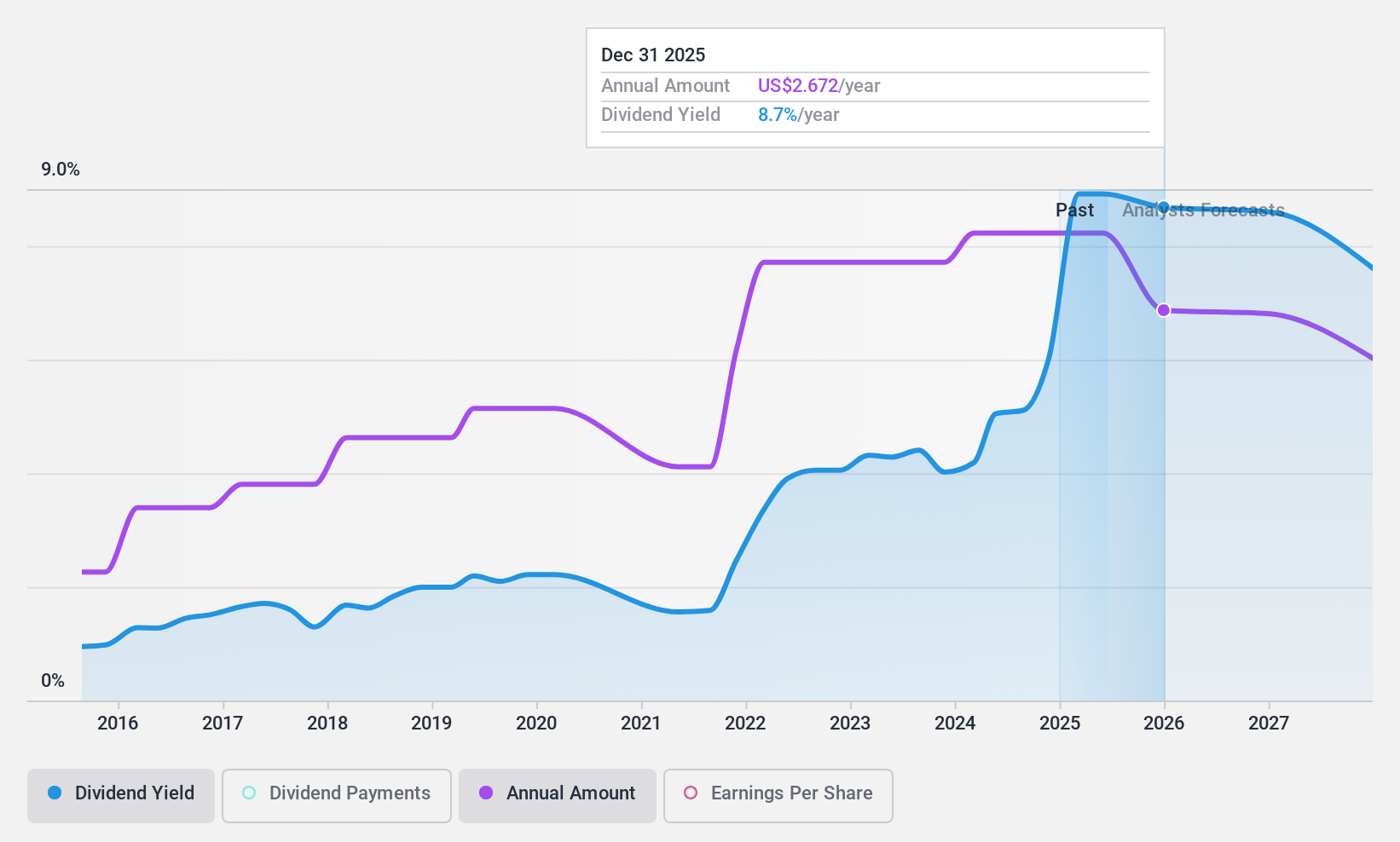

Carter's (NYSE:CRI)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Carter's, Inc. designs, sources, and markets branded childrenswear under various brands both in the United States and internationally, with a market cap of approximately $1.93 billion.

Operations: Carter's, Inc.'s revenue is primarily generated through its U.S. Retail segment at $1.43 billion, U.S. Wholesale at $1.00 billion, and International operations contributing $408 million.

Dividend Yield: 5.8%

Carter's dividend payments are well-covered by earnings and cash flows, with a payout ratio of 49.8% and a cash payout ratio of 41.5%. Despite being in the top 25% for dividend yield in the US market, its dividends have been volatile over the past decade. Recent changes in leadership and its drop from the S&P 400 to S&P 600 might impact investor sentiment. The company declared a quarterly dividend of US$0.80 per share recently, maintaining shareholder returns amidst these transitions.

- Click here and access our complete dividend analysis report to understand the dynamics of Carter's.

- According our valuation report, there's an indication that Carter's share price might be on the cheaper side.

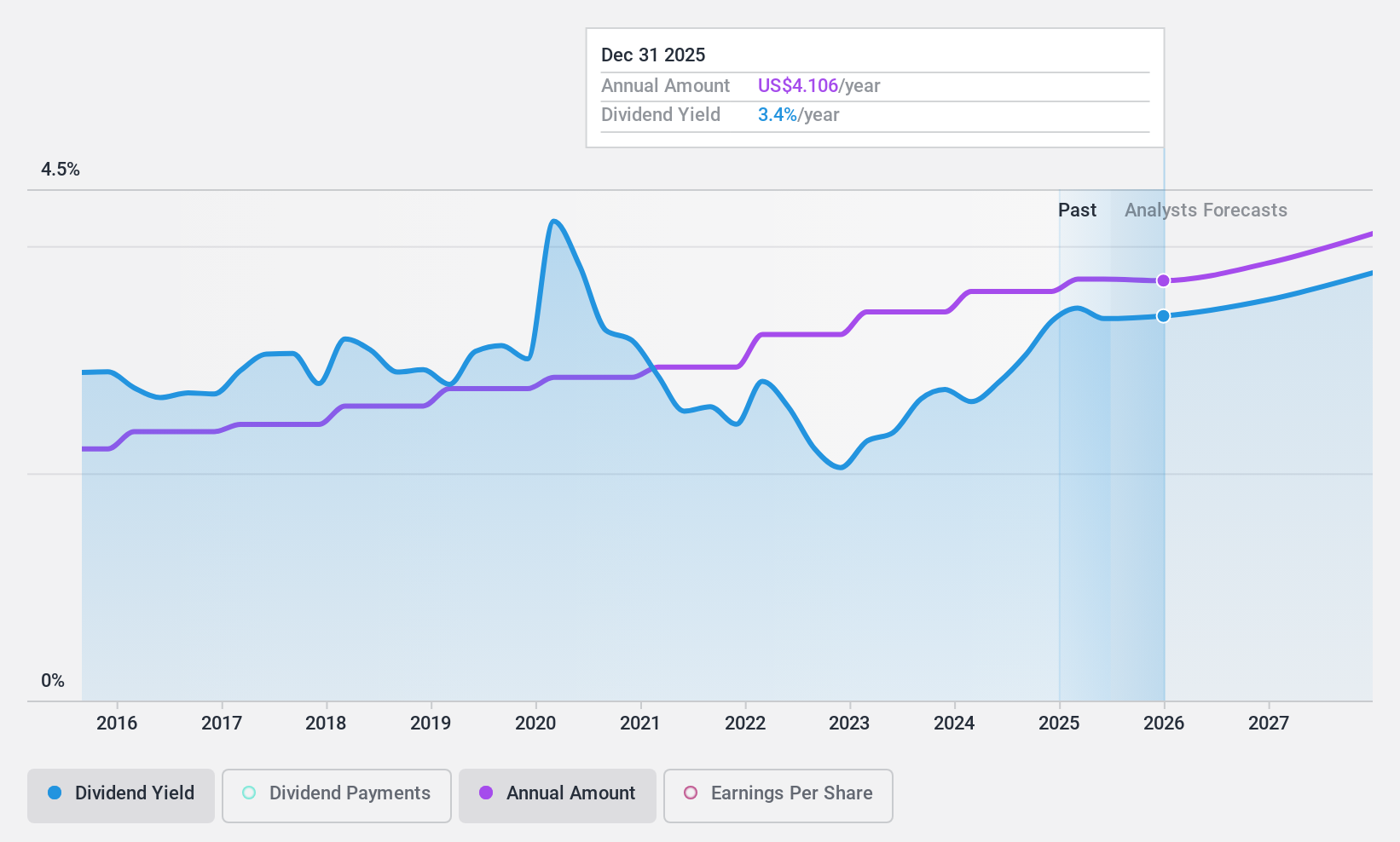

Genuine Parts (NYSE:GPC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Genuine Parts Company distributes automotive replacement parts and industrial parts and materials, with a market cap of $16.48 billion.

Operations: Genuine Parts Company's revenue is primarily derived from its automotive segment, generating $14.56 billion, and its industrial segment, which includes electrical and electronic materials, contributing $8.74 billion.

Dividend Yield: 3.3%

Genuine Parts Company maintains a reliable dividend history with stable payments over the past decade, supported by a reasonable payout ratio of 50.6% and cash payout ratio of 61.7%. Despite recent earnings guidance revisions and lower net income, the company declared a quarterly dividend of US$1.00 per share for early 2025. While trading below estimated fair value, its dividend yield remains below top-tier levels in the US market, and it carries significant debt.

- Get an in-depth perspective on Genuine Parts' performance by reading our dividend report here.

- The analysis detailed in our Genuine Parts valuation report hints at an deflated share price compared to its estimated value.

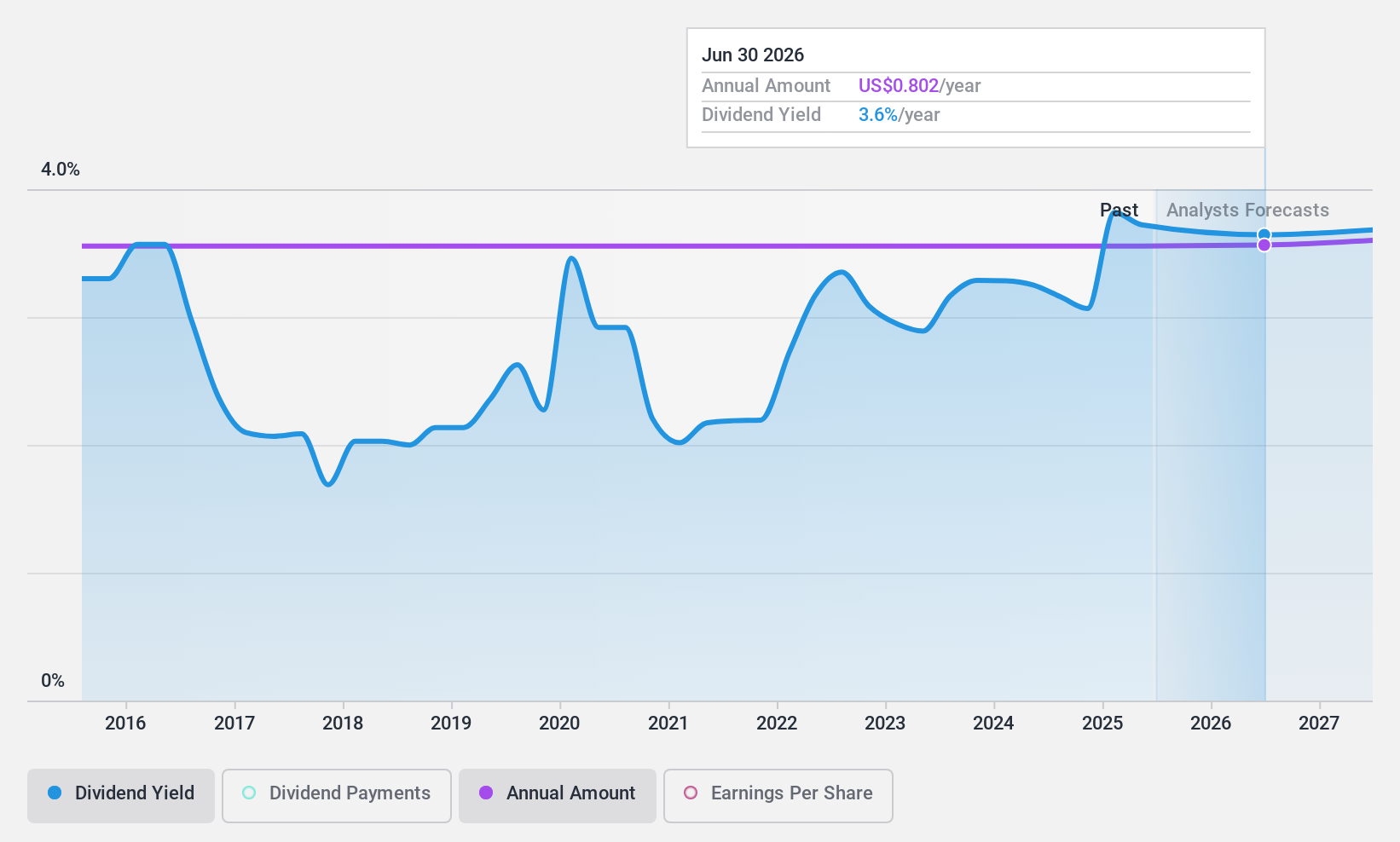

Kennametal (NYSE:KMT)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Kennametal Inc. develops and applies tungsten carbides, ceramics, and super-hard materials for metal cutting and extreme wear applications to help customers manage corrosion and high temperatures globally, with a market cap of approximately $1.88 billion.

Operations: Kennametal Inc.'s revenue segments include Metal Cutting, generating approximately $1.27 billion, and Infrastructure, contributing around $766.92 million.

Dividend Yield: 3.2%

Kennametal offers a reliable dividend history with stable and growing payments over the past decade, supported by a payout ratio of 62.3% and a cash payout ratio of 31.6%. Despite recent insider selling and lower earnings, it declared a quarterly dividend of US$0.20 per share. Trading at good value relative to peers, its dividend yield is below top-tier levels in the US market but remains well-covered by earnings and cash flows.

- Click to explore a detailed breakdown of our findings in Kennametal's dividend report.

- Our comprehensive valuation report raises the possibility that Kennametal is priced lower than what may be justified by its financials.

Key Takeaways

- Click here to access our complete index of 143 Top US Dividend Stocks.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kennametal might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KMT

Kennametal

Engages in development and application of tungsten carbides, ceramics, and super-hard materials and solutions for use in metal cutting and extreme wear applications to enable customers work against corrosion and high temperatures conditions worldwide.

Undervalued with excellent balance sheet and pays a dividend.