- United States

- /

- Specialty Stores

- /

- NYSE:FND

Assessing Floor & Decor Holdings’s (FND) Valuation After Opening New Warehouse Stores in Arizona and South Carolina

Reviewed by Simply Wall St

If you’re watching Floor & Decor Holdings (FND) after its latest moves, you’ll know the company just opened two new warehouse stores, one in suburban Phoenix and the other in South Carolina’s Myrtle Beach area. These new locations might not be grabbing national headlines, but for investors, they are part of a methodical expansion that could impact FND’s growth profile in the future. The openings come without any earnings surprises or major acquisitions, raising the question of whether these incremental steps are enough to change the narrative for the stock.

Over the past year, Floor & Decor Holdings’ stock has slipped 21%, and it has not rebounded in 2025 despite the company reporting healthy revenue and net income growth. Short-term moves have been more encouraging, as shares climbed 20% in the past three months, showing some momentum returning and perhaps reflecting improving sentiment as the company builds out its store base. Even so, investors have reason to be cautious, as FND’s long-term five-year return sits at just 20%, suggesting that steady growth has not always translated to standout stock gains.

As Floor & Decor continues expanding its footprint, the question remains whether this recent bounce marks the start of a stronger comeback or if investors are already pricing in all that future growth.

Most Popular Narrative: 5.2% Overvalued

According to community narrative, Floor & Decor Holdings is currently viewed as overvalued by 5.2% based on consensus analyst expectations for future performance, margins, and risk factors. This valuation is rooted in robust assumptions about the company's revenue trajectory and operational leverage as store expansion continues.

Floor & Decor's ongoing aggressive store expansion strategy, opening 20 new warehouse-format stores this year and at least 20 planned for next year, with the infrastructure to accelerate openings further as housing market conditions improve, positions the company to capture outsized revenue growth and future operating leverage as end-market demand returns.

Curious why analysts are so bullish on this expansion story? The formula behind this valuation hinges on bold growth ambitions and optimistic expectations for both top-line sales and profit margins. What exact quantitative targets must be hit for today's price to look fair? The answer may surprise you.

Result: Fair Value of $83.64 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent weak home sales and rising competition on price could limit FND’s revenue growth and challenge the more optimistic analyst projections.

Find out about the key risks to this Floor & Decor Holdings narrative.Another View: Discounted Cash Flow Puts Price in Doubt

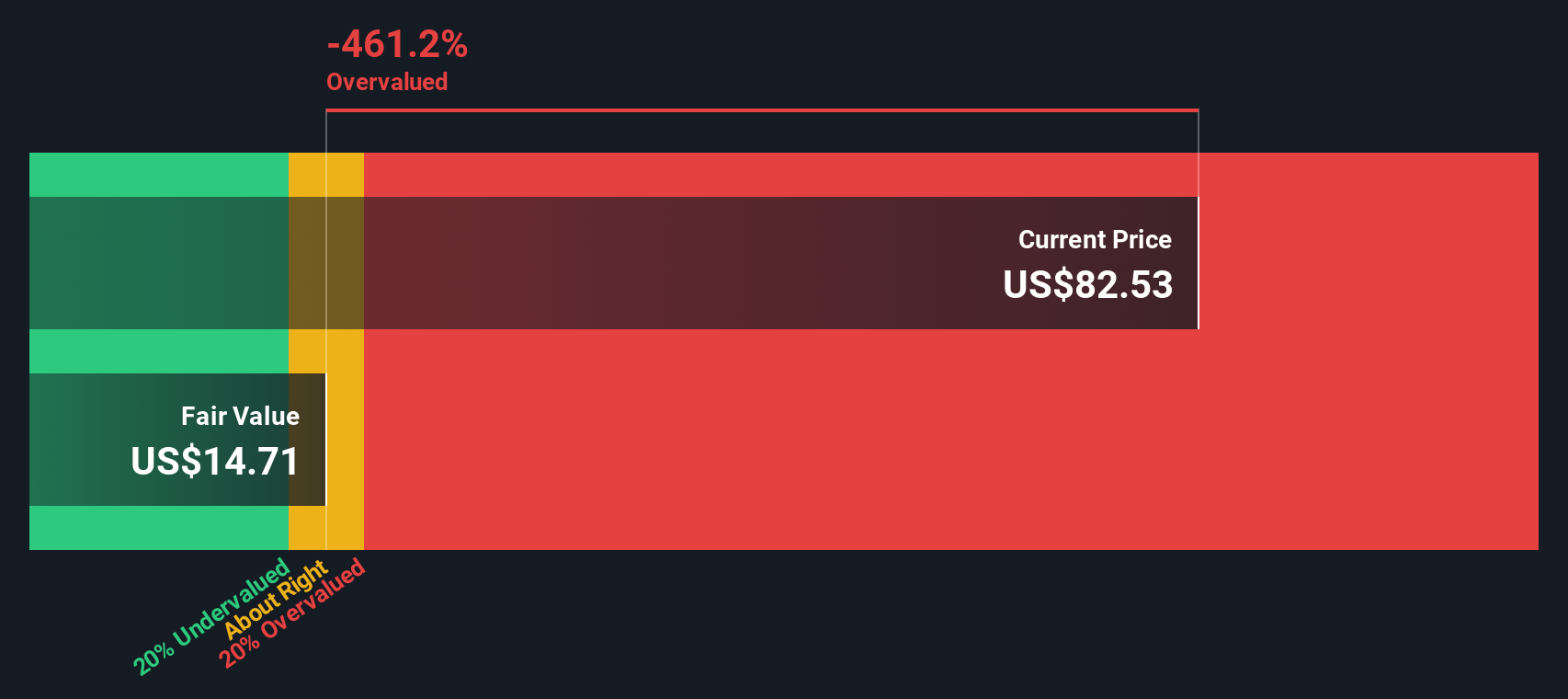

Looking from a different angle, the Simply Wall St DCF model tells a much more cautious story. This approach signals that Floor & Decor’s current share price may actually be well above its fair value. Could the market’s optimism be overextended?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Floor & Decor Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Floor & Decor Holdings Narrative

If you’re skeptical of these conclusions or want to dig into the numbers yourself, you can build your own thesis in just a few minutes. do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Floor & Decor Holdings.

Ready for More Smart Investment Opportunities?

Why settle for just one stock story? If you're eager to broaden your perspective and find standout investment candidates, now is the time to act. The Simply Wall Street Screener uncovers fresh trends and under-the-radar gems. Don’t risk missing your next idea by sitting on the sidelines.

- Boost your portfolio’s income potential by selecting dividend stocks with yields > 3% to find companies handing out yields above 3%, giving your returns a powerful edge.

- Seize the future as you track AI penny stocks and pinpoint AI-driven businesses transforming industries with cutting-edge tech and scalable market solutions.

- Supercharge your search for high-value opportunities using undervalued stocks based on cash flows to spot stocks trading below their worth according to fundamental cash flow analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FND

Floor & Decor Holdings

Operates as a multi-channel specialty retailer of hard surface flooring and related accessories, and commercial surfaces seller in the United States.

Excellent balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives